Best Buy has decided to get its hands dirty by digging deeper into the ad tech ecosystem.

Best Buy Ads, the consumer electronics chain’s retail media arm, on Tuesday announced a slate of new partnerships and new ad tech features that push it further into ad tech and data services.

“There’s a recognition that the person walking into our stores is not just a tech or consumer electronics person,” Best Buy Ads President Lisa Valentino told AdExchanger. “They’re also a business traveler; they’re also a gamer; they also over-index in terms of entertainment content.”

The “Me” in Media

Best Buy Ads has found a “winning formula” in its network of strategic partnerships, Valentino said. Those partnerships include consumer tech and review publications like CNET and Ziff Davis, which have created strategic and exclusive content integrations with Best Buy, rather than using a standard affiliate model.

Best Buy has also targeted media deals for sports and young male demographics in particular. Best Buy landed a deal with YouTube, so that its premium membership subscribers get the NFL Sunday Ticket package at a steep discount. Best Buy is expanding its NFL partnership this season by becoming an exclusive TV category sponsor.

Although Best Buy has no access to inventory to sell in its retail media business via YouTube or the NFL, the deal does have retail media implications.

The YouTube deal stipulates that TV manufacturers can advertise with the NFL – but only via Best Buy Ads, Valentino said.

Best Buy’s other sports deals are not as splashy. The retailer is renewing a partnership with Tomorrow’s Golf League, an indoor league is backed by the PGA, and with Dude Perfect, a big YouTube-based creator group that does sports-adjacent videos (think basketball trick shots or bizarro dodgeball games).

In March, Best Buy Ads debuted an integration with Meta, too, to enable addressable audience targeting based on its data.

The Best Buy date

Best Buy is doing more than adding third-party media partners to bolster its ads business. The company has plenty of its own canvas still available for ads.

One way to crank up ad revenue is to launch a third-party marketplace, à la Amazon and Walmart. And, wouldn’t you know it, one month ago Best Buy announced a new third-party marketplace for online sellers, which Valentino said has already grown by 10X in terms of the number of products now carried by Best Buy.

And then there’s the brick-and-mortar ad supply.

Best Buy Ads today unveiled a new “takeover” campaign package – not a takeover for the site or app, mind, but a physical takeover of some (or all) of Best Buy’s 1,000-plus stores in the US. That package includes signage outside and on top of stores, placements in the streaming loop of entertainment and info shown on the walls of TVs in stores, physical displays at the checkout and on PC monitors.

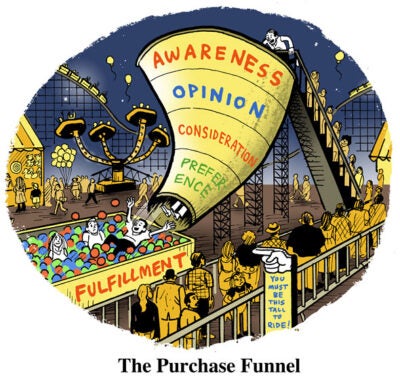

But despite the addition of so much fresh inventory clustered around their store checkouts, one of the most important trends in retail media right now is that buyers have upped their game and no longer want retail media simply to target inventory right before a likely purchase, said Milena Krasteva, Best Buy’s VP of product management for ad tech.

Best Buy Ads will do more to hand the keys to advertisers, when it comes to automation and campaign management on the platform. To date, Best Buy Ads has been a managed service for ads and a reporting tool for impressions on Best Buy properties, Krasteva said. From today, though, she said, Best Buy Ads will add campaign management and in the next year will add reporting for off-site and other non-owned media channels.

For example, Best Buy does have audience segments uploaded to DSPs including The Trade Desk, Google DV360 and Yahoo. But those are static data packages. For advertisers working through Best Buy Ads, the company can unlock custom audiences modeled for that campaign, and freshened based on real-time information about target audiences or campaign results.

When a retailer owns the customers data and sees the shopper journey, it can be a powerful tool regardless of the type or category of marketer, Valentino said. Most retail media is sitting right before the purchase, ready to snap up attribution for a purchase someone might make every month.

“We’re not selling soap every day,” she said. “This is a premium journey; and it’s a longer journey.”