“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Marc Grabowski, Chief Operating Officer of Nanigans.

Not all customers are created equal. And if you are acquiring customers on a CPA basis, you are making three major mistakes:

- You are missing the customers who represent the highest lifetime value

- You are only able to afford customers during supply rich periods

- Somebody is taking advantage of a margin on your spend and is incented against acquiring your most valuable customers.

CPA based bidding is one of the biggest farces in advertising. It assumes each customer generates the same value, when the reality is some purchase once and others purchase repeatedly. CPA based bidding incentivizes targeting lower quality customers who monetize once, versus those who deliver value over the long-term, encouraging opportunistic buying.

But there’s more to the story – price elasticity. In advertising, price elasticity refers to the ability to bid up or down on inventory as market conditions change, like during the holidays. Advertisers with rigid customer acquisition models like CPA are limited to supply abundant markets. Advertisers with models that allow for greater price elasticity, such as advertisers optimizing for the actual revenue generated from their campaigns, can take advantage of inventory in both supply-abundant and supply-constrained markets.

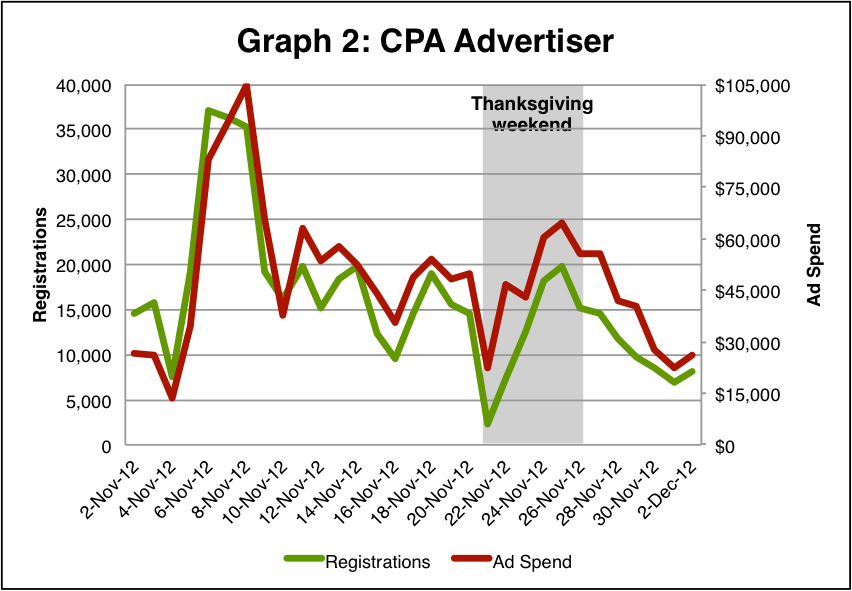

The graphs below show just this – an advertiser with rigid CPA-based bidding lost out on significant new registrations during the holidays when inventory demand was high, while an advertiser optimizing instead on revenue was able to continue to generate high-quality registrations during the same period.

CPA-Based Advertiser

As shown in Graph 1a and Graph 1b, this CPA-based advertiser was unable to adjust to spikes in market costs during the holidays. When prices rose (11/6-11/8, 11/16, 11/21 and 12/1), registrations plummeted.

The registration drops happened when inventory prices increased. The advertiser’s rigid CPA pricing structure assumed all customer acquisitions were valued equally, regardless of the fact that some acquisitions were generating far greater return over time.

Graph 2 further highlights the point above. The advertiser was unable to spend, as their hard CPA was more rigid that the market tolerated.

So, not only does CPA based customer acquisition suffocate the ability to reach your most valuable customers, it suffocates the ability to take advantage of market conditions. And this can lead to an advertiser under-valuing its best customers during peak sales periods.

Revenue Optimized Advertiser

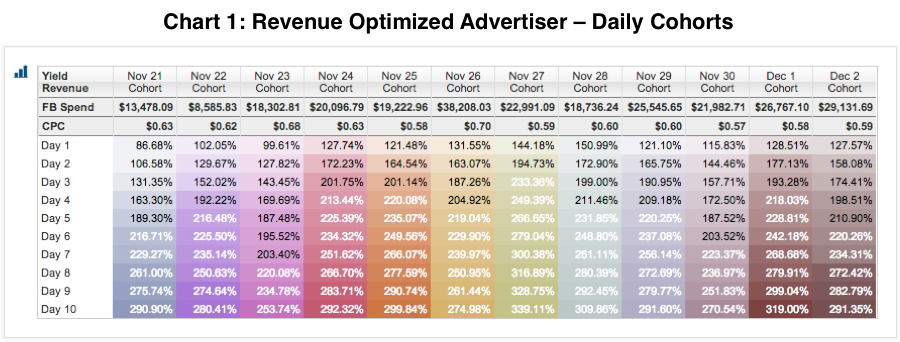

In contrast, an advertiser optimizing on the actual revenue generated from their ad campaigns was able to continue to spend and drive incremental registrations and revenue when costs spiked between Black Friday and Cyber Monday (see graph Graph 3 below).

The price elasticity in revenue-based optimization allowed this advertiser to absorb a cost increase of 21% on Cyber Monday vs. the prior day, all while achieving a single day return on ad spend (ROAS) of 131% on Cyber Monday – higher than their 121% ROAS on the day prior (see Chart 1 below).

In other words, revenue increased at a higher rate than price.

This case study makes clear that CPA is not a proxy for lifetime return. In fact, it discounts differences between high and low value customers, particularly those that often result from seasonal shopping. Revenue optimization, on the other hand, allows advertisers to take advantage of more inventory, regardless of changing market conditions.

So as you assess your advertising budgets in 2013, consider the opportunity loss that CPA-based optimization represents and the incremental revenue and value that would be achieved with revenue-based optimization.