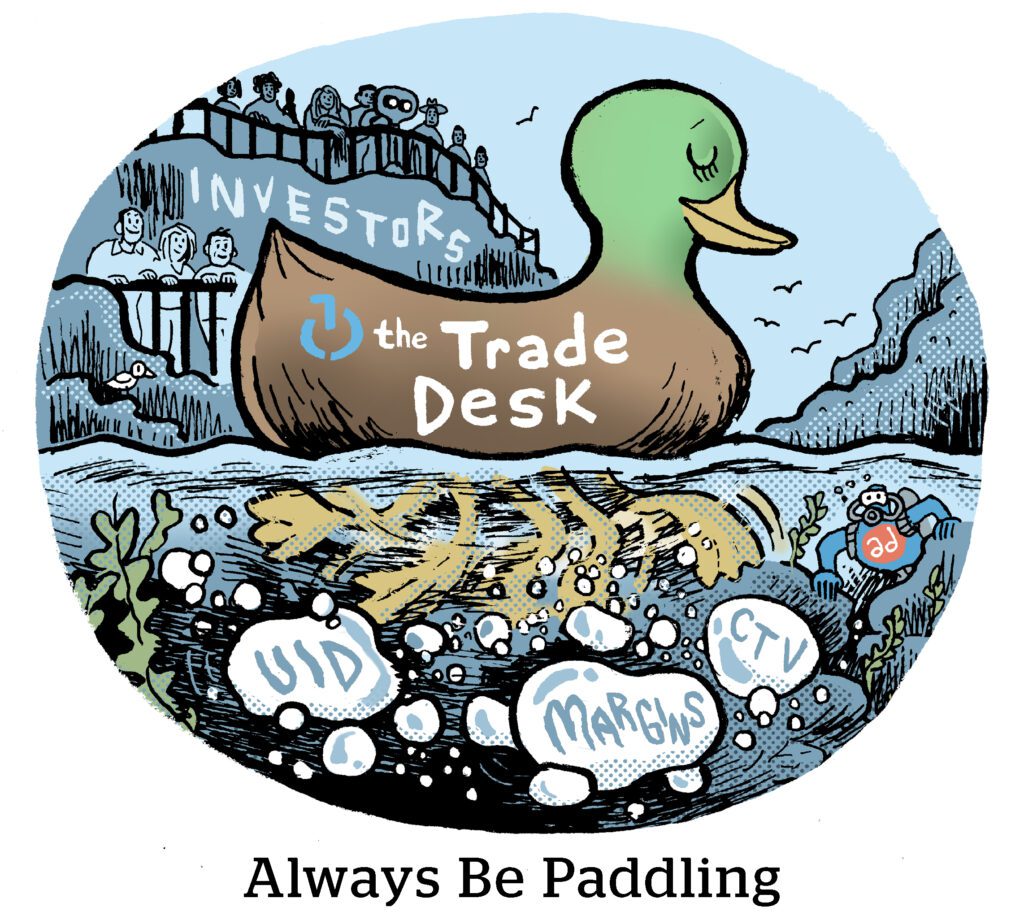

If you felt a strange gust around 5 pm ET on Thursday, it was probably the cumulative sighs of relief across Wall Street as The Trade Desk shook off its Q4 blues with a better-than-expected first quarter earnings report.

In February, when TTD reported a bad miss on Q4 revenue, its shares plummeted by one-third, from roughly $122 to $82.

This past quarter, The Trade Desk’s revenue was $616 million, up from $491 million a year ago, and net income rose from $31.7 million to $50.7 million.

The company’s shares jumped by more than 20% by Friday to more than $70.

Founder and CEO Jeff Green made the case for TTD’s growth potential by noting that Vivek Kundra, who came on board as COO in March, has been hired by Salesforce in 2012 at a time when that company was “pretty much the same size and scale as we are now.”

Today, Salesforce has a $268 billion market cap. TTD’s value is in the $30 billion range.

