An Acquired Taste

Earlier this year, Pinterest conducted reviews of five potential ad tech acquisitions, The Information reports. Although it would have settled on only one.

Clearly, no deal matriculated – at least not yet.

None of those five potential ad tech companies were cited. However, Index Exchange and Criteo were quietly added to Pinterest’s ads.txt and app-ads.txt files late last year and are currently being tested by Pinterest as potential ad sales partners.

Snap also browsed potential ad tech deals with the same and similar companies. Although, so did Amazon before it decided to launch its own ad tech (and eventually got Sizmek in a firesale).

There is an interesting trend, too, as tier-two hybrid walled gardens like Pinterest, Spotify, Microsoft, Netflix, Shopify and Roku (no offense, but none of them are Google, Meta or Amazon) lean on third-party programmatic vendors like Criteo, The Trade Desk, Index Exchange or LiveRamp.

The ad tech companies become more enticing as they plug into more and more hybrid walled gardens. But if one is acquired, like, say, Pinterest snapping up Index or a Roku deal for Criteo, it throws a delicately balanced ecosystem of open integrations into disarray.

For example, Roku’s acquisition of dataxu precipitated Amazon Fire TV scrapping its third-party ad tech partner program, which had consisted of dataxu and The Trade Desk.

What Does AI Think Of RMNs?

What happens when five LLMs (OpenAI GPT, Google’s Gemini, Anthropic Claude, Meta’s Llama, and DeepSeek) are asked: “What is the best retail media tech for retailers, and why?”

Then, they’re prompted to debate the matter between themselves.

That was the idea behind a report by Frederic Clement, co-founder of the retail media analytics company mimbi (and a former Criteo product manager).

Claude, for instance, initially ranked retailers and retail media networks (RMNs) primarily by size and hardly distinguished between retailer-owned media and a tech-operated platform. More than other LLMs, though, Claude acknowledged its confusion and revised its perspective, according to Clement.

Meta’s Llama prized omnichannel integrations and the ability to incorporate in-store retail. (Llama also blanked on Google and Amazon. Lol.)

The outputs tended to favor historical info.

Criteo, Citrus Ad (part of Publicis Epsilon) and Promote IQ (bought by Microsoft in 2019) were the runaway leaders. Except, uhhh … Microsoft shut down Promote IQ six months ago.

And Citrus, while well-regarded by the LLMs, was downgraded somewhat based on their structured counterarguments. The LLMs agreed that Citrus excels in ease of use and mid-market appeal, so it became categorized as an alternative for regional companies, but not a default option.

Revenue Review

Is it bad to already be reminiscing about how good the digital advertising industry had it last year?

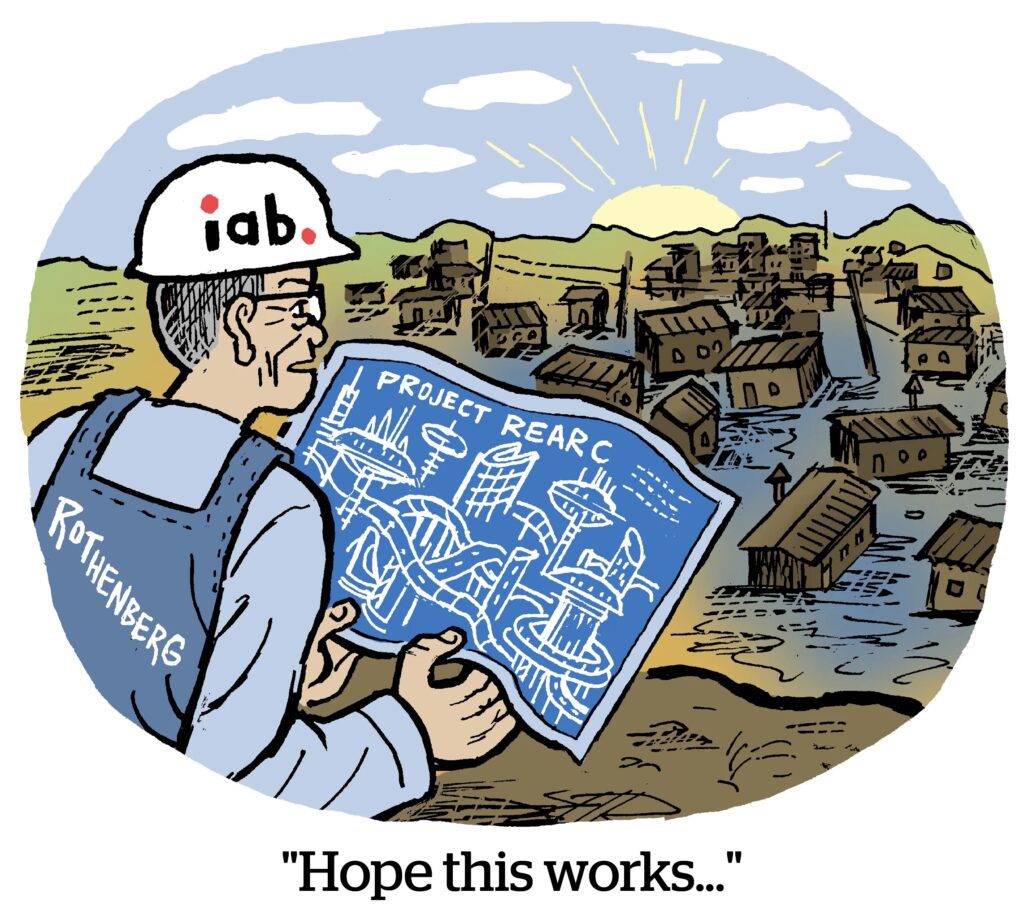

On Thursday, the IAB released its annual Internet Ad Revenue Report, which found that digital ad revenue in the US rose to an all-time high of $258 billion in 2024. It was also the strongest growth rate since 2021, at an increase of 15% year over year.

Some of that success was due to increased ad budgets during the US presidential election and Summer Olympic Games. So there was always bound to be a bit of a slowdown in comparison this year, the IAB notes, aside from ongoing concerns about tariffs affecting ad revenue.

Other interesting tidbits from the report: Digital video ad formats showed the strongest growth at a YOY rate of 19.2%, while search continues to hold the highest market share of $102.9 billion.

Excluding search, programmatic advertising also grew another 18%, from $114.2 billion in 2023 to $134.8 billion in 2024. The IAB attributes this in no small part to the rise in AI-optimized and automated ad placements, which the report says is “reshaping the entire media business model.” (Hopefully, for the better.)

But Wait! There’s More

Polite users who thank ChatGPT for its responses might be costing OpenAI tens of millions of dollars. [Tech Radar]

Similarly, does using too much corporate jargon cost marketers money, too? [Adweek]

Shein and Temu are officially planning to raise prices on US consumers. [TechCrunch]

Wikipedia makes a data set available to AI companies to keep them from scraping the platform. [Fortune]

New Jersey’s attorney general sues Discord for allegedly failing to protect users under 13. [Wired]

Jimmy Fallon is set to host a new competition reality show for NBC in which marketers design real-world ad campaigns. [The Hollywood Reporter]

You’re Hired!

Havas Media Network elevates Jon Waite to global head of planning. [post]