Some might view the timing of Tremor Video’s May S-1 filing with the SEC in preparation for its IPO as sign of a “video ad bubble,” but Michael Pachter, managing director of equity research for Wedbush Securities, warns that a public offering generally says more about the individual company than a particular industry segment, like online video ad services.

“I’m not sure that Tremor’s filing has anything to do with industry growth,” Pachter told AdExchanger in an email. “A rising tide lifts all ships, and the industry is definitely growing, but their filing is due to the desire of their founders and early investors to monetize their investment, and their advisors deemed now the best time. An IPO has nothing to do with growth, it’s just a way to raise capital.”

Still, as fellow video ad tech providers like YuMe, Adap.TV and others are discussed as future IPO candidates, Tremor’s early success or failure in the public markets will help determine whether its rivals seek their own IPO, additional venture capital or another company to buy them.

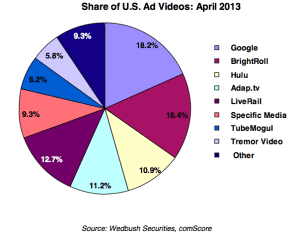

With a 5.8% share of the video ad marketplace in April 2013, according to Wedbush and comScore stats, Tremor ranks eighth in the space. But ranking isn’t everything. For one thing, Wedbush research points out that among the companies on that list, only Hulu and Tremor were able to buck the downward trend of CPMs. Where Wedbush saw CPMs peaking at $33 on average in Q2 2011, only to drop to $17 in Q1 2013, Tremor’s prices for inventory sold on its system grew from $10 to $12 per thousand views two years ago and have remained fairly steady ever since, though its prices did reach a high of $14.27 in Q4 2012.

The fact that it didn’t lose ground on CPMs over the last two years probably had something to do with Tremor’s decision to shift from reliance on relatively cheap, direct-response-based in-banner video ads to more brand-friendly, higher priced in-stream ads. It has also increasingly built out analytics for agencies and marketers via its two-year-old VideoHub business.

The fact that it didn’t lose ground on CPMs over the last two years probably had something to do with Tremor’s decision to shift from reliance on relatively cheap, direct-response-based in-banner video ads to more brand-friendly, higher priced in-stream ads. It has also increasingly built out analytics for agencies and marketers via its two-year-old VideoHub business.

The two sides of Tremor’s business – the largely sell-side facing Tremor Media Network offering and the demand-side VideoHub – have helped Tremor’s growth, though the company’s revenue appears to be growing more slowly than the North American video ad industry’s average of 20% over the past year, according to Magna Global estimates. (Tremor declined to comment for this story.)

As Tremor revealed in its SEC filing, its total revenue grew 16.5% from 2011 to 2012, to $105.2 million. Within that, its in-stream video ad dollars gained 32.1% to $99.7 million. The bet is that Tremor has room to grow from its nearly sole focus on the North American market – about 95% of its revenues come from the US, the company said in its release.

Wedbush’s Pachter, noting the lack of guidance on future revenues and specifics for how Tremor plans to reduce its losses, estimates that the company’s valuation is $700 million and that it’s looking to raise $86 million through its IPO.

Although Tremor isn’t talking at the moment, over the past year, it has made a concerted effort to be seen as more “brand campaign” friendly – a goal all its rivals are scrambling for as well.

Tremor has generally sought to be portrayed as offering a “neutral” approach to programmatic, suggesting that it primarily serves analytics to tell buyers and sellers how inventory will perform, leaving it to those two sides to work out the best method for transacting a deal.

In recent weeks, the company has also taken a “go it alone” strategy with regard to the space’s hot topic of the moment, viewability. A day before TubeMogul organized BrightRoll, Innovid, LiveRail and SpotXchange to support an “open-source” viewability metric called OpenVV (or, Open VideoView), Tremor’s VideoHub won Media Ratings Council accreditation for its five distinct metrics: Average Viewability Percentage, Engagement, Clicks, Served Digital Video Impressions and Unique Cookies.

Although not available for this piece, Anthony Risicato, VideoHub’s GM, did offer his own critique of the company’s rivals in the viewability space in a comment posted on our news item. Implying that the MRC and the Interactive Advertising Bureau would be the ones to establish a viewability standard, Risicato said, “In our view, random consortiums with no credible support of viewability seem like an odd path to go down. And, frankly, the industry shouldn’t support companies that try to water down viewability.”