Outgrowing Amazon

A whole category of ecommerce ad tech companies and commerce-focused agencies began as Amazon service providers. Later, many branched into “marketplaces,” such as Walmart or eBay. But there still remains a large Amazon-centric cottage industry.

Now, Amazon ad vendors are trying to escape the category they created, Digiday reports. Amazon’s own ad tech and data services ambitions are crowding out these so-called specialists.

One way to safeguard a point solution is to be acquired by a larger company. Flywheel Digital, an early Amazon ad-buying standout, sold to Omnicom last year for $835 million. Skai, another Amazon and retail search ad platform, is reportedly for sale and in discussions with Criteo. And last month, Kevel, which serves ads on retailer sites, acquired Nexta, a retail media specialist within walled gardens platforms.

Another option for these point solutions is to expand their business model.

For instance, nonendemic retail media specialist Rokt recently acquired mParticle for $300 million, thus entering the mar tech and SaaS analytics space. Pacvue, likewise, outgrew its retail marketplace and search bidding roots and is now a broader ecommerce infrastructure and data management platform.

“If we stayed as just an advertising platform, we’d be dead by now,” Pacvue President Melissa Burdick told AdExchanger last year.

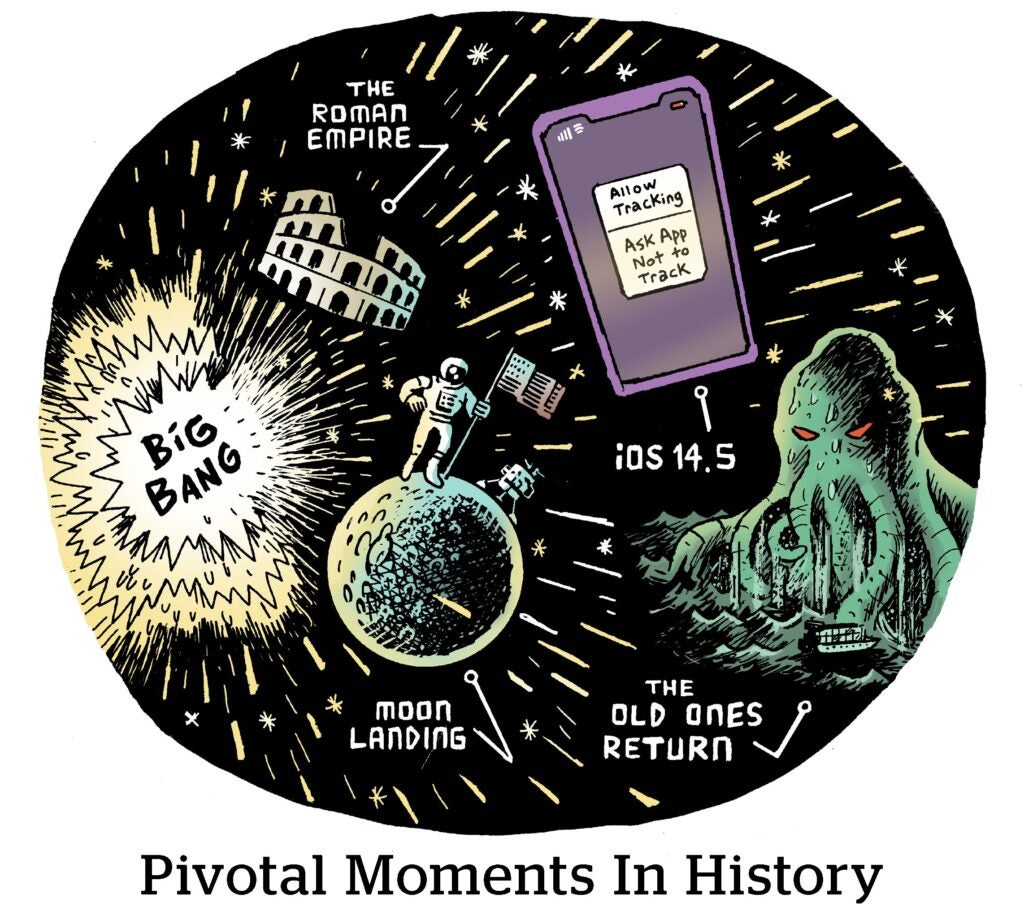

The ATT Hot Potato

Could Apple’s AppTrackingTransparency framework be rolled back?

That’s the hypothetical question posed in the headline of a piece by Mobile Dev Memo’s Eric Seufert. Betteridge’s law of headlines would say the answer is “no.” But Betteridge aside, Apple would no doubt fight to maintain its policy.

There is a glimmer of hope, however, for those who’d like to see changes made to ATT, if not a full reversal. According to Reuters, it’s that France’s antitrust regulator will fine Apple over ATT and even demand that Apple no longer enforce it in the country. The Germans also have concerns.

Yet, Seufert writes, “even a partial rollback – say, forcing Apple to harmonize the text between its own consent prompt for ‘personalized advertising’ with the ATT prompt – would be a moral victory.”

Systemic changes to ATT would be more than just a moral victory, though. Based on estimates by Seufert and academics from Northwestern, Columbia, UCLA and elsewhere, ATT reduces ecommerce sales by somewhere between 20% and 30%. Ouch.

As a major ad tech player, whether it wants to be or not, Apple will probably get hit with more cases raised by antitrust regulators – because it’s glaringly obvious that ATT favors Apple. This type of self-attribution would be instantly quashed if Google tried the same thing with its Android and Play Store advertising policies.

A House That Divides Google Cannot Stand

Google is imploring the Trump administration not to break it up to protect national security. Seriously.

After US District Judge Amit Mehta ruled last August that Google’s search business constitutes an illegal monopoly, the Department of Justice under ex-President Biden proposed that Google should sell its Chrome browser and nix exclusive search deals with Apple and other platforms.

But Google met with the DOJ last week to ask the government to pursue less aggressive remedies, Bloomberg reports.

Google has long claimed that breaking it up could undermine America’s supremacy in the global economy and threaten joint cybersecurity efforts between Google and the government. Google, alongside Apple and Meta, have likewise pushed back against previous antitrust regulation, claiming it would open the door for China to take America’s spot as a global tech leader.

Those national security arguments could find sympathetic ears within the Trump administration, according to Bloomberg.

For example, both Trump and Vice President JD Vance have said European regulators should back off on attempts to rein in US tech giants. Meanwhile, a White House statement last month framed EU laws like the Digital Markets Act as “extortion” that are to the “detriment of America’s economy.”

But Wait! There’s More

Confirmed: T-Mobile is buying location data platform Blis for $175 million. [Digiday]

Anthropic quietly removed its Biden-era policy commitments from its website. [TechCrunch]

Do pharma companies need to start prepping for a ban on ads? [Adweek]

Even more AI overviews are coming to Google. [The Verge]

YouTube brings its “Premium Lite” subscription tier to the US, which removes ads on most content, but not for music or Shorts. [The Hollywood Reporter]

You’re Hired

SiriusXM hires Scott Walker as its chief advertising revenue officer. [Adweek]

The Weather Company appoints Matthew Drooker as CTO and Brennan Gerster as chief business officer for GM consumer. [release]

Thanks for reading AdExchanger’s daily news round-up… Want it by email? Sign up here.