The Prebid Summit in New York City on Tuesday offered plenty of new details about The Trade Desk’s OpenAds and PubDesk products that were announced earlier this month.

For one thing, OpenAds – TTD’s version of a Prebid auction, but still with universal Transaction IDs (TIDs) – will require TID sharing, TTD GM of Product Mike O’Sullivan told AdExchanger.

That’s in contrast to how Prebid previously would allow publishers to opt into TID sharing, before the open-source trade org nixed universal TIDs in an August software update.

O’Sullivan also shared details about OpenAds features that let publishers see for themselves whether TTD is running a fair auction, as well as a new data signal that flags bid request tampering by resellers and SSPs.

Don’t mess with the auction

In addition to making these product announcements at Prebid Summit, The Trade Desk was all over the agenda for this year’s event, participating as a sponsor and sending multiple high-profile speakers. That omnipresence made the recent tension between TTD and Prebid impossible to avoid.

That tension has played out for weeks across LinkedIn posts and blog treatises, ever since Prebid began assigning unique Transaction IDs for individual sellers, rather than using the same TID across sellers. As a result, DSPs lost a key tool for tracking conversions across the third-party programmatic ecosystem.

Critics, TTD included, blasted Prebid’s move as an attempt by certain sellers to limit data transparency, which the buy side needs to identify and avoid tactics like bid duplication and ID bridging.

