What can publishers expect from PubDesk, The Trade Desk’s new publisher dashboard?

Not world domination, according to Mike O’Sullivan, The Trade Desk’s GM of product.

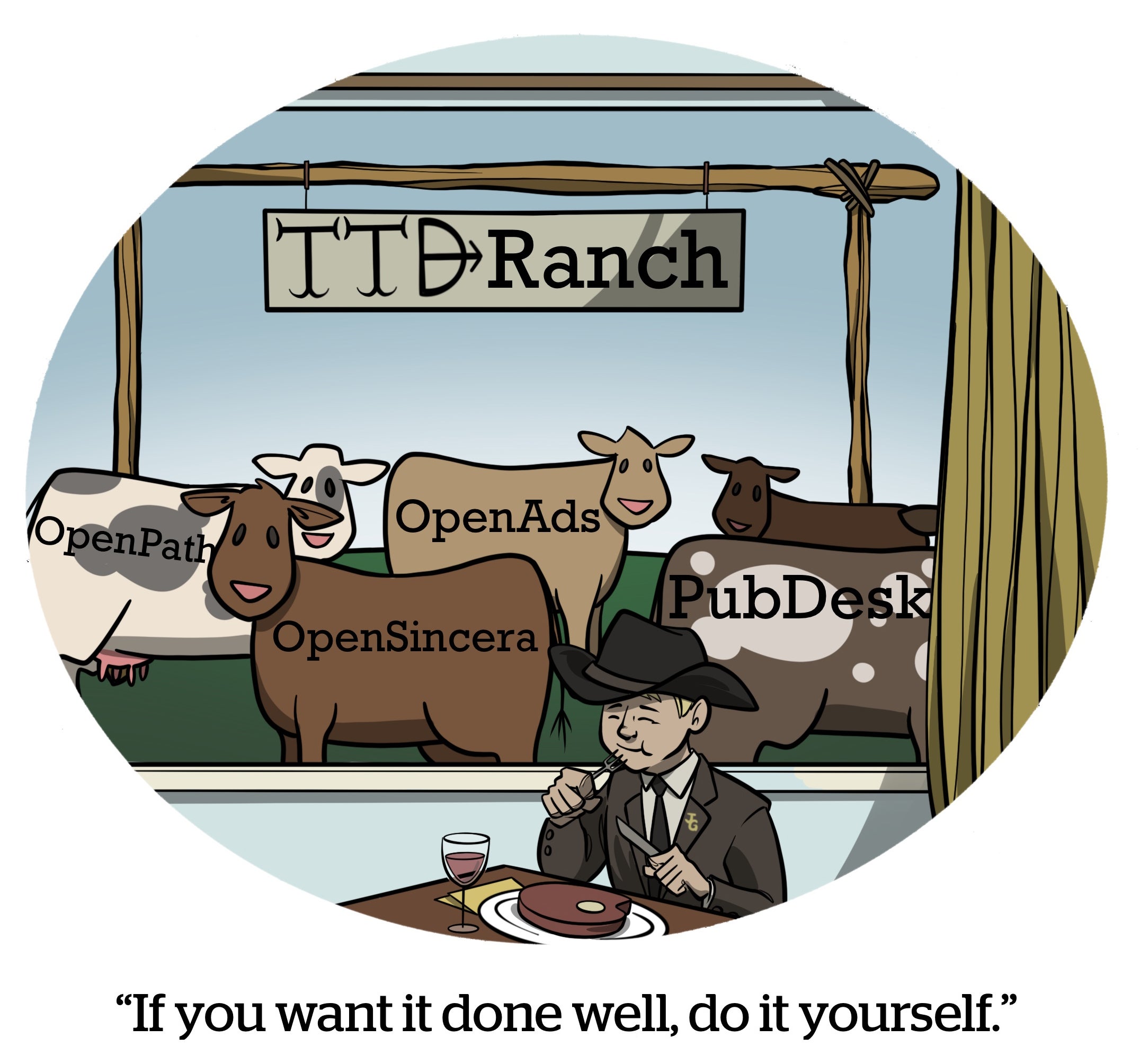

Since 2022, when TTD launched OpenPath, its direct-to-publisher supply connection, there’s been an industry narrative that the largest independent demand-side platform has it out for SSPs and is plotting a takeover of the supply side.

Last week, the speculation got a little louder when The Trade Desk announced plans to launch its own auction wrapper built on Prebid and release PubDesk as an accompanying dash for sellers.

But neither tool has anything to do with “going to the sell side,” O’Sullivan said.

“The question about whether we’re going to the sell side comes from folks afflicted with ‘The Trade Desk derangement syndrome,’” he said. “But that’s not what any of this is.”

OpenAds is about creating a fair auction environment, O’Sullivan said, and the purpose of PubDesk is to give publishers detailed info on how buyers value their inventory and what drives bid pricing.

Both products ultimately still serve the buy side first and foremost, according to O’Sullivan, because they aim to surface more high-performing inventory for buyers to target. Even PubDesk, which is a seller-focused tool, serves the needs of buyers.

“We simply built a scaled way to tell publishers what our buyers want to see,” he said, “because that’s what performs.”

