Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Gamesmanship

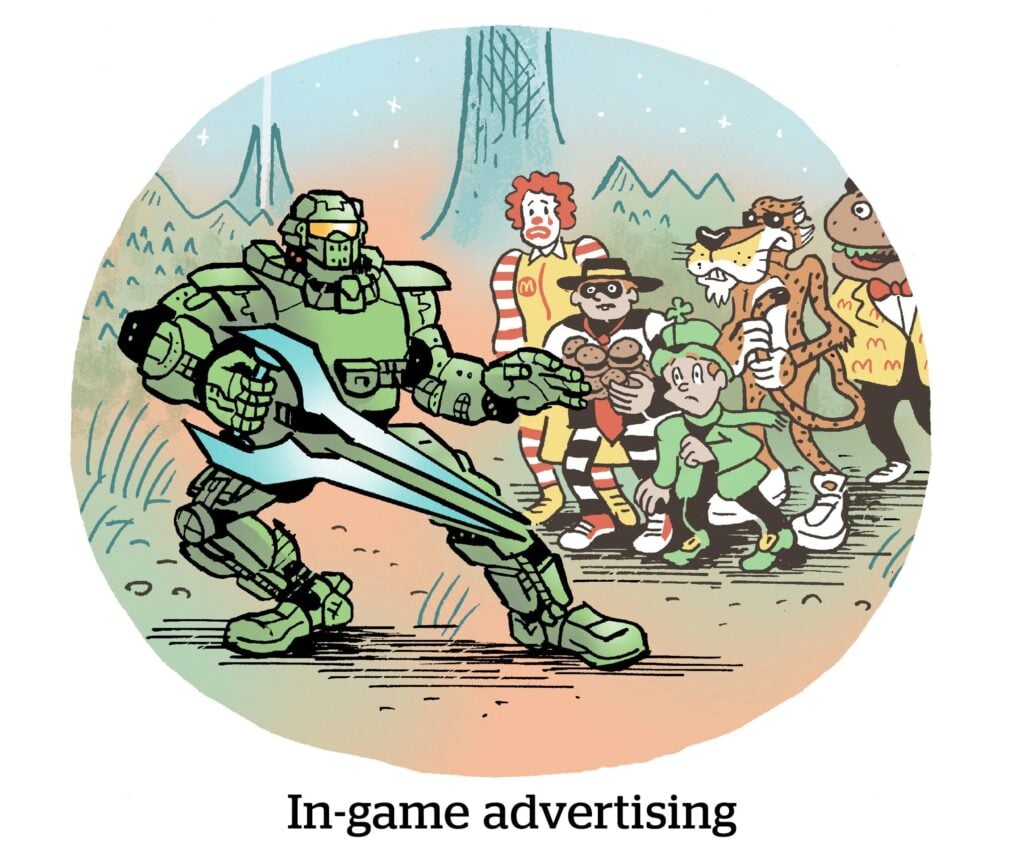

Frameplay, an in-game advertising company, is joining direct competitors to cultivate a critical mass of scale for programmatic gameplay ads.

The Frameplay Exchange now includes impressions from two other in-gaming ad exchanges, Adverty and AdInMo, which Frameplay CEO Sandy Shanman says represents three of the five leading native in-game ad tech businesses. (The other two aren’t specified, although it’s probably Anzu and … some other company.)

“We could be a force to be reckoned with, and not individually, but collectively so,” Adverty CEO Jonas Söderqvist tells Digiday. “So when [Frameplay] approached me with this, I was eager to jump onto that ship, because I truly believe that this is the way forward.”

In-game ad placements have great hypothetical appeal. One popular example is to place real-time targeted ads on the walls and billboards of a racing game or any game with a cityscape or to simply place a beverage or some other product in the background.

It’s a tough channel to scale up, though.

Game writers and producers often don’t want brands to be able to insert themselves into the content without their say-so. The in-game ads also aren’t standard programmatic, so it’s hard to fit them into your typical omnichannel campaign.

Eminent Domains

In the earliest days of the world wide web, top-level domains (TLDs) used to tell you a lot about the website you were about to visit. A generic TLD, like .gov (government), hinted at the site’s purpose, while a country code, like .ca (Canada), would tell you where it was registered.

But those distinctions have gotten fuzzier over time. Case in point: Thanks to the recent hype around artificial intelligence, Anguilla, a British territory in the Caribbean, now makes a third of its government’s revenue off of .ai domains.

And British territories are actually also the reason behind why the future of .io is suddenly uncertain. The domain refers to the Indian Ocean Territory of the Chagos Islands, which the UK recently promised to hand over to Mauritius in a historic treaty.

As British writer and digital strategist Gareth Edwards notes, the Internet Assigned Numbers Authority (IANA) has gotten stricter about shutting down the domains of dissolved nations in recent years. And for good reason. The former Soviet Union’s domain, .su, is now a hacker’s paradise.

But IT news outlet The Register figures there’s nothing to worry about yet. Assuming the .io domain does get retired, it wouldn’t kick in until five years after the treaty is ratified sometime in 2025. Hopefully that gives all the tech startups in .io-land plenty of time to pivot to something new. We hear AI is the next big thing.

The Ungoogleable Question

Last week, the DOJ published its list of proposed remedies and rationales for breaking up Google so it’s no longer able to operate monopolies in the search market. The DOJ is also proposing behavioral changes, including potentially forcing Google to open its data APIs so competitors can access its crawler data.

Ad tech has been having a field day speculating about what will happen here.

The verdict? A breakup might actually be the less painful option for Google.

“Splitting off or divesting Chrome or YouTube from Google would be less catastrophic for Google than forcing it to share its privately shared information,” Erik Hamilton, VP of search and social at indie agency Good Apple, tells Adweek.

But would Google really prefer to give up powerhouse properties like YouTube, Android or Chrome rather than open its search API feed so that, say, DuckDuckGo might improve its search engine? Or maybe we’ll see Google proactively lop off its third-party ad tech and ad network business entirely?

Only Google knows for sure.

But Wait, There’s More!

Instagram head Adam Mosseri blames the platform’s recent content moderation issues on humans rather than AI – but admits that one of its moderation tools “broke.” [TechCrunch]

Reddit introduces a new keyword targeting feature for ad placements. [SEO Journal]

X has dropped Unilever from its lawsuit against the World Federation of Advertisers. [WSJ]

Almost half of consumers say they’re interacting with brands on social media more frequently, according to a new Sprout Social survey. [Marketing Dive]