As the programmatic and real-time bidding (RTB) market in the Asia-Pacific region heats up, local inventory is starting to prove its worth and attract interest from advertisers.

As the programmatic and real-time bidding (RTB) market in the Asia-Pacific region heats up, local inventory is starting to prove its worth and attract interest from advertisers.

Demand-side platform (DSP) Brandscreen released its second Real Time Media Insights Report Monday, highlighting the battle between global and local inventories.

“The trends that continued from the previous report were around the migration of the supply sources,” Brandscreen CEO Stuart Spiteri told AdExchanger. “We have talked about a rebalancing of the global inventory to be equally balanced between Google, AppNexus and Rubicon, mainly. But with the progress we’ve made in mainland China, for example, we see how the local exchanges are performing as related to the global exchanges that we also have supply from inside China.”

Overall, Brandscreen reported a 70% increase in the number of campaigns on its network in the APAC region, compared to Q3 last year, and that the number of the company’s partners, both the inventory and data providers, increased by 51% compared to the previous year.

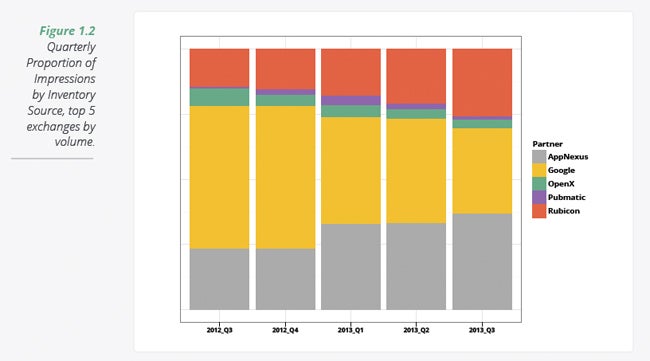

Looking at the global inventory providers, Brandscreen works with Google, AppNexus, Rubicon, OpenX and PubMatic. While Google’s share of inventory on the Brandscreen platform has been decreasing over the past several quarters, this is not reflective of the amount of spend on that platform, as overall spend on programmatic in the region is increasing. Meanwhile, Rubicon’s and AppNexus’ respective shares of inventory have been growing.

Beyond these global partners, local exchanges in countries like China are playing a major role in the continued growth of programmatic. Major publishers in China including Taobao, Tencent, Baidu and Sina all have ad exchanges and have been boosting the programmatic market in China.

“The local inventory from TaoBao and Tencent performs, on a CPA price performance basis, over 200% better than the global providers in China,” Spiteri said, noting that Brandscreen recently started working with the Baidu Exchange Service and Sina’s exchange, which will impact its findings next quarter. “This is a tiny pinhole view to the future where local inventory and local providers of that inventory, we believe, will continue to win the performance race and continue to offer better quality product.”

There is, however, less local inventory available than global inventory, which can drive up prices in some instances. While Brandscreen found that CPC and CPM rates of local inventory were similar to the rates associated with global inventory, CPA rates for local inventory were 59% lower than CPA rates for global inventory.

Spiteri said this is a metric to watch in APAC, since acquisitions are actual business results and monitoring acquisitions over clicks has helped normalize the click-reporting challenges in places like China.

Local publishers and inventory providers throughout APAC have the benefit of watching as programmatic and RTB become more popular around the world, and they operate in the local language and understand the nuances of each market. Global players coming into non-English-speaking countries such as Japan, Korea and China must work to get situated in a new market and face behemoth local publishers that can also sell more premium inventory.

Another challenge in the APAC market is the lack of data. Many advertisers and publishers are working with first- and second-party data and are starting to be more aggressive in how they leverage that information for retargeting.

Retargeting efforts in APAC have proven successful for advertisers, who are more interested in increasing their use of third-party data. Looking at the third quarter 2013, retargeting impressions were up 200% in APAC, year-over-year, and up 50% compared to the previous quarter, Brandscreen reported.

As this trend continues, data owners and providers may be more willing to open up their data inventories, Spiteri said, because they see how valuable that information can be. Building up that data marketplace, he added, will help improve the programmatic market in APAC and especially in countries like China.

“What we’re seeing here is that the APAC market has a lot of similarities to the global market. The core technologies are global and the tenets of programmatic hold true,” Spiteri said. “But now, you can see the first steps and first insights into how the programmatic industry in APAC will evolve slightly differently to other places of the world.”