Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Thank You, Next

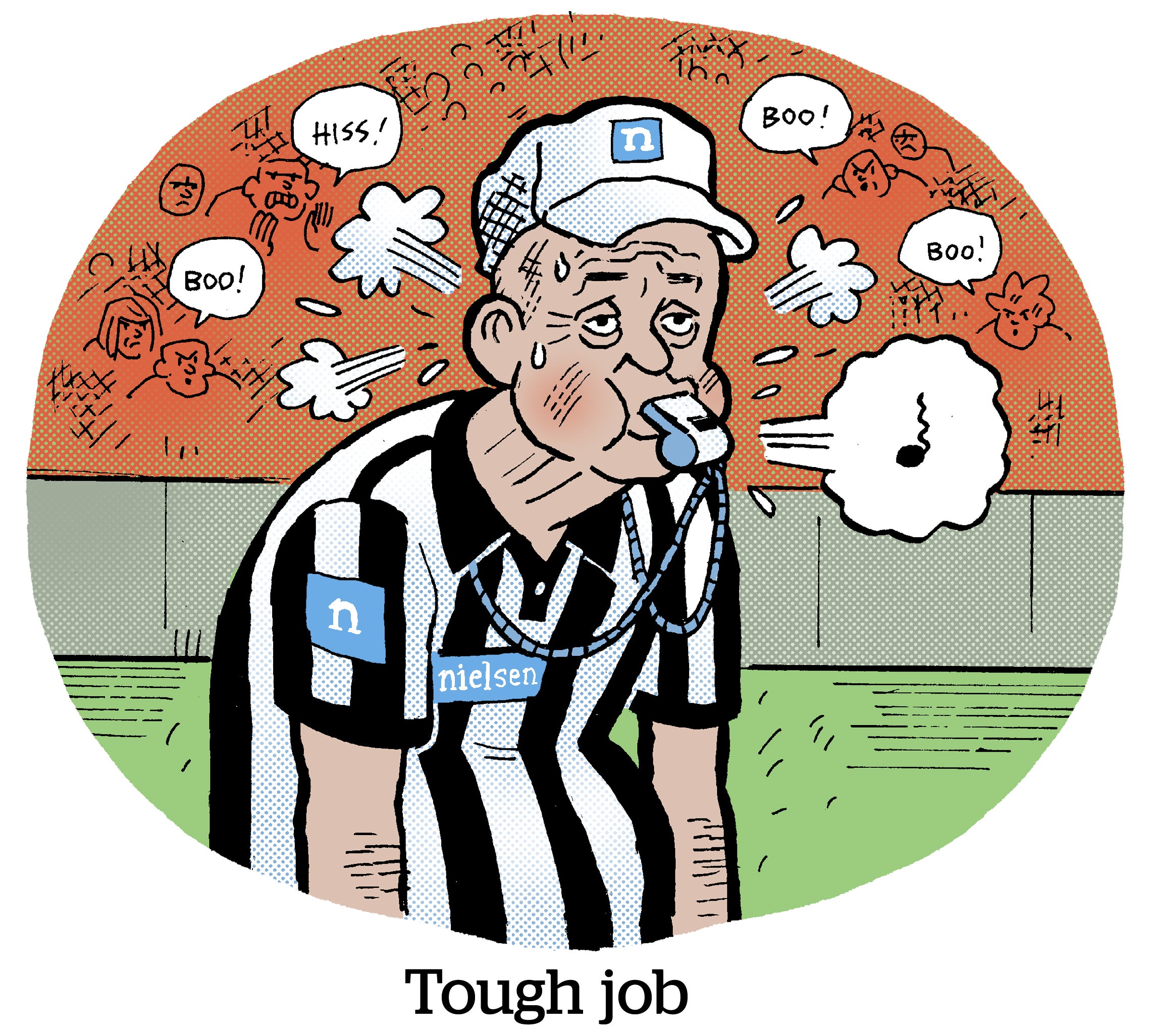

Amid all its other TV measurement drama, Nielsen is swapping CEOs, Ad Age reports.

David Kenny, CEO since 2018, will be succeeded by Karthik Rao, leader of the company’s audience measurement unit. (Nielsen split into three divisions during a business reorg in December.) Kenny will remain at Nielsen as executive chairman.

“[Rao] is now the right leader for Nielsen as it undergoes a period of dramatic change,” writes David Kerko, head of private equity at one of Nielsen’s investors, Elliott Investment Management, in a statement. (Nielsen went private in March 2022.)

Rao, however, has been at the center of a few controversies. Most recently, he was embroiled in a very public back-and-forth with the Video Advertising Bureau, which ended with Nielsen scrapping its plan to integrate Amazon streaming data into TV ratings. Still, several industry execs privately rank Rao highly for his grasp of audience measurement solutions.

But be that as it may, new leadership won’t end the constrained relationship between Nielsen and the TV industry. Rao was the public face of Nielsen’s refusal to join the broadcaster joint industry committee to create new video currency standards.

Headed For The X-it

Twitter has made huge efforts to rebuild its advertiser accounts after many brands and businesses ditched the platform following Elon Musk’s takeover. Linda Yaccarino, the consummate ad sales leader, was made CEO, and big discounts were dished out to former advertisers as an incentive to resume campaigns.

Twitter missed the boat, however, to secure any share of holiday ad budgets this year, which are generally set by September, Bloomberg reports.

Regardless, Twitter’s moves misdiagnose its problem as an advertiser issue. If only advertisers would come back, the story goes, they’d find their old Twitter audiences as engaged as always.

But Twitter actually has a user problem. The people are gone.

“NBA Twitter” and “Black Twitter,” for instance, used to be legit cultural hubs. Audiences followed games live, and players were active on the platform. It was a powerhouse spot for sports sponsors and shoe or clothing brands.

Post-Musk, there is no NBA Twitter or Black Twitter. Users have defected, and wooing a sneaker brand to the platform isn’t going to bring the people back. It’s like thinking you can resurrect an abandoned theme park if Pepsi restocks the vending machines.

The. People. Are. Gone.

“Spy” Vs. Spy

Data collection is fundamental to both digital advertising and espionage.

And some Israeli tech companies, such as Insanet, Cobwebs and Rayzone, are leading the charge to repurpose digital advertising’s data collection mechanisms on behalf of national intel organizations, Haaretz reports. Sometimes they even use advertising businesses or false advertisers as a front.

Advertisers, for example, can acquire geolocation data directly from data brokers or by buying ads through a DSP. This location data can be used to track an individual if the advertiser knows the owner connected to the mobile device ID.

Companies can also build audiences that match espionage targets – like nuclear scientists or government officials – and target them with malware carried in ads, which, if clicked, might hijack their devices.

But although the exploitation of digital advertising presents national security concerns, don’t be surprised if governments hesitate to crack down. National security risks can be opportunities, depending on your perspective.

But Wait, There’s More!

Lies, damned lies and social media metrics. [New York Mag]

Instacart is following the gig-worker playbook, which means it’s not a grocery delivery service anymore – it’s an advertising business. [NYT]

Pixis, an AI-based marketing stack for in-house marketers, has raised $85 million in Series C funding. [TechCrunch]

Mike Shields: Does Pinterest have an AI ace in the hole? [blog]

How TV cancellation rates vary between streaming services. [Variety]

You’re Hired!

Twitter names four new ad sales and revenue ops execs. [tweet]

Premion hires Al Behmoiras as head of political sales. [release]