Every once in a while, we like to pull the curtain back here at AdExchanger and discuss how we decide what’s worth covering.

Which is why this week’s episode of The Big Story opens with an important question: Why do we report on earnings calls in the first place?

It’s like good police work, Senior Editor James Hercher says. Meaning, it takes a lot of time and can often get very tedious, but can lead to some incredible insights when done correctly.

At the risk of belaboring the metaphor, reports this quarter have more in common with late-night stakeouts than thrilling perp chases. But there were a few juicy tidbits to pull out, particularly with regard to what companies in the ad tech space (and their investors, of course) are currently thinking about.

The results of the Google antitrust trial – and the wave of pre-remedy lawsuits that have followed – came up more than a few times. So did The Trade Desk’s recent policy changes with OpenPath and Kokai, which have caused ripples among SSPs in recent months.

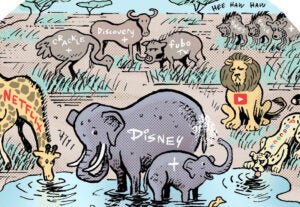

But, although the live Q&As with investors occasionally offer some neat surprises (remember Disney CEO Bob Iger’s hot mic moment last year?), the folks asking the questions often aren’t really trying to uncover the truth in the same way that journalists are.

Which is a shame, because executives are legally obligated to tell the truth during earnings calls – something they don’t technically have to do in press interviews, much to our chagrin.

“I’ve been lied to before. Like, to my face,” recalls Managing Editor Allison Schiff. “But I discovered it later.”