It’s A Metastrophe!

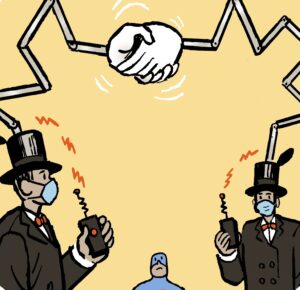

Meta reported solid Q3 earnings, but here’s an awkward revelation: Apparently, Meta expects that around 10% of its annual revenue will likely come from fraudulent ads.

According to documents shown to Reuters, Meta has exposed its users to financial fraud over the past three years in the form of ads for investment schemes, illegal online casinos and the sale of banned medical products.

Meta spokesperson Andy Stone says in a statement that the documents “present a selective view that distorts Meta’s approach to fraud and scams” and that the initial 10% estimate is “rough and overly-inclusive.”

He did not provide specific figures.

Another shocking reveal is that Meta’s ad system only flags ads as part of a scam if its automated detection reaches an extremely high confidence level – over 95% – meaning that most scam ads slip through.

But, as Reuters reports, Meta was aware that certain advertiser accounts were up to no good and responded by charging those advertisers higher rates – thus profiting more from scam ads than ads from good-faith advertisers.

Advertisers on Meta, and Google for that matter, have long struggled with ad fraud on these platforms as well as bugs and glitches that, in general, prove quite lucrative to the walled gardens.

And to add insult to injury, when forced to issue refunds, platforms typically do so in ad credits.

Subscription Conniption

The rapid growth of AI vendor tech has put software as a service companies in a strange position.

For one, incumbent software providers are LLM power users. Also, SaaS customers often begrudge their purportedly “sticky” vendor partners. Some brands will opt for an OpenAI subscription and then just feed it prompts like “create a customer review software tool that plugs into Shopify.”

The latest indignity, The Information reports, is that LLMs have figured out how to take advantage of SaaS pricing policies to negotiate down the price of a given vendor’s tech.

The AI will scan contracts, renewals and third-party data sources to identify opportunities to reduce subscription vendor costs. The agent will then draft an email that purportedly comes from the business’s own procurement department. From there, it will negotiate prices down.

It’s easy to see how this dynamic could naturally extend to other types of subscriptions.

For example, news and entertainment subscriptions, as well as shopping membership programs, will often offer a steep discount when subscribers are just about to hit that final “confirm” to unsubscribe button.

An AI tool could help apply that approach at scale.

The Ult-AI-mate Showdown

People like to say AI is a great equalizer or democratizer of tech. Advertisers can generate higher-quality content at a faster rate for less money – so, where’s the downside?

The loser in this equation is generally thought to be the agencies, although the aforementioned SaaS providers are taking a hit, too.

And as the popularity of generative AI continues to rise, whispered rumors of the demise of agencies only get louder. The thing is, agencies themselves don’t think they’re facing an existential crisis.

WPP is leaning into AI with an increased AI investment of 300 million pounds ($390.7 million) this year, compared to 250 million last year, The Wall Street Journal reports.

There have been major reductions in the cost to produce an ad, but clients are asking agencies to create more content, so there isn’t necessarily a revenue dip, according to WPP CTO Stephan Pretorius.

Although, he also said WPP has plans for “attacking the mid-market and smaller brands” with its self-serve Open Pro product. Looks like agencies are getting out of the services business to some degree.

But Wait! There’s More!

Snap’s share price rose 25% after it announced a $400 million deal to integrate Perplexity’s AI answer engine into Snapchat. [WSJ]

Meanwhile, Amazon sent Perplexity a legal threat claiming the LLM’s Comet shopping assistant is violating Amazon’s terms of service by not declaring itself as an AI agent. [TechCrunch]

Speaking of Amazon, its DSP is making deeper inroads into programmatic audio by integrating iHeartMedia’s podcasts and streaming music. [Variety]

Search queries that feature a Google AI Overview have seen organic click-through rates drop 61% and paid click-throughs drop 68% since mid-2024. [Search Engine Land]

As part of a criminal investigation, the FBI is trying to unmask the owner of archive.today, a web archiving domain that’s commonly used to bypass publisher paywalls. [404 Media]

OpenAI walks back comments its CFO Sarah Friar made this week about seeking government backing for loans the company has taken to support its $1 trillion infrastructure expansion. [MarketWatch]

Social media giants must stand trial for addiction claims, as per a Los Angeles Superior Court decision. [Bloomberg]

You’re Hired!

OpenX promotes three senior leaders, including Matt Sattel to president, Joel Meyer to CTO and Tyler Romasco to EVP of demand platforms and publisher partnerships. [release]

Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.