As brands become better stewards of their first-party data, they’re bringing their programmatic video buys in-house to better control their media expenditures, according to AOL Platforms’ report, the “US State of the Video Industry,” released Monday.

As brands become better stewards of their first-party data, they’re bringing their programmatic video buys in-house to better control their media expenditures, according to AOL Platforms’ report, the “US State of the Video Industry,” released Monday.

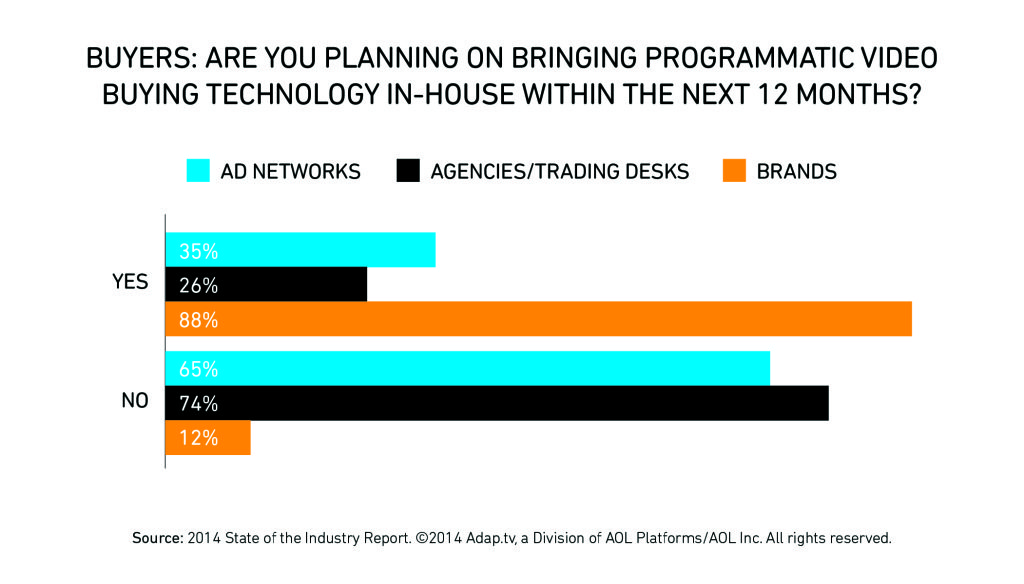

Although only 13% of the 350 media and marketing professionals (both AOL customers and non-customers) surveyed said they have in-house programmatic video-buying programs, 88% said they intend to develop one over the next 12 months.

“That was a big, surprising number for us and my hunch is a lot of this is being driven by the data piece and that more often than not, the brand owns their own data and there is this movement toward owning that multitouch attribution themselves,” said Toby Gabriner, head of Adap.tv and ONE by AOL.

AOL Platforms also found 60% of brands’ online video spend is programmatic, compared to 40% of agencies’ video spend. The difference is because publishers adept at harnessing their audience data know the value of that data and work directly with brands.

About 51% of publishers say they have put premium inventory up for sale programmatically, compared to 36% last year. Various influences, such as inventory packages that increase yield, fuel this uptick.

“We think these numbers demystify myths about publishers making their inventory available programmatically,” Gabriner said. “More than half saw their fill rates increase and more than 55% said they’d leverage private marketplaces going forward. This indicates to me that long- to mid-tail to premium all see this as a way to connect in and do business with the buy side.”

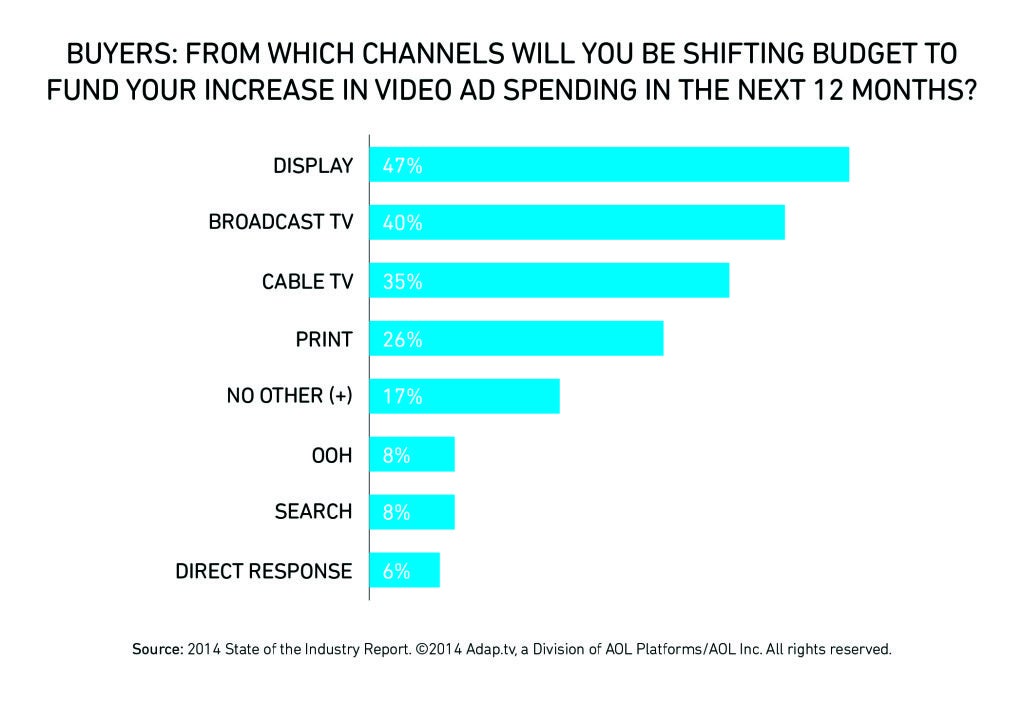

On the buyer side, how are marketers shifting budgets to fund online video buys? While past surveys indicated marketers did not draw from television budgets, tides have shifted.

Although 50% of brands said they will move money from standard display to account for programmatic video, a close second was cable TV, at 40%, and broadcast TV, at 33%. This beat both print and out-of-home for the source of shift in ad budgets to account for video.

“There is not this delineation of video being just a subset of display anymore,” Gabriner said. As channels converge, marketers are beginning to move budget more fluidly between cable/broadcast and video. “Also, as data drives television more, it’s just a factor that’s driving those things together. Video is thought of in a larger, (more blurred) way with television.”

Despite programmatic video’s maturation, there are still areas that require clarification. For instance, while online video inventory is often labeled as “premium,” what has been traditionally considered “premium” in TV are broadcast buys and much of that inventory isn’t available on the open exchanges.

Is all online video equally premium? When asked whether “in-stream” or “in-banner” constitutes premium inventory, Gabriner said premium is in the eyes of the beholder and is dependent upon need. The advent of original programming and content by digital constituencies could feasibly command higher CPMs, and more nuanced formats could change what constitutes “premium” inventory.