“On TV And Video” is a column exploring opportunities and challenges in advanced TV and video.

Today’s column is written by Lindsey Harju, co-founder at Blinc Digital Group.

Marketers and investors care about what consumers like, and right now that is TV. A seemingly obvious statement, yet tech startup leaders are once again acting as though they have discovered an otherwise unknown potion for success.

We have seen this sequence of events play out before. Consumers started going digital, so investors put up the money and tech companies developed capabilities, which marketers bought. Years later, consumers started transitioning from desktop to mobile, and the trend repeated.

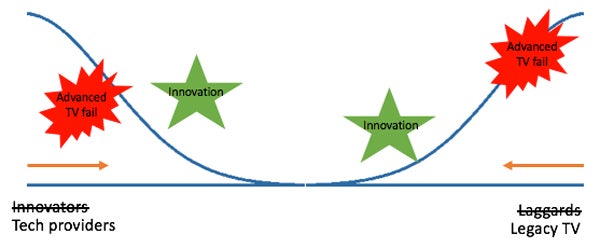

The latest major shift in media involves the changing consumer behavior of TV consumption. Those holding the checkbooks enabled both in-house capabilities or new startups to develop solutions, and marketing dollars followed. But what happened next has not followed the standard innovation adoption curve.

The recent changes in advanced TV aren’t a single linear shift experienced by all parties, starting or ending at the same point along the curve. The pattern has instead changed to a legacy industry and a technologically advanced industry colliding at multiple points, moving in different directions and confusing buyers and investors on what is innovative, unrealistic or actually new.

Instead of the standard curve led by innovators and ending with laggards, we have TV providers at one end advancing their tech capabilities, while digital providers at the other end are trying to offer more “premium” marketing experiences to get some of those TV dollars.

Instead of the standard curve led by innovators and ending with laggards, we have TV providers at one end advancing their tech capabilities, while digital providers at the other end are trying to offer more “premium” marketing experiences to get some of those TV dollars.

Why is this a problem?

- No one understands their competition.

Especially when the battleground is OTT-focused capabilities, legacy TV providers don’t understand their digital competitors, and the feeling is mutual. This means they are either vastly overestimating what they are up against, or vastly underestimating their competitors’ edge.

I have experienced an uncomfortable moment multiple times over the last couple years, when a provider shares with me their groundbreaking innovation, and I respond “Oh, so it’s like XYZ company?” The awkward silence that follows is not something I savor. They are completely dumbfounded as I share a URL for a company that has been providing that same capability to the market for the past several years.

Some of the most future-focused and brilliant thinkers in the digital industry are missing some of the coolest opportunities for innovation because they don’t understand what is already extremely valuable about TV as a medium. Basically, they are trying to solve problems that don’t exist.

- Even well-informed buyers are getting confused.

The unfortunate truth of innovation is that many buyers are being educated by the parties selling solutions to them. This can work well enough in many scenarios, but when both sides on the spectrum of providers are missing the other half of the story, it can be hard to see the full picture.

This leads to incorrect assumptions like, “If I go directly to programmers, I am going to miss every single cord cutter and cord-never.”

- Investors steer clear of what they don’t understand.

In the TV space, we have seen some exciting acquisitions recently, so you may disagree with my conclusion. A common theme of the companies that have recently won in the startup “Game of Life” is that they were already adding value to the acquiring company or had the revenue to prove they were adding value to others.

Essentially, they didn’t just add the word “TV” to their company motto and head out on a global speaking tour. They were actually delivering something that the acquiring company believed would generate even greater revenue when combined with other existing elements.

That doesn’t necessarily mean the acquiring company is making a good purchase that will result in grateful investors for years to come. What it does mean is that the age when companies were bought based on their extreme levels of innovation in the space (i.e. confusing explanations that made them sound brilliant) are behind us.

Now companies are buying 1) vendors from a similar industry background, making smoke and mirrors harder to sell; 2) a proven partner relationship with a positive track record; or 3) financials that show that the market needs what they have to offer.

Back to basics

The answer to success is no longer a list of buzzwords; it’s in proof points. Actual value delivered, problems solved that are actually problems and long-term revenue earned by providing client wins. Not sexy, but as both sides of the industry become more educated, it’s what is required to succeed.

Follow AdExchanger (@adexchanger) on Twitter.