The ongoing corporate conflict between Alphonso and LG Electronics (LGE) has all the makings of a Netflix docuseries.

In fact, Ashish Chordia, co-founder and former CEO of Alphonso, the TV data startup that became LG Ads after LGE acquired a controlling stake in 2021, is actually considering it.

“I think I’ve got enough material. I’m not joking,” he told AdExchanger.

Speaking of material, in late November, Alphonso’s founders fired their latest salvo, a lawsuit filed in the California Superior Court of Santa Clara County that seeks more than $1.5 billion in personal punitive damages as a result of an alleged breach of fiduciary duty.

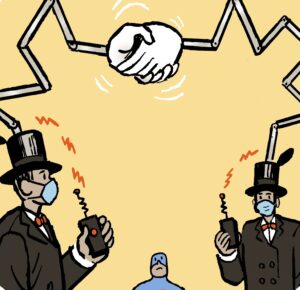

In plain English: LGE allegedly squeezed Alphonso’s founders off the board, capped their profits at 15% and pocketed more than $100 million while blocking an IPO with the intention of buying them out cheap.

The suit further alleges that LGE’s actions weren’t isolated maneuvers but part of a calculated pattern to erode the value and influence of minority shareholders.

“Look, we think a lot of bad things were done and we’re going to prosecute to the maximum extent we can,” Chordia said. “And we feel that discovery will show what we believe to be true based on what we already know.”

LG Ads declined to comment on the lawsuit.

Inventory disagreement

The plaintiffs are asking for a jury trial and, if they win, they could be awarded up to $4.5 billion, because California’s penal code allows for treble damages in cases of proven theft.

And the complaint is jam-packed with juicy details that would play well to a jury, including an alleged secret plan to eliminate shareholder protections for Alphonso’s founders.

But let’s back it up.

The drama began with what should have been a straightforward agreement detailing how Alphonso would price, buy and sell LG’s ad inventory.

When the two companies first hammered out the terms of their inventory agreement in April 2021 – eventually finalizing pricing at a $1.52 CPM for display and $3.20 for video, which were favorable rates for Alphonso – the idea was to put Alphonso in a prime position to IPO, a plan LGE had committed to in the original stockholders agreement.

But the spirit of partnership didn’t last long.

The ink was barely dry on the final pricing when, according to the complaint, LGE’s leadership pressured Alphonso’s management to renegotiate the deal, with LGE demanding a five- to six-fold price increase for inventory that would kick in retroactively.

LGE allegedly also tried to strong-arm KPMG, the outside accounting firm that helped set the price, into revising its prior analysis. Alphonso’s management and independent board members pushed back, and LGE’s proposed amendment to the inventory agreement didn’t go through.

But, according to the complaint, that didn’t stop LGE. “Unable to amend the inventory agreement,” the suit claims, “LGE simply breached it.”

For example, the inventory agreement included an exclusivity clause that gave Alphonso the sole right to sell LG’s ad inventory and full control over sales decisions. According to the suit, LGE ignored this clause and cut side deals with two third-party streaming and TV ad platforms – AppLovin-owned Wurl and Amagi – to sell LG ad inventory.

When Raghu Kodige, Alphonso’s then CEO, flagged this as a violation of the inventory agreement, LGE didn’t revise its contracts with Wurl or Amagi, which, according to the suit, caused Alphonso to lose out on millions in additional revenue.

“Not content with this small ‘victory,’ the suit continues, LG’s leadership allegedly then set “Project Wall-E” in motion, the aforementioned secret plan to strip minority shareholders of their voting rights, dissolve the stockholders agreement and squeeze out minority shareholders at the lowest-possible price so LGE could snap up the remaining shares for less than their fair value.

LGE executed Project Wall-E – a reference to the Pixar movie about a trash-collecting robot – on December 16, 2022, with the mass firing of all key shareholders, including Chordia and Kodige.

Déjà sued

If this all sounds familiar, that’s because Alphonso has already notched several victories in other recent legal battles with LGE over shareholder rights and corporate control.

This is Alphonso’s fourth lawsuit related to LGE over the past two years.

In 2023, Alphonso’s co-founders sued LGE twice in a Delaware court over breach of contract and board misconduct. They won both times and had their board rights reinstated.

Over the summer, Lampros Kalampoukas, another Alphonso co-founder and the company’s former CTO and VP of engineering, filed a lawsuit in Manhattan Supreme Court against risk and financial advisory services firm Kroll for allegedly undervaluing Alphonso by nearly $100 million on purpose to benefit LGE in its legal battle with Alphonso’s minority shareholders. That one’s still pending.

Then, in September, several Alphonso co-founders filed an amended suit in Delaware seeking monetary damages from LGE and its Zenith subsidiary for the harm caused by the earlier board takeover fight.

But while those prior wins may have set important precedents, the latest case in California is different, because it’s not structured as a class action. This suit was brought directly by minority shareholders, a strategy that allows them to pursue remedies not available in other earlier actions, including a jury trial and the possibility of significant punitive damages – $4.5 billion in this case.

Yet even as these legal battles continue to play out, Alphonso is getting itself ready to hit the public markets.

In August, Chordia hosted a press conference in Seoul, South Korea, touting his IPO plans and, late the following month, Alphonso announced that it had confidentially filed paperwork with the SEC to take the company public.

Although there’s still a lot that’s TBD here, one thing is clear: The Alphonso/LGE standoff has plenty of twists and turns left to come.