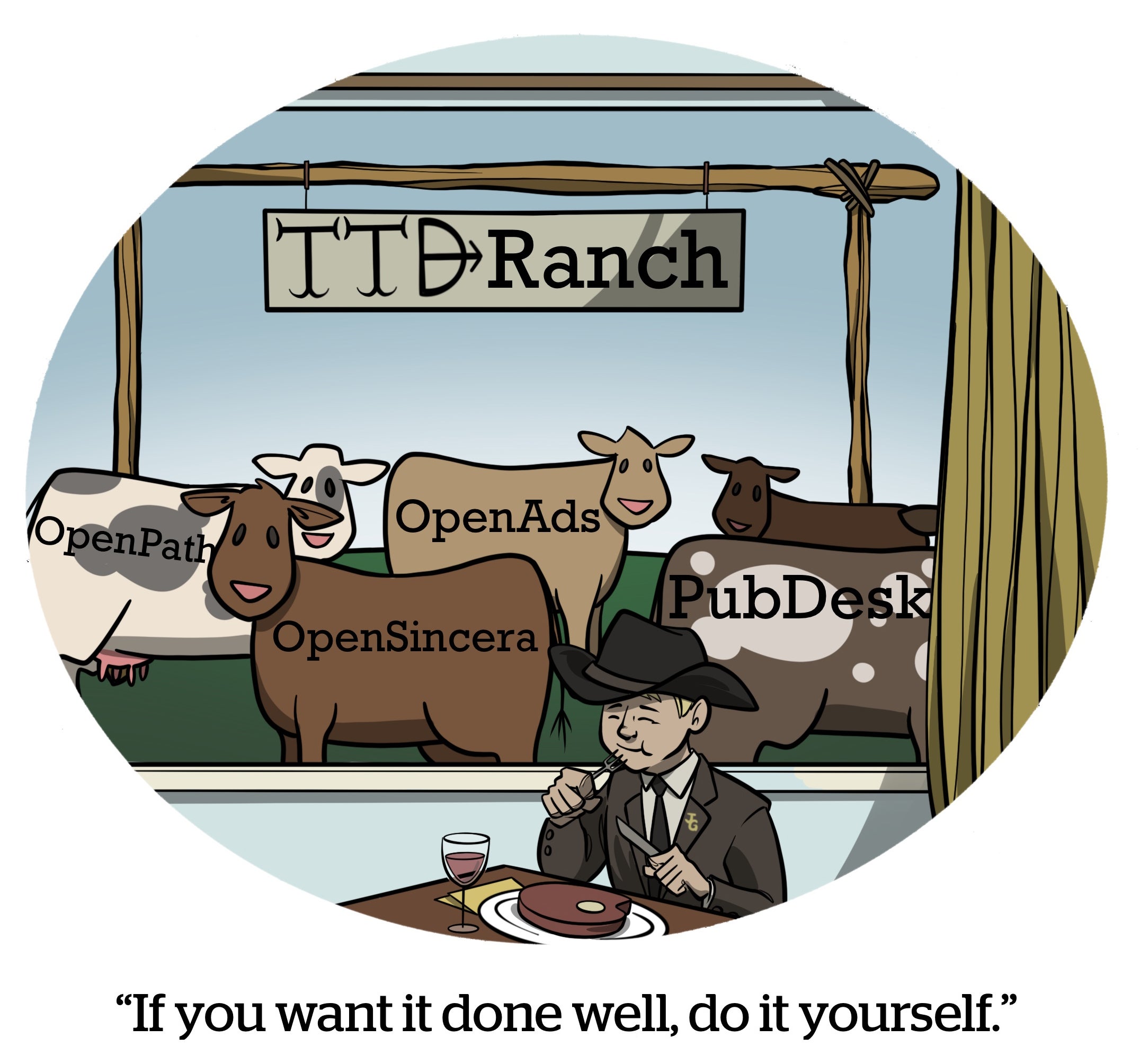

However, to critics, TTD’s decision to launch its own forked version of Prebid is yet another example of the DSP launching what many in the industry see as sell-side products.

In his presentation, TTD CEO Jeff Green emphasized that, in the company’s view, even OpenAds, an auction wrapper, and PubDesk, a publisher dashboard, are products that ultimately serve buyers by informing publishers how to gain more of their demand.

Green disputed that TTD running its own auction – in a similar fashion to a sell-side platform – shows that it’s no longer purely a demand-side platform. He reiterated TTD’s position that not actively participating in publisher yield management is what separates it from SSPs.

And it’s not like buyers have no stakes in auction mechanics, Green said.

“I don’t believe that the auction itself is inherently a sell-side thing,” he said. “Sellers want a fair auction, and so do buyers.”

Green even decried the “tribalism” of the buy side vs. sell side discussion. But, he added, if the industry insists on an “us vs. them” framing, it should focus on the divide between “quality publishers who are taking home less than they should be and publishers that are taking home more than they should.”

According to Green, TTD’s priority is a fair auction for all parties. To that end, he said the company’s goal in running its own auction wrapper is to “not perpetuate the legacy that Google started, which is, ‘Let’s fuck with the auction as much as the law will allow, and even maybe a little beyond that.’”

New OpenAds features

With that goal in mind, O’Sullivan previewed an OpenAds feature called Auction Code Attestation. It basically allows the sell side to review aspects of TTD’s auction code to ensure the DSP has no advantage compared to other bidders.

He also demonstrated a feature called Auction Audit. It allows publishers to see discrepancies between the publisher’s preferred auction parameters and how auctions are actually handled by SSPs and resellers. This reporting is included in TTD’s PubDesk dashboard.

For example, O’Sullivan told AdExchanger, publishers are often surprised that their Google Ad Manager settings are not universally applied across auctions. They might set a 30-second ad refresh rate in GAM, then be shocked when TTD informs them of an ad refresh rate of seven seconds. Or they might believe they run one or two video placements on a page, only to discover some ad tech partner has placed a third in-banner video unit.

Another OpenAds feature O’Sullivan previewed at Prebid Summit, called the Sincera Integrity Signal, is meant to prevent such bidstream tampering.

He compared it to how, in medieval times, letters came with a wax seal to demonstrate the message was not tampered with before it arrived. The integrity signal is like a wax seal for bid requests, he said. If TTD finds certain bidstream data has been changed, it knows to investigate that supply chain.

Sell-side skepticism

Despite TTD’s attempts to highlight the transparency features baked into OpenAds, skepticism persisted among the mostly sell-side crowd at Prebid Summit.

