Corporate siblings WarnerMedia and Xandr are full steam ahead on data-driven TV sales. Just look at this year’s upfront, where the AT&T subsidiaries will go to market together for the first time.

The companies have been inching their way toward a joint offering over the past year and a half in an effort to sell more premium inventory against audiences. Over that period, brands across every major vertical have executed roughly 700 campaigns across WarnerMedia’s linear and digital inventory using Xandr data.

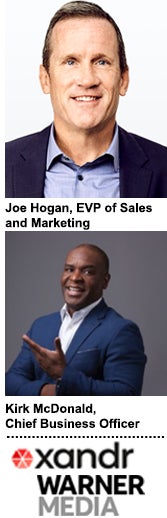

“Our assets are complementary,” said Joe Hogan, EVP of sales and marketing at WarnerMedia. “I don’t think the marketplace understood that fully to begin with, but now they do.”

At the upfront, Xandr and WarnerMedia will focus on the incremental reach available through addressable TV, where Xandr’s footprint spans 75 networks and 16 million homes. They’ll also talk about enhancing brand experiences using AT&T wireless.

“Marketers want to know not just how to get in a show, but target audiences and do branded content,” said Xandr chief business officer Kirk McDonald.

However, HBO Max, AT&T’s streaming service launching in May, will not be part of the upfront conversation. The platform plans to launch an ad-supported tier in 2021.

Hogan and McDonald spoke with AdExchanger.

AdExchanger: Why are Xandr and WarnerMedia having a joint upfront?

JOE HOGAN: Clients traditionally looked at WarnerMedia as tier one, top-funnel inventory. Because of our assets cross the portfolio, from Community to Xandr addressable, we’re now able to work with them deeper into the funnel. It’s an opportunity to help them complete the picture for higher performing investments in premium video. That is a complementary approach.

How are negotiations changing as you bring data and targeting to the table?

KIRK MCDONALD: We’ve changed our mindset. We’re not saying to the client, “This is what you get from Xandr, and this is what you get from WarnerMedia.” It’s a bespoke solution for that client.

Xandr has normalized and anonymized AT&T data and made it compliant and appendable to an ad impression. We can now activate and do attribution on the back end. The conversation isn’t just based on point shift, which has been the traditional upfront negotiation. [We’re talking] about data, targeting, attribution and analytics, all the way through what can we do in your physical infrastructure. To go to the upfront with hundreds of campaigns and real case studies allows us to change the narrative.

Which joint offerings are brands and agencies most interested in?

MCDONALD: Agencies want to support a client through all stages of the funnel. With the engagement we have across WarnerMedia, we can target light TV viewers, which we couldn’t independently do. We have extended reach opportunities. WarnerMedia has a product for audience reach and lift. Combined with the addressable footprint we have, that is an advanced solution. Marketers have always had to piece that together.

Marketers also now have what we hope is a frictionless conversation between their point of contact and a subject matter expert. If we’re starting with a client focused on targeting but they want to have a conversation around brand experiences, we can bring in those experts.

What targeting opportunities are available?

MCDONALD: We’ve gone to market with multiple data segments. Understanding the user with single identity characteristics across everything [we sell] has been part of that. The segments that we’ve lit up are being used to the tune of hundreds of campaigns.

HOGAN: We’re not looking to say, “Here’s an off-the-shelf segment, take it and run.” That’s not reflective of how advertisers are tackling their challenges. As we analyze performance, we can offer fluidity to maximize for reach or frequency and pivot [along the way].

Where do branding opportunities with AT&T connectivity come into the equation?

MCDONALD: [AT&T’s] communications business is a critical part of enhanced marketing going forward as consumers have more connectivity, speed and content than ever before. For a brand that activates in store, we can light up that location with faster Wi-Fi. So faster connectivity becomes part of the brand experience. Then we can take first-party data and targeting to amplify that message.

HOGAN: We’ve worked together on a client in the QSR space that was attracted to this piece of branded content. They happen to be brick-and-mortar, so we brought in AT&T and Xandr. That’s the complementary aspect. It rounds out our discussions with advertisers.

But it depends on the client. Some need to talk about segmenting products to different audiences. They want to lead with that, full stop. Then it inevitably comes to, what are the best environments for this segment? Can you help us produce branded content? Others are like, I just want to be involved with “Rick and Morty” or CNN in 2020. We’re not trying to force-feed anything.

This interview has been edited and condensed.