The New York Times and News Corp are two prime case studies in how news publishers are evolving to be less reliant on ad revenue.

Both publishers reported their most recent earnings on Wednesday (Q4 for The New York Times, Q2 for News Corp, which operates on a different fiscal calendar than most). And both publishers reported stronger growth in subscriptions than in digital ads.

Both publishers have also increasingly looked to new revenue streams for sustained growth.

In The New York Times’ case, that means ramping up its gaming, lifestyle, sports and podcast content to keep readers engaged and drive adoption of pricier subscription bundles. In News Corp’s case, that means likewise leaning on subscription bundles, as well as B2B subscription services and generative AI partnerships.

A Sign Of The Times

The New York Times has been a subscription-first business for a while now. Subscriptions remain its main revenue driver, CEO Meredith Kopit Levien told investors.

The Times reported digital subscription revenue of $334.9 million in Q4, a 16% year-over-year increase. It added 350,000 net new digital subscribers compared to Q3, bringing its total to 10.8 million.

Plus, digital average subscription revenue per user was $9.65 for the quarter, a 4.4% YOY increase. This boost resulted from increased adoption of subscription bundles. Forty-eight percent of digital subscribers signed up for more than one product, like NYT Cooking and Wirecutter. The publication also made gains from subscribers stepping up to more expensive subscription tiers, said EVP and CFO William Bardeen.

The Times’ subscription revenue growth continues to outstrip its advertising revenue growth. Digital ad revenue in Q4 was $117.9 million, a 9.5% YOY increase.

In other words, ad revenue was about a third of subscription revenue, and digital ads grew at almost half the rate of subscriptions.

Still, while ad revenue lagged subscriptions, a 9.5% growth rate in digital ads is nothing to sneeze at for any news publisher.

Kopit Levien pointed to “strategically expanded ad supply” across NYT Games and The Athletic as instrumental to bringing in new demand. She also touted improvements to existing ad products and enhanced ad targeting capabilities. That includes the generative AI-powered BrandMatch tool the Times launched last year, which matches ads to content based on a brand’s campaign brief.

Going forward, the Times will continue to expand ad supply on its lifestyle content, within games, on The Athletic and in podcasts, Kopit Levien said in response to an investor question. And it will explore opportunities to work with marketers on messaging across these properties.

While programmatic is a growing piece of the Times’ pie, the company also remains focused on direct-sold ads, which represent the majority of its ad business, she added.

Speaking of, direct-sold display remains one of the Times’ best-performing ad products, according to the company’s Q4 earnings release.

Asked by an investor whether the Times sees an opportunity to court higher CPMs by expanding its video ad products, Kopit Levien said there’s definitely opportunity in video. But she stressed that CPMs for direct-sold display remain strong, and targeting improvements should further shore up direct-sold CPMs.

However, she added, the Times has been experimenting with more video-centric and interactive ad creative within its existing display placements, and there will be more to come on that front.

The News On News Corp

Meanwhile, the contrast between subscriptions and ad revenue in News Corp’s earnings was even stronger.

For example, News Corp’s Dow Jones segment, which includes Dow Jones, The Wall Street Journal and Barron’s, reported $600 million in total Q2 revenue. That represented a $16 million increase, or a 3% YOY growth rate, driven mainly by B2B subscriptions, increased circulation and generative AI licensing deals.

Dow Jones’ circulation and subscription revenues increased $20 million in Q2, or 4% YOY.

Part of that growth came from increased adoption of subscription bundles, such as a package that includes access to The Wall Street Journal, Barron’s, Investor’s Business Daily and MarketWatch.

Dow Jones now has 950,000 bundled subscribers, a 45% YOY increase, News Corp’s new EVP and CFO, Lavanya Chandrashekar, told investors.

However, Dow Jones’ ad revenue was $121 million, down $5 million, or 4% YOY. This decrease was mostly from a 10% dip in print advertising, although digital ad revenue was flat for the quarter.

In News Corps’ News Media division, which includes a number of Australia- and UK-based publications, total revenue declined to $570 million, down by $12 million, or 2% YOY.

