Deal curation captured the ad industry’s imagination last year. But the curation conversation has already taken on a more pessimistic tone on the publisher side in 2025.

Critics say curation is nothing new. DSP data marketplaces have long enabled curated deals. Even on the sell side, SSPs have been curating private marketplaces (PMPs) for years. And the IAB Tech Lab developed a framework built on its Seller Defined Audience (SDA) spec to enable publishers to curate their own audiences back in 2022.

But SDAs failed to catch on in the open market. And other approaches to curation are driven primarily by ad tech platforms, rather than publishers. Meanwhile, although publishers are generating revenue from curated deals, some suspect they should be seeing more incremental growth, given all the hype.

Now a new storyline is emerging around curation, one in which publishers feel they’ve missed yet another opportunity to capitalize on how their first-party data is used to build audiences. And they worry that opportunity – and the resulting revenue – has instead been seized by middlemen.

In other words, the same old story of ad tech.

Publishers are missing out on curation

“Most publishers that I’ve talked to are not seeing any lift tied to curation,” Ryan Pauley, president of revenue and growth at Vox Media, told AdExchanger. Although the company owns an SSP and a first-party data platform – technology layers that are best positioned to benefit from the curation craze – curation’s lack of revenue lift applies to Vox Media, too.

“If anyone’s going to see lift from curation, it’s a company like Vox Media,” Pauley said. “And if that’s not happening, I don’t know where the value is going – other than where it always goes: to the middlemen.”

In that sense, curation is “just marketing spin to get advertisers to keep spend within the programmatic ad tech pipes,” Pauley said, and to prevent ad budgets from being rerouted toward direct deals with publishers.

Indeed, publishers are watching former data management platforms (DMPs) rebrand themselves as curation specialists and grow fat on the demand driven by advertisers flocking to curated deals, said Justin Wohl, the former CRO of Snopes and TV Tropes who joined publisher tech platform Aditude in December.

“That indicates to me, as a publisher, that there was a great amount of opportunity that I didn’t get to realize,” Wohl told AdExchanger just before he made the jump to Aditude.

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

In 2025, publishers need to rethink how they work with curation partners, Wohl said.

Rather than letting multiple partners place code on their pages and create audience graphs using their first-party data, publishers should do the graphing themselves – or at the very least make partners pay to access that data, he said.

“If you’re able to make some conclusion about an audience member because of the cookies that I provided, or because of the user agent or the IP address of my user,” Wohl said, “then I, as the publisher, should be taking the most value for that, because it originated with me.”

Who do advertisers trust?

While the data that powers curation originates at the publisher, advertisers seem much more inclined to trust how ad tech vendors are packaging audiences than how publishers are doing it themselves.

“The whole reason that SDA didn’t go forward was that we had this consensus that publishers couldn’t be trusted, and that the audience defined by the seller would not be accurate or trustworthy enough for the buyer to adopt,” Wohl said.

IAB Tech Lab CEO Anthony Katsur echoed that sentiment when he announced last month that the Tech Lab would rebrand SDAs as “Curated Audiences” – pointing to the “seller-defined” nomenclature as a sticking point for buyers who wanted to control how audiences are built, rather than trusting sellers.

Meanwhile, the buy side seems to place much more trust in the tech vendors cornering the curation market.

Part of the reason for that trust is because SSPs, DMPs and curation houses can offer greater scale across multiple publishers, said publisher monetization consultant Scott Messer. But it’s also because these tech vendors aggressively market themselves through industry events and thought leadership, he said.

SSPs are also better positioned to build relationships with DSPs and agencies than individual publishers, Wohl said, which means buyers are more inclined to trust an audience that’s been packaged by an SSP.

DMPs and SSPs also build trust among buyers by selling publisher inventory – but with the DMP’s or SSP’s branding attached, Wohl added. And if those audiences perform, the tech vendor gets the reputational boost, not the publisher.

For example, DMPs and SSPs can package inventory from multiple sports publishers and sell it as their own curated sports enthusiast audience, rather than pitching buyers on individual publisher domains.

However, when curated packages are sold under the DMP’s or SSP’s name rather than the publisher’s, sometimes the publisher’s pricing floor gets ignored, Wohl said. Which results in premium publisher inventory getting packaged alongside less valuable sites and sold for sub-premium prices, he said.

So premium pubs may still be moving inventory through curated deals, but they’re probably netting lower CPMs than they would have if buyers bought that inventory directly, according to Wohl.

Plus, publishers lack transparency into just how much of a take rate their curation partners are collecting, Wohl said. So pubs have no idea how much money they’re leaving on the table – other than what they can infer from DMP and SSP growth.

