This week, the AdExchanger Commerce Media Newsletter took a look at AquaSonic an oral care manufacturer and – in my humble opinion – an emblematic case study for digital-native consumer brands.

AquaSonic, founded in 2017, picked up early traction by offering a far more affordable electric toothbrush and accessory kit than was available at the time, said Arsalan Rahbarpoor, a co-founder and president.

There is an interesting bifurcation in the toothbrush market. Amazon’s list of best sellers in the toothbrush and accessory category is a useful example, as you’ll see a mix at the top that includes the AquaSonic hero product ($29.95), the Philips Sonicare ($39.96) and Oral-B iO ($59.99), alongside the best-selling analog brush, a Colgate six-pack ($4.96).

But the other detail from Amazon’s category best seller list is the overall number of reviews received by each product: AquaSonic (129,000+), Philips Sonicare (51,400+) and Oral-B iO (15,100+).

The takeaway from that number is the fact that AquaSonic is a monster Amazon brand.

I hear you. Yeah, duh?

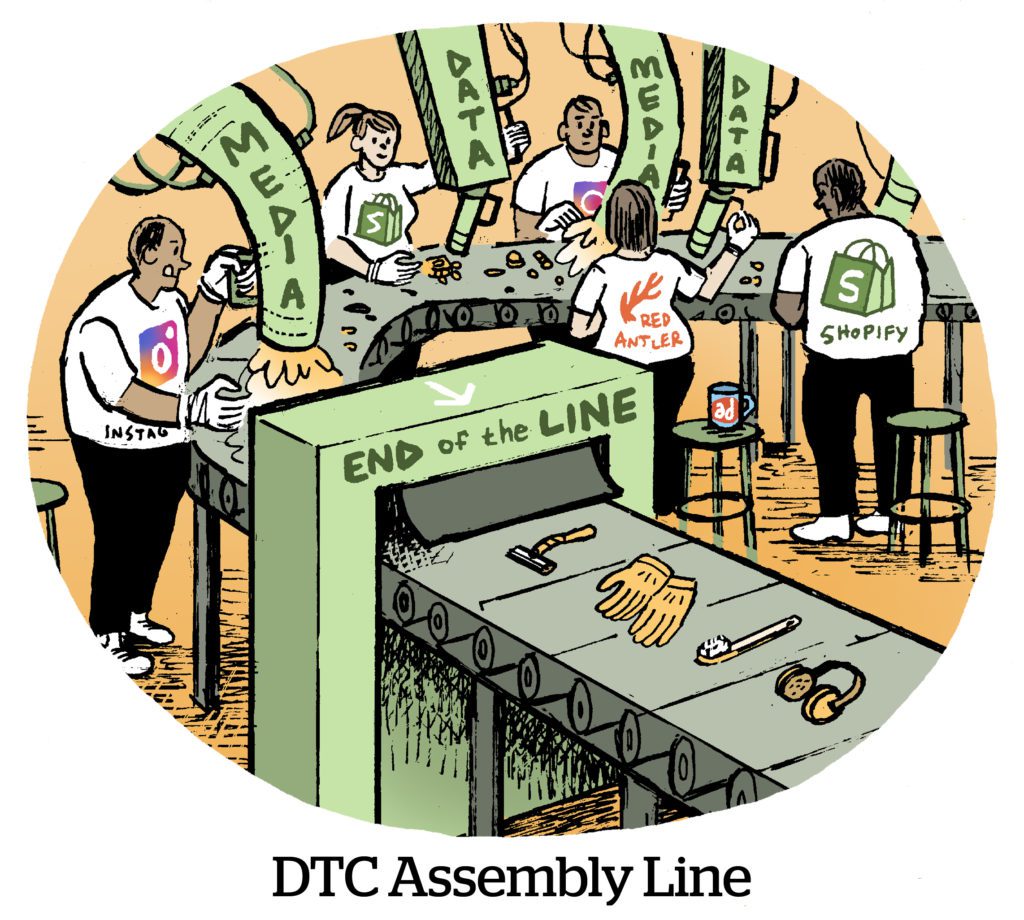

But it is important. People tend to think of digital-native product brands as a single bucket. But there’s a huge difference between companies that are social natives, for instance, rather than an Amazon-based brand. For one thing, a brand that’s born and raised on Facebook, Instagram, TikTok and/or YouTube generally prioritizes its own site and DTC shopping experience. The Amazon brand relies on Amazon for that, rather than its site as the primary checkout lane.

