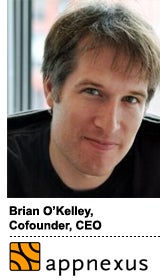

Alphonso’s Legal Fight With LG Isn't Over Yet – And Now $4.5 Billion Is At Stake

Alphonso’s founders lobbed yet another lawsuit at LG Electronics – this one seeking up to $4.5 billion in damages – over claims the company sabotaged their IPO, diverted profits and unfairly diluted their stake.