Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

You Got Peltzed

Unilever will cut jobs and reorganize to fend off activist investor Trian Fund Management, led by Nelson Peltz, The Wall Street Journal reports.

Peltz unseated a Procter & Gamble board member in a shocking shareholder vote in 2017 – winning a recount by 0.0016% after losing the initial call.

Unilever is reorganizing its overall business into five categories: beauty and well-being, personal care, home care, nutrition and ice cream. The nutrition category will include faster-growing healthy snacks, while ice cream, which encompasses the Ben & Jerry’s brand, will live as a stand-alone unit.

Ice cream isn’t the best fit for Unilever. Like, soap, laundry detergent, skin-care ointments and … ice cream? On top of that, the macro-trend is all about healthy snacking.

Ice cream is also an ecommerce nightmare. People don’t order grocery delivery ice cream. And it has a low Inventory Performance Index rating – Amazon’s supply-chain and advertising metric. Ice cream is expensive to store and ship and over-indexes on complaints because, despite best efforts, it still melts. Amazon factors that into IPI scores, resulting in a lower star rating.

But as the Journal points out, separating ice cream as a stand-alone unit should make it easier for Unilever to sell slower-growing businesses.

And activist investors don’t necessarily want to see the world burn (or melt). P&G’s stock doubled since Peltz joined the board in March 2018. Last August, Peltz announced he would vacate the seat after selling part of Trian’s stake – and, apparently, after identifying a new target.

Creatoring A Business

YouTube, Facebookagram, TikTok, Snapchat, Twitter, Pinterest and even Twitch are in land-grab mode to strike relationships with creators and influencers. Across the board, platforms have raised payouts for viral content, announced new subscription or revenue services and tried straight-up cash-for-content deals.

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

But only YouTube ties creators to its platform with a percent of ad sales.

TikTok and Snapchat have lottery-esque bonuses but are inconsistent and unreliable. Their influencers are stuck in a side hustle, whereas popular YouTube video makers have steady businesses.

So why don’t other platforms commit a share of advertising to creators? It would be a powerful commitment, since creator revenue would grow with the company, points out New York Times columnist Shira Ovide.

The obvious rejoinder: Why should the platforms give up a significant share of earnings when they don’t have to? Twitter, Snap and Pinterest are scrapping for profitability as is. Any portion of ad revenue big enough to matter for creators would cut into their margins.

But there is a business case for influencer altruism.

“This is a moment when established norms of the internet are being questioned,” Ovide writes. “Let’s extend that to the economics of who is paid, and for what, to keep the internet fun and useful for all of us.”

Amazon’s Airwaves

Amazon’s ad business is evolving similarly to tech titans Google and Facebook as it starts growing beyond shopper marketing budgets and into general national branding bucks.

Its goal is to woo more non-endemic, big-ticket brands that are players on TV to Amazon video-based properties Twitch, Fire TV and IMDb TV, Insider reports.

Ad spending by non-endemic clients (brands not sold on Amazon, like universities, insurance companies or financial services) almost quadrupled in the last six months.

Amazon also restructured into two sales teams: one that works closely with big brands and agencies and another for smaller brands or platform users.

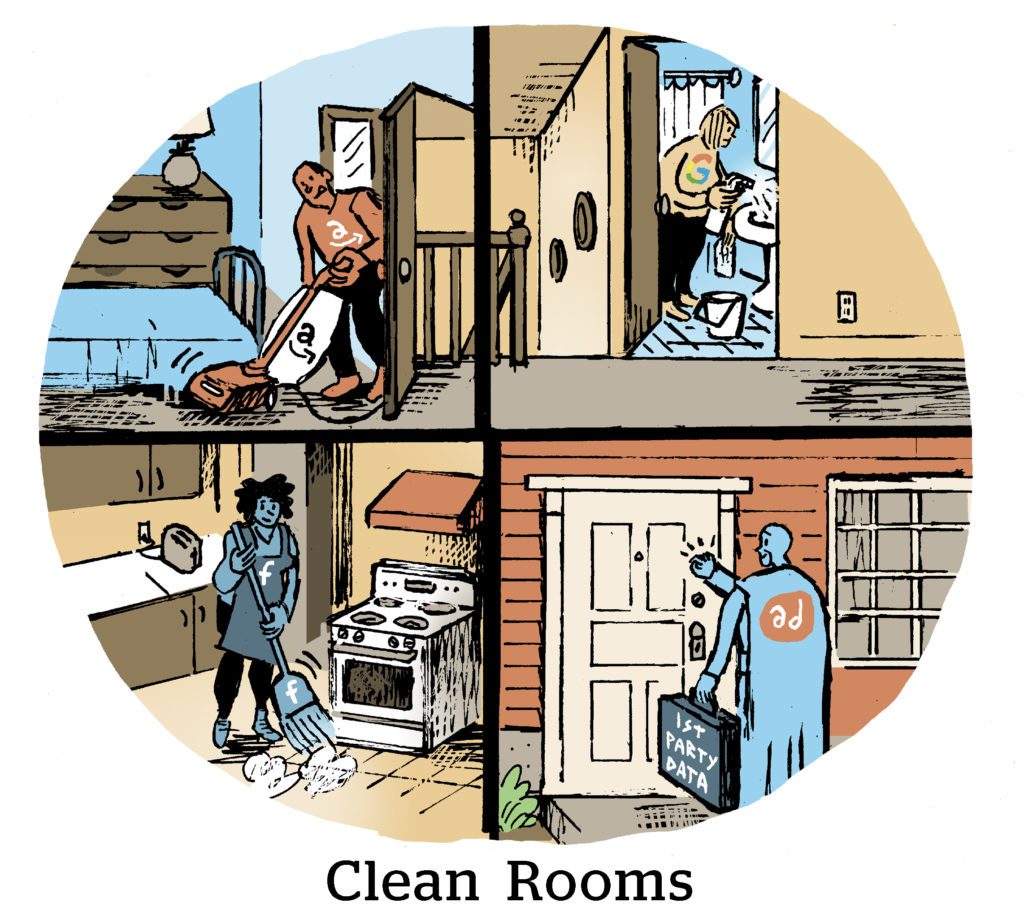

Amazon is selling marketers on its wider ad business, rather than individual ad placements. There is also more emphasis on measurement using the Amazon Marketing Cloud (AMC), a data clean room where clients can run user-level analytics.

But here’s a nifty differentiator: Marketers can use AMC without an AWS account, whereas the Google cloud-based clean room, Ads Data Hub, must be accessed with a Google Cloud Platform seat. (In other words, Google is leveraging its ubiquitous marketer contracts to boost Google Cloud, while the ubiquitous AWS is giving a leg up to Amazon’s young ad business.)

But Wait, There’s More!

Substack adds video player options to attract new creators and talent. [Axios]

Jebbit, a zero-party data company, raises $70 million from Vista Equity Partners. [release]

Eric Seufert: The App Store has a “too big to fail’ problem. [Mobile Dev Memo]

Broadcasters test measurement options and loosen Nielsen’s grip on the ecosystem. [Morning Brew]

Pinterest has lost at least seven senior execs – not to mention experiencing a drop in US users. [The Information]

You’re Hired!

InMarket president Todd Morris named co-CEO with founder Todd Dipaola. [release]

Kepler names co-founder Remy Stiles as CEO, North America. [release]

European publisher vet Ossie Bayram joins Ogury as UK country director. [release]

Adsquare appoints Chris Gurciullo as GM, Americas. [blog]