Yotpo, the retention-based marketing and analytics company, announced on Tuesday that it is acquiring fellow Israeli tech startup Coho AI, a customer data platform.

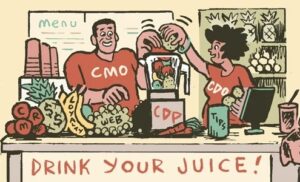

Yotpo had been looking for a CDP business “to leverage that into a more actionable CDP,” co-founder and CEO Tomer Tagrin told AdExchanger

Terms of the deal were not disclosed, though Tagrin said Yotpo, a 900-person company, will add about a dozen new employees with Coho.

Ready, set, actionable

By making the CDP “more actionable,” Tagrin is referring to the firewall most independent CDP vendors have maintained between their data sets and ad tech audience data. CDPs generally don’t earn a cut of the CPMs or performance conversion goals, but they also aren’t so hamstrung by privacy rules, because they aren’t using the data for advertising purposes.

Yotpo doesn’t actually serve ads, either, Tagrin is quick to add. Many other CDPs are being acquired by ad servers and ad tech.

The CDP mParticle, for instance, which partially established these informal CDP standards, was acquired in January by Rokt, a retail media ad tech company that decidedly does bring the CDP data directly into advertising and the bidstream.

For Yotpo, Coho’s data will help connect online audiences to ecommerce companies’ loyalty programs, as well as SMS and email marketing to known customers. For instance, Tagrin said a Yotpo client will be able to more effectively remarket to customers who, say, left glowing four- or five-star reviews but haven’t purchased in many months.

Advertising is “definitely not our sweet spot and not where we focus,” he said. But many marketers are focused on advertising and reaching incremental new customers or audiences. Retention marketing inherently involves reaching out to people who have purchased from a brand before. By incorporating the CDP data integrations, customer retention becomes a more compelling way to create audience segments and think about incremental growth, even from preexisting customers.

Incrementality vs. Retention

One of the big buzzwords right now is “incrementality.” Should brands be focused on reaching net new customers and adding rows to their customer data set?

You can’t see me right now, Tagrin said. “I’m rolling my eyes.”

Tariffs are the no. 1 issue every client is dealing with right now – “by a mile” – he said. But the perils of overindexing to incrementality measurement are a problem as well.

For one thing, “incrementality” is often not as advertised. When Amazon, Meta, Alphabet, etc., attribute an incremental conversion, it just means it was the first time that platform converted on the customer for that brand within the past year. One conversion, even of a loyal customer, might be credited as incremental business by a host of platforms.

And Tagrin said many online shopping players that perform well for a while as incremental growth drivers turn out to be unsustainable and unprofitable.

TikTok Shops, for example, had a burst of incrementality because it was new (everyone they converted was incremental from TikTok’s perspective) and has a young user base. For many brands, those promising incremental results did not turn into sustainable business. AppLovin also saw a spike in ecommerce incrementality measurements, he said, and now many product sellers question whether its incrementality numbers can hold.

CPMs and customer acquisition costs are mounting across the major ad platforms, Tagrin said. And that should put a shine on retention marketing.

“You already have the customer’s phone number, their email number, and they’re familiar with the brand,” he said. “We do see a lot of shifts toward retention because brands cannot afford the new costs for net new customer acquisition.”