Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

AdExchanger’s daily news round-up will return on Monday. Enjoy your holiday, and may all your online orders arrive on time.

A Little Bit Lauder Now

Estée Lauder wasn’t a first mover on TikTok – but it was a very fast follower.

The Estée Lauder EMEA marketing team was driven to TikTok largely due to Instagram’s diminishing ability to reach new audiences, Lubna Mohsin, the brand’s social media and content manager in the region, tells Digiday.

People typically think of Meta as having practically everyone in its audience pool. But even for a big brand like Estée Lauder, at some point, increasing spend on Meta’s apps simply means higher frequency rates against the same audience segments – especially when campaigns are in finite geographies (although EMEA is pretty massive).

TikTok, meanwhile, is begging for a chance to show off its ability to achieve scale with largely untapped consumers (i.e., teens and young adults).

“Last year, Estée Lauder’s presence on TikTok was staggered whereas this year we’re mandating its use because recruitment is our top objective on social media,” Mohsin says. “It’s already an always-on part of the marketing plan.”

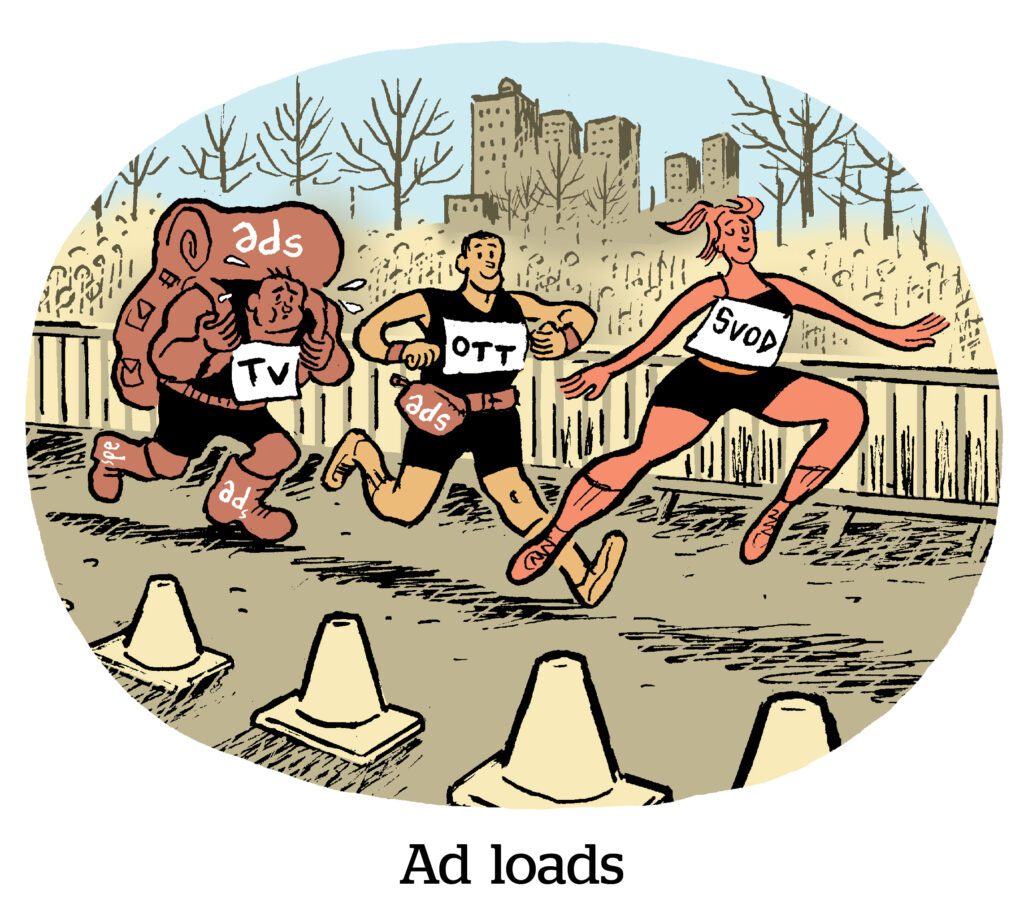

Changing Channels

Major advertisers in the UK will spend less on linear TV in 2023, creating an opportunity for smaller brands, The Drum reports.

Ebiquity and the Incorporated Society of British Advertisers (ISBA) conducted a survey of 59 top UK-based brands, including Unilever, Tesco and Procter & Gamble, that found two-thirds of respondents plan to cut linear TV budgets in 2023.

This pullback demonstrates the preference advertisers have for media channels that offer them more flexibility with their advertising commitments, especially during an economic downturn, says Phil Smith, ISBA’s director general.

But Lindsey Clay, CEO of Thinkbox, which represents major TV broadcasters like Sky Media and Channel 4, is pushing back on that assessment. Rather, she says, this change in spending priorities reflects the trend of marketers shifting away from linear and toward CTV and AVOD, as opposed to a recession-driven sea change.

Also, as larger brands hit pause, that should drive down prices for linear TV spots, giving other, possibly smaller, brands a chance to break in, Clay argues.

Other channels might benefit from the pullback, too. One-third of the ISBA survey’s respondents say they plan to increase paid search and social, while 22% say they’ll spend more on performance marketing.

Relay The Message

Fraudsters are taking advantage of Apple Private Relay, a feature that masks IP address and email data for iCloud+ subscribers. Why? So as to slip fake impressions to advertisers.

Pixalate and Basis Technologies worked together to identify invalid traffic masquerading as iCloud+ Private Relay (iCPR) audiences. Safari traffic that alleges to be covered by iCPR gets a pass in programmatic pipes because Apple expressly guarantees that all Private Relay traffic is fraud-free, writes Pixalate’s VP of product management, Amit Shetty. Private Relay blocks the data that would confirm the invalid traffic and reconcile campaign spend.

Pixalate first published information about this Private Relay fraud scheme three months ago, which in turn was three months after Pixalate first reported the scheme’s existence to Apple. And yet the amount of fraud has only grown – on pace to hit $60 million in 2022.

Apple isn’t committing fraud or even profiting from the malfeasance. Fraudsters are simply taking advantage of the fact that devices carrying iCPR labels are considered fraud-free and always obscured.

According to Pixalate, one-fifth of all Safari traffic is designated as iCPR, but nine out of every 10 iCPR impressions are spoofed.

Apparently, Pixalate has been unable to get Apple’s attention. Gizmodo also wrote about Pixalate’s findings, and Apple did not respond to repeated requests for comment.

But Wait, There’s More!

S4S Ventures, a venture fund backed by Martin Sorrell’s S4 Capital and Bertelsmann, invests $10 million in content management tech provider Tenovos. [Digiday]

The Athletic and Google launch a program to double the NYT-owned site’s coverage of professional women’s sports. [release]

Apple and Google are being probed by the UK’s CMA over their “stranglehold” on mobile devices. [Bloomberg]

Don Marti on Topics API data: What a million impressions tell us. [WebWideOpen]

What will Disney’s Bob Iger do with Hulu and ESPN? [NYT]

SponsorUnited secures a $35 million investment to build out its database of brand sponsorships. [TechCrunch]

You’re Hired!

CNN recruits Insider Inc.’s Alex Charalambides as CTO. [Variety]

Grocery TV, a digital retail advertising network, appoints Mike Pollack as its first CRO. [release]