Platform shake-ups

Throughout the investor call, Green emphasized that open internet programmatic is better-positioned now than it’s ever been, because walled gardens might finally be cracking.

They aren’t opening, mind. But walled gardens are being forced to compete on more even and transparent terms with their third-party vendors.

For example, in the space of less than a year, Google was found guilty of operating two separate monopolies, one over search and another in the online advertising market.

“Google is already beginning to turn down and turn off some of the draconian and illegal practices of the past,” Green said.

But it’s not just Google’s walls that are cracking.

Green pointed to a class-action suit against Meta over its use of “blended price” auctions as opposed to the second-price auctions that advertisers expect. And just last week, Apple was forced by a US judge to allow developers and businesses to promote and process payments without Apple’s high fees.

These changes forced upon Apple and other walled gardens “represent a significant milestone for developers and entrepreneurs everywhere who want to build and compete on a more level playing field,” Green said.

But what about Amazon?

Matt Swanson of RBC Capital Markets asked how the growth of the Amazon DSP has shaped the market for TTD.

“I don’t really consider them a competitor,” Green said.

Which, lol.

Amazon’s ad business will grow and remain a high-margin asset because Amazon owns Prime Video, not to mention Amazon’s own search and sponsored products, Green said. But “we’re very clear on what Amazon’s playbook is, and it’s actually very similar to the Google playbook,” he added.

For instance, walled gardens are being forced to focus more on their own properties, he said, in part due to regulatory scrutiny but also as a result of natural market trends.

Meta doesn’t have the same antitrust headaches as Google, because it doesn’t operate an open internet DSP like Google’s DV360. Green predicted Google will follow Meta’s lead and that DV360 will increasingly become the buying platform for YouTube and other Google-owned inventory. Similarly, Amazon’s DSP will eventually be the way advertisers purchase Prime Video and other Amazon media.

But Amazon also faces a unique challenge in that it competes directly with so many Fortune 1000 companies. Banking, health care, cloud services, consumer tech, household products, grocery brands, retailers and so many other types of businesses are in direct competition with at least some part of Amazon’s business. Those companies aren’t going to ignore Prime Video or Fire TV, but they’re less likely to default to Amazon DSP for ad buying.

TTD’s focus, therefore, is on “continuing to execute on the things that we’re focused on, rather than getting distracted by somebody like Amazon,” Green said.

Too many links in the supply chain

But despite the headwinds facing walled gardens, they continue to earn the vast majority of all new online ad budgets. And despite their well-known lack of transparency, “in some cases, [walled gardens] have won on supply chain efficiency,” Green said.

Yet walled gardens have far higher margins when their ad tech serves ads within their own environments.

“In order to compete with that, we need a supply chain that is quite efficient,” Green said. That’s where products like OpenPath and TTD’s AI-based bidding product, Kokai, come into play.

It should be noted that TTD often gets called out for its own relatively high roughly 20% take rate.

But Kokai creates a simpler supply chain by consolidating data providers and campaign optimization into one product, where decisions are made more by the machine.

“We’re always trying to balance giving clients exactly what they want versus pushing the industry forward,” Green said. Kokai is an example of TTD pushing, rather than responding to the demand of its clients.

Walled gardens are winning in part because they make it so easy to set up and run campaigns. Kokai is TTD’s version of the platform easy button.

OpenPath is another example of TTD pushing into something new – in this case, the supply side. By integrating TTD’s bidding directly with publishers, OpenPath can often cut out the SSP and reduce publisher ad server costs.

Green described OpenPath as “a stalking horse and a canary in the coal mine.”

Mixed metaphors aside, the idea is that the DSP gets great value when publishers take OpenPath’s gift of direct demand (the stalking horse). OpenPath pixels (the so-called canaries) then send back important information from publisher sites.

“We don’t need OpenPath to be 100% of the inventory to get all the benefits,” Green said. “We just need the visibility from it so that we can make certain that we’re steering the supply chain in the right way.”