But there are many other ways in which ecommerce manufacturing startups become fused with their preferred digital platforms.

The platform ride-or-die

For some products, having thumb-stopping social content and strong Amazon seller chops may not be irreconcilable. But AquaSonic is an interesting example because, for the oral care category, the difference is quite stark.

While AquaSonic posts organic content on all the social channels and does have shopping integrations for TikTok and Instagram, it isn’t really a social brand, CMO Jonathan Cohen said.

On TikTok, he said the toothbrush and oral care category is flooded with “false or dubious claims.” Many of those startups “overreached” in terms of their claimed health benefits, he said, and are now struggling.

For a reporter who perhaps is casually dipping into the oral care content stream on TikTok and Instagram for a story, there may be a rude awakening in the form of off-putting videos of teeth-cleaning or weird light-up things people put in their mouths.

Cohen said there are copycat products on social platforms that make bold health and wellness claims and are now hampered by strict limitations on those types of advertisers. But that thumb-stopping approach never made sense for AquaSonic because those types of shock-value videos and bold claims don’t really work on Amazon.

Also, one of the factors that led to AquaSonic’s distribution deal with Walmart that began in September is its ADA Seal of Acceptance, Rahbarpoor said.

And, Cohen noted, the big social platforms have seen major increases in average cost per acquisition, which hasn’t been true for Amazon.

AquaSonic’s cool disdain for its social-native startup brethren is mirrored by its full trust in Amazon.

Many consumer ecommerce brands, especially those with a big social presence or influencer budgets, refuse to spend search budgets to protect their own terms. Or see zero value in doing so.

AquaSonic is a strong believer in protecting its brand terms, in line with Amazon’s best practices, Cohen said. When it doesn’t do so, the company sees AquaSonic-branded searches plucked away by other sellers.

Cohen also said AquaSonic was an early adopter of Amazon’s Premium A+ content – which sounds comical but is the terminology for rich media assets that can be delivered for a product listing or on a product page. Rather than text product descriptions, some items might include a small animation or video that demonstrates how a piece of clothing hangs on a person or how a feature is used.

The A+ content access is a useful example, too, because of how strategically the product was used by Amazon. It wasn’t something a smaller brand could simply pay for, or any other seller could outbid them for like an ad unit. The A+ content is also a psychological nod of sorts. It is the Amazon platform’s way of tacitly endorsing a product’s legitimacy, since the brands with access were generally direct manufacturers or well-known consumer brands.

For brands that commit to its platform, Amazon does dole out those kinds of benefits, as well as early access to new formats and features.

Currently, AquaSonic is an early and eager tester of Amazon’s new creative generation products, which were introduced in beta in September, Cohen said. Not to mention streaming TV, which, he said, is “an opportunity to bring our storytelling to a broader audience while staying within Amazon’s ecosystem.”

Over the next Wal’

Just because AquaSonic is an Amazon native doesn’t mean it can never expand or commit elsewhere.

As noted above, the company recently announce a rollout to some 1,400 Walmart locations in the US.

But Walmart and Amazon are peas in a pod, more like how a different startup might be a good fit on TikTok and Instagram. And AquaSonic is bringing the same attitude, where it builds for the channel and relies on the retailer’s best practices.

The products it sells in Walmart, for one thing, are slightly different versions of what’s carried on Amazon.

“Retailers like Walmart invest more when you deliver something built for their shopper,” Rahbarpoor said. And aside from giving the retailer a reason to champion the exclusive product, it “also prevents direct price competition across channels.”

If the products were the exact same, Amazon and Walmart would penalize AquaSonic for any price differences, although they have different promotional schedules. Creating an exclusive product for Walmart means AquaSonic can attach itself to Walmart without complicating the same level of platform devotion on Amazon.

The brand has been working with Walmart Connect to drive local traffic and store sales, Cohen said, and has taken the Connect team’s guidance on building curated landing pages and sponsored brand video placements.

After all, he said, “who knows Walmart shoppers better?”