Curation is fueled by data

Clearly, there’s some bitterness over curation on the publisher side. But before publishers dwell too much on the negative, there are some important points to keep in mind.

For one thing, ad tech vendors have an advantage over publishers when it comes to providing measurement and attribution for programmatic channels, Vox Media’s Pauley said.

And while it’s true that publishers could curate audiences themselves, Messer said, the current curation craze is fueled by data-driven selection of inventory. And most publishers aren’t as sophisticated as DMPs and SSPs when it comes to making sense of audience data or selling it to advertisers, he added.

Publishers also shouldn’t stress too much about differences in CPMs for curated deals, Messer said.

“If a curated deal through your SSP is clearing at $1, but your open auction average is $2, it’s not necessarily a bad thing,” he said. “It just means the SSP found some inventory that nobody else wanted to buy, but they enriched it with data and [other] inventory and got somebody to buy it.”

Plus, curated supply currently represents just a single-digit percentage of most publishers’ SSP demand, Messer said. So publishers still have a chance to negotiate fairer terms with their tech partners as the sell-side curation business matures.

However, curation partners should be more proactive about enforcing publisher rate card pricing going forward, Messer said. That way, they ensure not only that publishers get fair market value for their inventory, but that curators are getting fair value for their data processing.

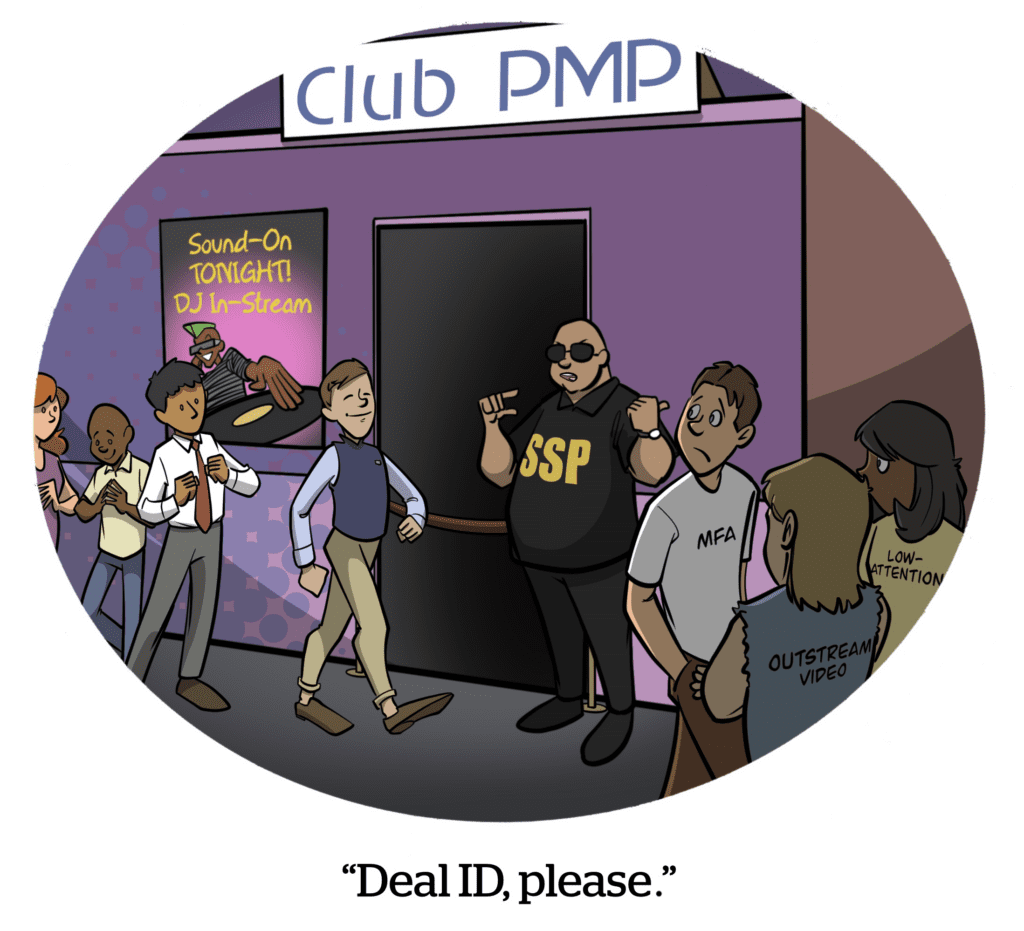

And ultimately, the curation hype is good for publishers because “PMPs are cool again,” he said. “From 2018 to 2024, deal IDs were hard to sell, because buyers were leaning harder into the open auction and their vendors’ DSP set. This shift [to sell-side curation] has brought PMPs back.”