Gartner’s fourth annual Magic Quadrant for buy-side ad tech in a nutshell: Keep your eye on Amazon.

Amazon is ascending into the stratosphere, where it’s now rubbing shoulders in the “leader” category alongside Google and The Trade Desk. Rounding out the leader quadrant you’ll find Adobe, Amobee, Adform and Mediaocean.

MediaMath, Criteo, Verizon Media (ahem, Yahoo), Basis Technologies (you know ’em as Centro) and Xandr all have scale and expertise, according to Gartner, but they’re in the “challenger” category this year, meaning they lag the leaders when it comes to innovation and organizational stability.

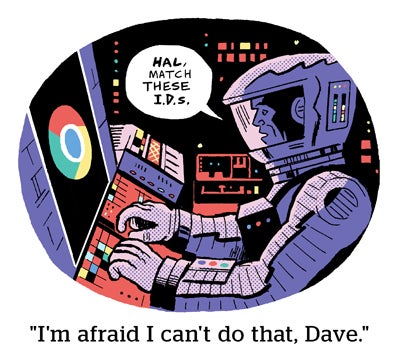

But there’s one thing all of these companies have in common, which is they live in a world on the verge of going third-party cookie free, and advertisers want them to have a solid, well-formed plan in place to deal with that massive change.

“Some of these companies have been thinking about that longer and harder than others, and that’s a differentiator,” said Andrew Frank, VP of research and a distinguished analyst at Gartner and one of the authors of the quadrant, which was released last week.

Amazon eating the world

Last year, Amazon was classified as a “challenger” on the quadrant. This year, it’s a “leader” sandwiched right between Google’s DV360 and The Trade Desk, two dominant demand-side platforms on the market.

The evolution of Amazon’s advertising business – it may have whiffed on its Q3 earnings, but advertising is growing like crazy – is “a textbook example of an effective fast follow strategy,” Frank said.

Amazon took a page right out of Google’s playbook, he said, by creating a workable balance between its own inventory and third-party ad inventory and by embracing self-serve.

Google was the programmatic pioneer, and now Amazon’s sliding in with a napkin tied around its neck ready to eat Google’s lunch.

“The biggest risk Amazon had before was that it wouldn’t take the media business seriously – but that’s clearly proven not to be the case,” Frank said. “They’ve dedicated the resources and they’re moving the needle as a result.”

One of the most appealing aspects of Amazon Advertising’s offering is its cookieless audience data, he said, including from amazon.com, Whole Foods, Amazon Fresh, Twitch, IMDb, Prime Video and Fire TV. Each asset contributes behavioral and demographic signals that feed the Amazon DSP and Amazon Marketing Cloud’s data clean room.

“It used to be that commerce data didn’t really drive media planning for the big brand advertisers, and so they didn’t care about it as much,” Frank said. Now, brands use commerce data to target based on lifestyle, values and consumer priorities, often as a replacement for third-party audience packages such as “high-end fashion shoppers” or “fitness enthusiasts.”

It’s no surprise Google and The Trade Desk were labeled as leaders once again. Both were leaders in last year’s Magic Quadrant.

But that was before Google let it be known that it’s no fan of email-based IDs as an alternative to third-party cookies. The Trade Desk, meanwhile, is Unified ID 2.0’s biggest cheerleader. Their presence in a tight cluster on the quadrant is like a visual metaphor for the current debate surrounding identity and the demise of third-party cookies.

“They represent the most fundamental conflict in terms of a vision for the future of the internet,” Frank said. “Do we want walled gardens making the rules or do we want an open web with standards and protocols everyone has to adhere to?”

Right now, it looks like the walled gardens are winning – but the jury’s still out.

“I wouldn’t underestimate … let’s call them the forces that would very much prefer to see an open web solution,” Frank said.

Different algebra

But other buy-side platforms appear to have paid less attention to the changes happening around digital identity, and that’s cost them market presence.

MediaMath, for example, went from a leader last year to a challenger in this Magic Quadrant largely because it failed to articulate its vision for the post-cookie future of digital identity. As a result, Gartner’s research sees fewer brands talking about MediaMath than before.

“They’re still in the top half in terms of their ability to execute,” Frank said. But MediaMath went all in on the Source initiative regarding transparency in the supply chain, which was eclipsed by the cookie conversation.

Beeswax & Zeta MIA

A few high-profile companies are conspicuously absent from the quadrant altogether.

FreeWheel-owned Beeswax and recently public Zeta Global both made their first appearance last year in the “visionary” and “niche” categories, respectively. But this year, neither company was evaluated.

In Zeta’s case, that has something to do with Gartner’s new inclusion criteria for the 2021 quadrant. Zeta’s impression volume didn’t meet Gartner’s newly raised minimum requirement, which calls for companies to have managed at least 100 billion ad impressions in the fiscal year 2020.

And in the case of Beeswax, its new ownership – Beeswax was acquired by Comcast’s FreeWheel late last year – coupled with its atypical bidder-as-a-service offering swayed Gartner to leave it out of the quadrant.

“Beeswax has always been sort of an outlier,” Frank said. “They’re almost in a market of their own, and it just didn’t feel like they belong this year.”

But who does belong? Gartner has sometimes been criticized for comparing companies that are quite different from each other despite the fact that they fall under the same wide umbrella of buy-side-focused ad technology.

In the colorful words of one commenter on AdExchanger’s coverage of Gartner’s 2020 Magic Quadrant for ad tech: “Comparing Criteo to Mediaocean is about as useful as comparing lasagna to cricket. The whole premise is nuts.”

Well, you can’t please everyone, Frank said.

And, regardless, all of these companies consider themselves to be competitors and part of a “coherent market,” even if the specific features and functions aren’t exactly the same, he said.

“We attempted to encapsulate what we think is important to the clients we serve,” Frank said. “That doesn’t mean every company is perfectly comparable, but if you’re in the market for buy-side ad technologies, these are the companies it’s useful to compare.”