“On TV And Video” is a column exploring opportunities and challenges in advanced TV and video.

Today’s column is written by Raquel Rosenthal, CEO at Digilant.

Connected TV (CTV) is attractive to advertisers looking for ways to combine TV’s compelling brand storytelling with a digital marketing approach that can better target and measure those messages and automate the media buying process.

Long-term success in CTV requires maximizing the expertise from both the TV and digital departments within brands and agencies. Fortunately, emerging tools, analytics and services can defuse internal turf battles and unite both sides in their efforts to engage the cord-cutting audience.

Nielsen’s Digital Ad Ratings are a good example thus far, enabling gross rating point equivalencies that allow brands and agencies to compare CTV performance with traditional TV buys. This enables traditional TV ad experts to better understand and articulate how 15- and 30-second CTV spots are moving the needle for consumer awareness and purchase intent.

Digital advertising experts bring to the table not just an understanding of how programmatic buying works and the tools for maximizing ROI, but also the pitfalls to avoid when entering the space.

For example, fraud is typically found in places with high revenue opportunities and new channels without foolproof measurement. Open exchange CTV inventory has likely been a victim of high fraud rates, creating a need for not just CTV-specific detection tools and standards, but also for TV and digital departments to cooperate in evaluating and benchmarking results and spotting metric anomalies to ensure it evolves as a brand-safe channel.

Since CTV inventory is also fairly limited and highly competitive, both TV and digital marketers can combine their expertise to determine if they should go direct or buy via private marketplaces – and then factor in how these channels’ higher CPMs impact overall ad campaign performance.

Other mechanisms being developed by a growing number of ad tech partners allow data from both TV and digital sources to be seamlessly integrated to create unified user profiles that can then be targeted with specific and relevant messaging.

Tools that sync CTV and other OTT devices across a single unified ID enable marketers and their agency partners to measure and attribute performance to CTV more easily and affordably than with traditional TV.

By creating a shared metric, TV and digital departments can better determine what messaging and creative in CTV drives site traffic, brand affinity, conversion and sales lift. These metrics can then be augmented with qualitative data, which traditional TV advertisers have long relied on, to create a fuller, more nuanced understanding of whether a brand’s storytelling is resonating with target consumers.

With CTV as a growing focal point, digital and TV departments should be able to better coordinate everything from initial planning and goal setting to executing creatives, ensuring that brand identity remains consistent regardless of where the consumer engagement is taking place.

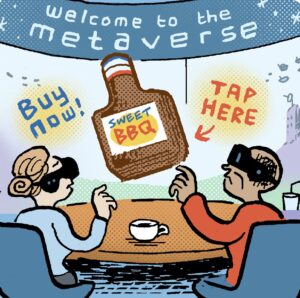

Bridging the internal gap will also allow brands to take advantage of new ways to engage consumers in a hybrid premium, ad-supported CTV landscape where the traditional 15- and 30-second spot is only part of the marketing arsenal.

By cooperating on CTV opportunities, such as brand home-screen takeovers, sponsorships and product placement, linear TV and digital departments can shape these initiatives’ goals and determine how they’re impacting viewer perception and engagement.

Follow Digilant (@Digilant_US) and AdExchanger (@adexchanger) on Twitter.