Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

In Vegas, The American Way

Ad tech can no longer avoid privacy scrutiny, from platform changes to privacy regulations coming into effect across the US.

But many of the consumer tech startups at CES last week seemed blissfully unaware of such concerns, writes Tatum Hunter of The Washington Post.

One connected healthcare company is planning the US launch of a urine scanner that detects hormones, which is information that could be used as evidence against women if (or likely when) a Republican attorney general subpoenas that information for abortion-related cases. The company, called Withings, stores the health data it collects indefinitely and says it will comply with the legal requirement in any region where it operates.

An autonomous lawn mower, meanwhile, claims to blur faces and house numbers before sending its data to cloud storage, but its policies also allow data to be shared with third parties for advertising purposes.

For its part, the organizers of CES are attempting to toe the line between compliance and providing a forum for cool stuff.

“CES requires exhibits to comply with US law, which favors innovation and focuses on restricting bad behavior rather than banning new and innovative products,” says Jamie Kaplan, VP of comms for CES.

Net-New Netflix

Netflix is hoping that its new ad-supported tier generates new subscribers for its platform.

Its longtime plan has been to build an “incremental audience” of subscribers who are dropping cable, which has been difficult, said Jeremi Gorman, Netflix’s new president of worldwide advertising, speaking at CES last week. The challenge, however, is that, until now, Netflix accounts have been perceived as too expensive.

But AVOD “opens the door to more subscribers who want to make changes in a difficult macroenvironment,” Gorman said.

Basic with Ads accounted for 13% of sign-ups in November, its first month on the market, according to research from investment banking firm Evercore as reported by Insider.

Nearly half of those sign-ups are net-new users or previous subscribers that had churned. Although Netflix had anticipated that most Basic with Ads accounts would be net-new, lower pricing also reduces churn by giving users a cheaper option rather than leaving entirely. Three-quarters of Basic with Ads sign-ups in November were users who downgraded from Netflix’s cheapest ad-free tier.

According to Evercore, the additional ad revenue from these accounts should raise Netflix’s average revenue per user – and if advertising proves more lucrative than ad-free viewing, Netflix will no doubt find new ways to push people into that package.

Big Tech Will Eat Big Sports

Equity analysts are perplexed by Google’s decision to pay $2 billion per year for the rights to NFL Sunday Ticket – which offers all the Sunday afternoon NFL games. After all, DirecTV, the former rightsholder, paid $500 million less per year and couldn’t make those numbers work.

In a piece at Light Reading, MoffettNathanson analyst Michael Nathanson says YouTube won’t even have the full ad inventory. With less than $100 million in ad revenue per season, YouTube must generate 4.5 million subscribers to turn a profit … and that just ain’t gonna happen. (DirecTV maxed out Sunday Ticket subscribers at 2 million.)

On the other hand, companies like Google and Amazon generate value in various ways.

Amazon spent big for Thursday Night Football, but used it to promote lots of its own stuff, including Audible (which was a title sponsor), AWS, the core Amazon retail business and Amazon Prime Video’s Lord of the Rings series. Amazon spent $715 million to produce season one of its LotR series, which it advertised heavily during the first few weeks of NFL programming this year.

Back to Google, its Pixel 8 phone is slated to launch around the same time as the next NFL season begins – and where better to promote it than during Sunday games?

But Wait, There’s More!

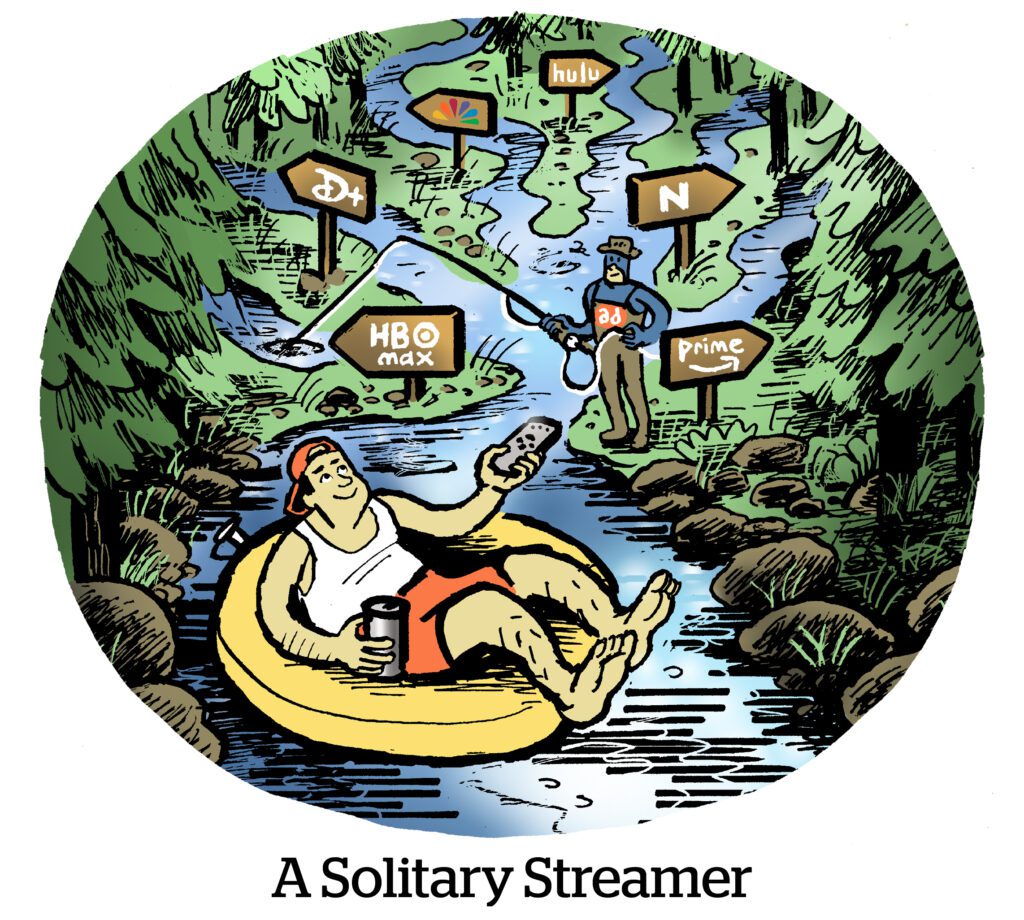

What streaming services have up their sleeves in 2023. [TechCrunch]

Even alcohol brands are investing in Dry January campaigns. [ModernRetail]

Five ways an economic downturn this year could affect influencer marketing. [Ad Age]

Facebook has a new system to help ensure ads are delivered fairly to different demographic groups. [release]

Amazon is reimbursing some ad buyers after a holiday glitch cost them big – but advertisers are upset they aren’t getting the right amount back. [Insider]

You’re Hired!

ArcSpan hires Ben Diesbach as VP of analytics and data science, and Jose Cabal-Ugaz as senior software engineer. [release]

Braze promotes Myles Kleeger to president and chief commercial officer and Astha Malik to chief business officer. [release]