Looks like Pinterest has its eyes – or its pins, rather – fixed on connected TV.

On Thursday, the social image-sharing platform announced plans to acquire tvScientific, a CTV advertising platform that specializes in outcomes-based ad buying for performance marketers.

Although financial terms of the deal were not disclosed, Pinterest did reveal that the transaction is subject to regulatory review, suggesting that it is valued at or above the Federal Trade Commission’s reporting threshold of $126.4 million.

The deal is expected to close in the first half of 2026, after which tvScientific will continue to operate independently under its own branding.

As seen on TV

Pinterest buying an advertising platform shouldn’t come as too much of a shock, given that the company reportedly conducted reviews of five potential ad tech acquisitions earlier this year.

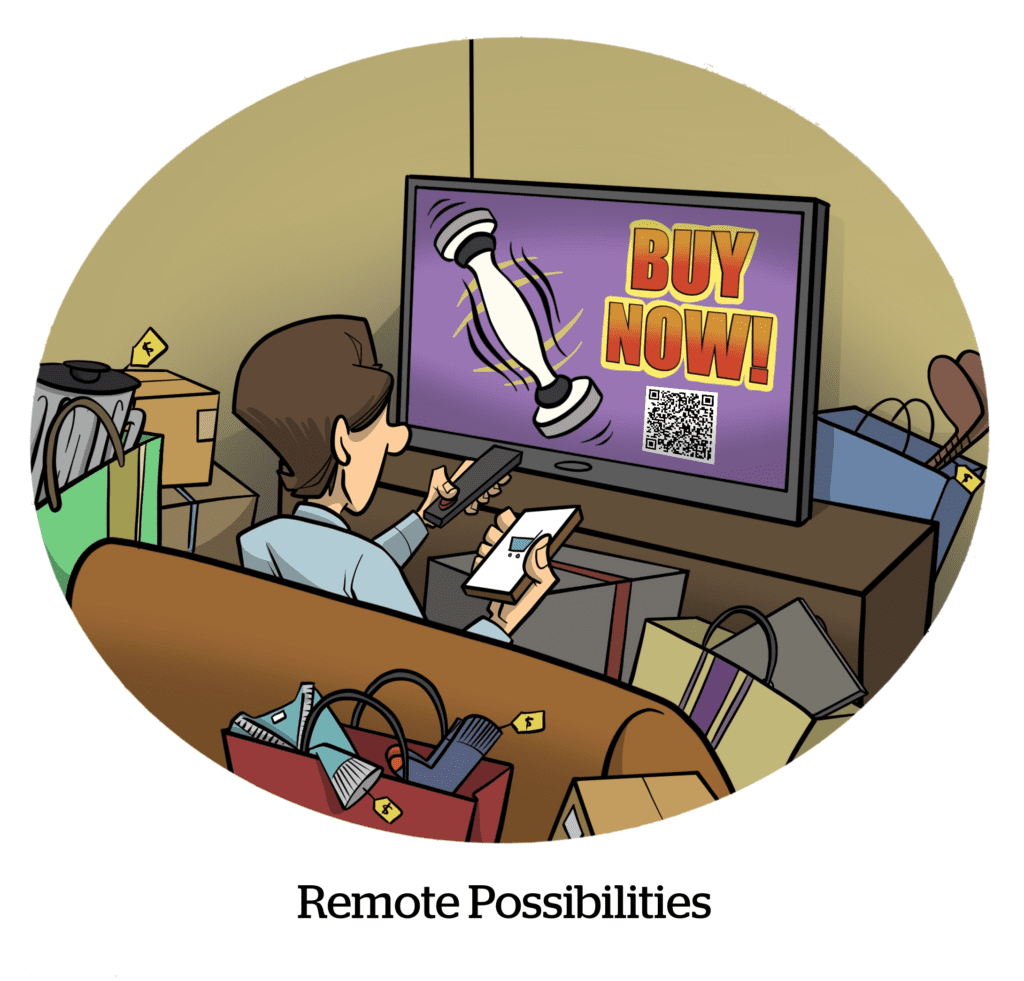

CTV, however, is a new advertising channel for Pinterest (not counting Pinterest TV, which isn’t actually television so much as it is live streaming video.)

Still, tvScientific’s outcomes-focused business model arguably aligns with Pinterest’s larger goal of repositioning itself as a performance marketing platform. Over the past few years, Pinterest has leaned into commerce marketing APIs, shoppable ad formats and AI-powered tools for content discovery and ad optimization.

One of those tools is Performance+, an AI ad targeting product that Pinterest introduced in 2024 to compete with the likes of Google’s Performance Max and Meta’s Advantage+. According to Pinterest CRO Bill Watkins, ad impressions grew 41% YOY in Q3 right after Performance+ launched, and advertisers that use the tool have been seeing 20% efficiency gains.

TvScientific integrates similar techniques into its ad buying strategies, using algorithmically optimized placements based on client-approved metrics. The startup also uses a cost-per-outcome pricing model, which only charges advertisers when their campaigns achieve the desired metrics. The tech is already integrated directly into several affiliate marketing platforms, including Rakuten and Impact.

Meanwhile, the deal could allow Pinterest to build something akin to Google AdSense or Meta’s Audience Network but for CTV, where smaller advertisers buy TV inventory through the platform, Pinterest takes a cut, and attribution data feeds back into its ad stack.

Against this backdrop, exploring new opportunities in CTV could also give Pinterest a way to address one of its biggest current challenges, which is that the proliferation of AI-generated content on its platform may be alienating its core user base.

After all, it’s hard to get someone to click on a shoppable ad if they’re not engaging anymore.