Multiple attendees expressed to AdExchanger concerns about TTD’s precarious balancing act between the buy side and sell side. They voiced fears that TTD’s real goal is to tip the balance of power in open web advertising in its favor, similar to how Google and other Big Tech platforms have behaved in the past – despite TTD’s explicit attempts to assure them otherwise.

Two attendees separately noted that TTD is forking its own version of Prebid at a time when other Big Tech platforms, such as Amazon, are embracing the standard.

It’s possible that even Google will soon offer a Prebid adapter as part of a remedy to its ad tech monopoly. And, while TTD will continue to bid into Prebid, concerns are growing that most of TTD’s demand will end up flowing to publishers using OpenAds and TTD’s OpenPath direct-to-publisher connection.

However, O’Sullivan stressed to AdExchanger that anyone could create a branched-off version of Prebid’s open-source code. And while there are differences between OpenAds and Prebid, he said, there are many similarities.

Green echoed that sentiment, noting during an onstage Q&A that TTD’s version of the auction is the same as Prebid’s, just from a few months ago. (Except, that is, for OpenAds requiring TID sharing, rather than making it opt-in.)

Plus, O’Sullivan said, TTD will incorporate new Prebid features into OpenAds “on a case-by-case basis” as they roll out.

O’Sullivan also confirmed that OpenAds will have a code repository and a way for programmers to offer feedback.

And TTD won’t be abandoning Prebid while only supporting its own auction.

According to Green, TTD wants to keep working with Prebid and contributing to buy-side representation in the organization. But he said there are concerns about which voices will dictate the org’s direction.

“We have to decide what are our constituents are going to be,” Green said. “And if it’s just resellers, this will be a very different group than if we’re representing resellers, sellers, publishers and buyers.”

Thought leadership through posting

Speaking of resellers, Prebid’s TID change wasn’t the only public beef hanging over discussions at Prebid Summit. There was plenty of drama about TTD’s decision to brand all SSPs as resellers in its Kokai platform.

Both topics have generated online finger-pointing over who’s really pushing for transparency for both sides of the supply chain, rather than giving one side an advantage over the other.

Before Prebid even announced its TID shift, O’Sullivan had already triggered a social media back-and-forth by posting that he was “struggling” to find “principled reasons for not supporting Transaction ID.”

Green later added fuel to the fire in a blog post announcing OpenAds. He described Prebid’s update as a “ploy to obfuscate the supply chain, allowing sellers and publishers who focus on supply chain shenanigans to monetize better than those who focus on driving demand for quality content.”

In kicking off the Prebid Summit, Prebid President Mike Racic took a few thinly-veiled shots back at TTD’s online jabs.

“We do not engage in the trolling wars on LinkedIn,” Racic said. “I read it. My blood pressure rises about 30 points and I want to kill someone.” But, he added, Prebid focuses on “putting out fires,” not “pointing fingers.”

However, Green doubled down on “itemizing the sins of the past,” as he phrased it.

“Many people have said to me, Jeff, it would have been less contentious if you’d have done this another way,” he said. “And my response to that is, ‘Yes, but this is faster. This is facilitating the dialogue that we need to be having.’”

O’Sullivan agreed that “having these conversations serves the industry well,” he told AdExchanger.

But multiple Prebid Summit attendees said they’re not convinced the two sides can reconcile their differences. After all, publishers in particular have been burned by big platforms’ promises before.

For his part, Racic said during his summit intro that he feels there’s a lot of “gaslighting about transparency” going on.

There also isn’t much agreement on how best to promote a fairer ecosystem. Prebid sees itself as also fighting for more auction transparency, he said. But he added that no one platform – Prebid included – should dictate terms to the rest of the industry.

Trusting one company to be the shepherds of transparency, Racic said, is “almost ridiculously stupid.”

Correction 10/16/25: This article originally said that TTD’s Mike O’Sullivan posted on LinkedIn to ask about “principled reasons for not supporting Transaction ID” following Prebid’s announcement that it would no longer support universal TIDs. O’Sullivan actually posted about the topic before Prebid announced its change in TID policy.