Well, well, well. Look who finally found a buyer?

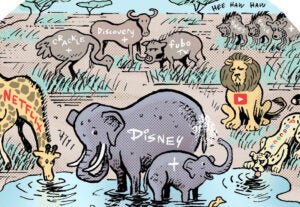

After a prolonged will-they, won’t-they phase between Paramount Skydance and Warner Bros. Discovery, Netflix swooped in with an $83 billion offer on Friday to acquire the Warner Bros. side of the business – which includes the film and TV studios, HBO Max and HBO.

Variety reports that the $83 billion in enterprise value (meaning the entire worth of the business, including debt) levels out to about $72 billion in equity value, which is the amount that WBD shareholders actually pocket. The deal is slated to close in 12 to 18 months, after the planned spin-off of Discovery Global into its own company in Q3 next year.

Of course, the deal is far from done yet, as several regulatory bodies still need to give their approval. Complicating this further in the US is President Donald Trump’s close ties to Larry Ellison, the largest shareholder of Paramount Skydance and father of Paramount CEO David Ellison. Netflix CEO Reed Hastings is a prominent Democratic donor.

In previous administrations, those wouldn’t be such mitigating factors. But under President Trump and the current leadership of the DOJ, it would be unsurprising, and in fact was already reported by The New York Post, that Netflix would face a “sweeping, multiyear investigation” if its offer beat Paramount.

David Ellison is already on the offensive as well, having penned an open letter to WBD CEO David Zaslav that called the process “tilted and unfair.”

Meanwhile, in Ad Land

Assuming everything goes through as intended, however, the buyout has huge ramifications for both the entertainment and advertising industries.

In the short term, Netflix stated that it “expects to maintain Warner Bros.’ current operations and build on its strengths, including theatrical releases for films.”

But in the long term, it’s entirely possible that Netflix will take a page out of other post-merger playbooks (like Disney and Twentieth Century Fox/Hulu or Paramount and Skydance, for example) and consolidate all of its back-end ad sales and ad tech products, not just the entertainment libraries.

That might be bad news for WBD’s NEO platform, which is live with a select group of beta partners. The Netflix Ad Suite is relatively nascent as well, but, as of June, it’s available across all 12 of Netflix’s ad-supported markets, putting it slightly ahead in terms of global development.

Then again, NEO allows advertisers to buy against linear and FAST channels. So maybe it will go to Discovery Global in the divorce instead, along with WBD’s TV networks business.

Similarly, DemoDirect, the other ad product that WBD unveiled during its upfront presentation this year, has a much stronger focus on linear advertising audiences, which seems like it would fit squarely into Discovery Global’s camp as well.

Representatives from neither Netflix nor Warner Bros. Discovery could be reached for comment.