Circulation and subscription revenues were flat YOY. However, the segment benefited from increased subscription pricing across multiple titles, Chandrashekar said.

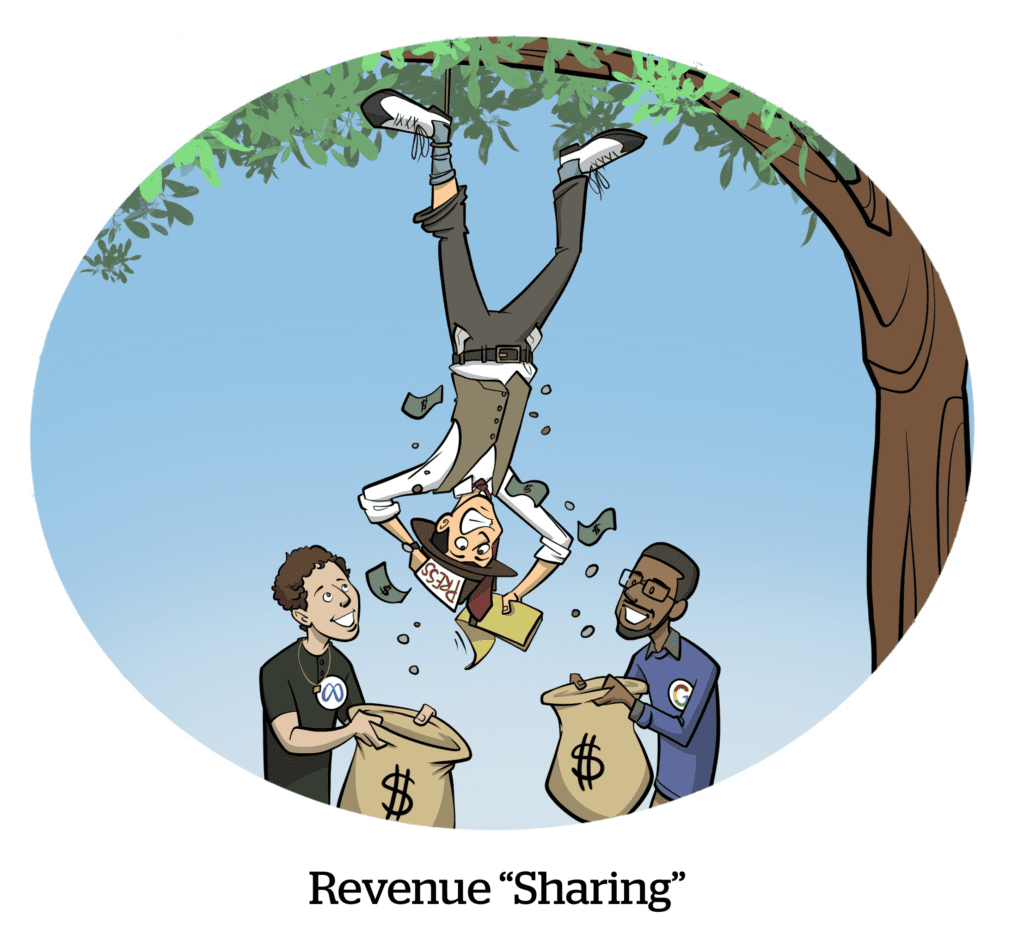

But advertising was a loss leader. Ad revenue dropped $4 million, or 2% YOY, reflecting losses in both print and digital. On the digital side, losses were driven by traffic downturns in the News UK division, caused by “algorithm changes at certain platforms,” according to the company’s earnings release.

One bright spot for the ad business was The New York Post, which saw its digital ad revenue grow by 13% YOY, said News Corp CEO Robert Thomson.

The New York Post, and News Corp’s wider news publishing business, also benefited from the company’s content licensing deal with OpenAI, Thomson said.

He added that News Corp’s content will be featured in OpenAI’s Operator, which is an AI agent capable of independent work. Thomson said this product partnership will ensure “prominence for our journalism in the burgeoning world of agentic AI.”