The commerce media puzzle is coming together.

On Wednesday, retail and CPG data company SPINS added a new piece with its acquisition of MikMak, a click-to-buy ad tech and analytics startup that helps optimize their commerce media.

Terms of the deal were not disclosed.

The two companies first began talking about a potential partnership last year, SPINS CEO Jay Margolis told AdExchanger.

SPINS wanted to expand into MikMak’s space – which is to say, serving online ads and driving online conversions – as an extension of its in-store purchase and shelf-monitoring data offering.

The conversation quickly changed to, “actually, what would it look like if these two entities came together?” Margolis said.

For MikMak, the appeal, according to the startup’s CEO and Founder Rachel Tipograph, is that SPINS “has a proprietary data asset that we always wish we had.”

The new normal

The merger of SPINS and MikMak is a natural fit.

MikMak specializes in driving ecommerce conversions from social, programmatic and online marketplace ads. But it hasn’t had its own data on which products are available at nearby stores or visibility into whether its online campaigns are driving in-store sales.

SPINS is a data seller that also has direct relationships with retailers, mostly regional and smaller chains, and with a particular focus on the natural wellness and health verticals. MikMak’s clients, meanwhile, are all large enterprise CPG brands.

But the deal also brings together two parts of the retail marketing chain that, traditionally, weren’t supposed to be under the same roof.

Historically, SPINS has competed with attribution services like Circana, which was formed by the merger of IRI and NCSolutions, the two largest store-based purchase data providers.

It also has its own marketing platform called Destini that includes ad serving and, therefore, marginally competed with MikMak, Margolis said.

But by acquiring MikMak, SPINS is adding more robust campaign delivery combined with measurement to its tool kit, which is what brands want.

For example, when marketers run an Instagram campaign, he said, they don’t only want to know how many conversions they drove on Instagram “in a vacuum.”

They want campaign results “put into the context of everything that we do,” Margolis said, meaning the context of in-store data tied to sales lift and market share gains.

Tipograph added that the market has also changed a great deal in just the past five or so years, and that’s created the need for new measurement approaches.

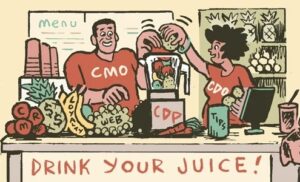

Traditionally, big CPG brands would typically split responsibilities between a marketing team running national or global campaigns and a trade marketing team partnering with retailers to boost sales in their stores.

“Walmart is now calling on the sales and marketing teams,” Tipograph said. “This has fundamentally changed the entire ecosystem.”

Large CPG companies and retailers are therefore now more open to integrating purchase data providers, ad vendors and online platforms instead of keeping them separate.

“They don’t want to work with siloed vendors,” Tipograph said. “That’s the market signaling this is where they want us to head.”