O’Sullivan and Ian Meyers, TTD’s director of engineering, gave AdExchanger a preview of PubDesk’s feature set. The tool will exit beta on Tuesday and be available to any publisher that’s also using OpenPath. All publishers and SSPs working with TTD will be able to access PubDesk starting around Thanksgiving.

Pub pulse check

The Trade Desk already has a tool, called OpenSincera, that provides buyers, sellers and their tech partners with media quality metrics about the ad experience on a page, including ad-to-content ratio, the number of ads in view and the ad refresh rate.

PubDesk is different in that it’s specifically designed to help publishers better understand demand-side behavior and pricing on The Trade Desk’s platform so they can improve their monetization strategies.

“OpenSincera is for the entire ecosystem,” O’Sullivan said. “PubDesk is specifically oriented around sellers and showing them how they show up to TTD.”

The first thing publishers see in PubDesk is a set of pacing “cards” or snapshots that benchmark their performance against the overall market and detail changes in fill rate, impressions, CPMs and spend over time.

Instead of panicking over a decline in any one of these metrics, a publisher can see side-by-side performance data that shows at a glance whether their dip mirrors the broader ecosystem. That makes it easier to understand whether something is truly wrong or just part of a bigger market shift.

Consider seasonality, for instance. A publisher might be super stressed because spend from The Trade Desk is way down in August.

“But, well, hold on, they can see it’s actually down for everyone,” O’Sullivan said. “Having that data reduces the anxiety and depressurizes the situation.”

But the tool also lets publishers go deeper.

PubDesk comes with a supply chain visualizer that shows breakdowns of spend, take rates and bid request duplication across different supply paths and supply-side platforms.

The Trade Desk, which recently reclassified SSPs as “resellers” within its Kokai platform, has a direct line of sight into how spend is flowing when publishers use OpenPath.

“We can tell exactly how much money of what we spent with a publisher actually made it into their pocket,” O’Sullivan said.

Once a publisher logs into PubDesk, TTD deploys synthetic users to visit its site on a regular basis and collect data on costs and fees by analyzing bidstream activity across all of the supply paths TTD uses to purchase media. Publishers then see sample-based weighted average take rates by SSP.

While these aren’t exact figures, the data is precise enough to help publishers understand how much spend is flowing through each partner and then make more informed monetization decisions, O’Sullivan said.

Beyond spend, publishers also get insight into bid duplication across SSPs – and the numbers are wild.

For example, OpenPath sent 145 million bid requests to one publisher (O’Sullivan obscured the name) on a particular date in early October. PubMatic sent around 125 million, so in the same neighborhood. But Index Exchange sent roughly 300 million requests and Rubicon (aka Magnite) sent 479 million – nearly 3x as many bid requests as OpenPath.

Shedding light on how spend and auction activity is distributed across multiple supply paths and SSPs gives publishers valuable transparency into their programmatic traffic, O’Sullivan said.

They can export the data and do whatever they want with it, whether that’s custom analysis or using it as a jumping off point to start asking tough questions.

“Our goal is buyer performance through efficient supply paths, and part of that is educating publishers about what partners are doing on their behalf,” O’Sullivan said. “And hey, maybe publishers are okay with that, but they should at least understand what’s actually happening behind the scenes.”

‘Reallocation towards quality’

‘Reallocation towards quality’

Not that some publishers don’t have a little soul searching to do regarding their own websites, having in many cases degraded their site experience in the name of monetization.

Anyone who’s been on the internet over the past decade, for example, knows what it’s like to be bombarded by multiple auto-play videos on a single page.

The Trade Desk recently ran a platform-wide test and found that its bidder devalues multi-video environments and shifts spend toward richer, single-video experiences that are better for capturing user attention. Advertisers running CPA-based campaigns through TTD saw a 15% drop in their cost per acquisition when buying the latter, which is a reflection of the direct connection between media quality and performance, O’Sullivan said.

Lower CPAs is great news for advertisers. Buyers always want to pay the lowest price possible for the best stuff.

But what about publishers just trying to make a buck and survive? They, understandably, want the highest price and the maximum value for any given opportunity.

This inherent tension between buyers and sellers isn’t a bad thing, though, O’Sullivan said. It’s the sign of a healthy, well-functioning market,

“It’s a feature, not a bug,” he said. “We just want a fair environment for that dynamic to play out in.”

To that end, PubDesk gives publishers recommendations on metrics that drive performance so they can improve their site experience. Publishers can even request a “revisit” from PubDesk after making changes to see if there are still any problems to deal with on their site.

“If publishers optimize solely on price or viewability, you end up with these extremes that don’t perform very well for buyers, like MFA,” Myers said. “We’re actually paying more for better buyer performance, though, so it’s like a reallocation towards quality.”

Clean eating

But the data available in PubDesk is only as actionable as a publisher wants it to be.

The Trade Desk is offering insight into how publishers can improve their spend, but “you don’t have to listen,” O’Sullivan said. Nothing’s being enforced.

“We understand if some publishers are hesitant,” he said, “and we’re not asking anyone to blindly trust us.”

The purpose of PubDesk and OpenAds, O’Sullivan said, is to help publishers answer a simple question: What does The Trade Desk value?

“And the simple answer is that we’re focused on clean, effective, efficient supply paths,” he said. “Think of PubDesk as an extension of what Chris Kane said about feeding DSPs what they want to eat. We built a tool to help publishers do that and to measure it at scale.”