Most Facebook observers would be hard-pressed to find “negatives” in the evolution of the company’s ad products over the past year.

Most Facebook observers would be hard-pressed to find “negatives” in the evolution of the company’s ad products over the past year.

Performance continues to improve, as detailed in a new report from Adobe. Mobile monetization is proceeding apace. And it has executed on programmatic selling, through its Facebook Exchange, Custom Audiences database match program and Partner Categories third-party data targeting.

But all is not well with the world’s largest social platform, according to a new report from Forrester Research analyst Nate Elliott. Facebook, Elliott concludes, has largely turned its back on the social and affinity data it once heralded — and it has done so to the detriment of large marketers.

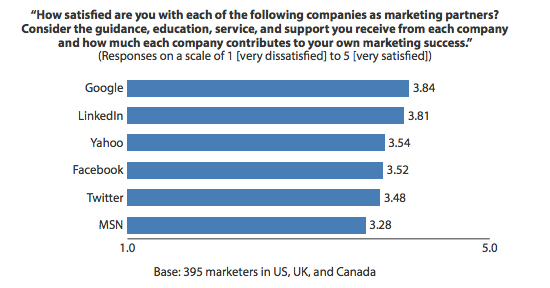

Forrester surveyed 395 executives in the US, UK and Canada in August for the report, called “Why Facebook Is Failing Marketers.” It asked them, among other things, how satisfied they are with the business value generated by a lineup of 13 different “online marketing sites and tactics.” Stunner: Facebook ranked dead last on that list. When placed next to five other “large online and social properties,” it also ranked poorly – ahead of MSN and Twitter but behind Yahoo, LinkedIn and Google.

According to Elliott, Facebook no longer prioritizes affinity and social connections in its ad products, and is now so enthralled to revenue growth sourced to lower-funnel advertiser demand that it can’t see how much it has alienated many advertisers. Facebook’s failings, as detailed by Forrester, also touch on its neglect of non-paid tools products such as Brand Pages and a poor overall quality of service — even for some Fortune 500 companies. (Facebook offers special tools and opportunities to members of its Client Council. As a result, Council members are generally satisfied, while “hundreds of billion-dollar companies are not getting that special attention and are overwhelmingly dissatisfied,” said Elliott.)

The affinity data to which marketers have access is very thin, according to the report. “Facebook needs to do more and do better ,” Elliott said. “When Facebook says, ‘We think someone’s purchase history in Epsilon’s database is more effective than affinity data,’ that just means the purchase data is better leveraged.”

In a phone interview, he was careful not to imply negative intent on Facebook’s part. “The conversations I have with Facebook indicate they honestly believe they are serving customers well. I think the massive revenues have blinded Facebook executives to the growing dissatisfaction of marketers who pay their bills,” he said.

One interpretation of the data is that Facebook has optimized its ad algorithms for its own yield rather than for advertiser objectives. As Forrester notes, fewer than 15% of Facebook paid media impressions use social data to target audiences. That ratio might be higher if ads with social data weren’t squeezed out by higher bids from advertisers targeting users lower in the purchase funnel.

Elliott is urging clients to put pressure on Facebook, by eliminating dedicated budgets and forcing it to compete with other websites for spend. But he’s not optimistic.

“We don’t believe that Facebook will make the changes needed to win back marketers’ hearts,” he writes in the report. “In fact, we don’t believe the company even sees the need to change.”

From Facebook’s perspective, marketers may no longer need or want affinity-based targeting solutions. Rather, they’re looking for performance and engagement, which the company increasingly aims to fulfill through advanced targeting capabilities combined with enormous reach. The revolutionary idea of “word of mouth at scale,” while not forgotten, is no longer on the front burner.

The company issued the following statement in response to the report:

Facebook acknowledges that its biggest complaint from advertisers and agencies is around the quality of service, an area it says it has taken steps to improve.