Local Media Needs Consolidation To Compete, But An Outdated Legal Standard Stands In The Way

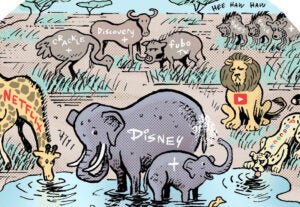

A 2004 statute prevents owning enough TV stations to reach 39% of households. But without the scale afforded to other digital content companies, local TV is at a competitive disadvantage.