Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

You, Me And UID2

Although more state and international privacy laws are classifying IP addresses as personal information, smart TV makers with ad businesses still haven’t announced plans to block or obfuscate them.

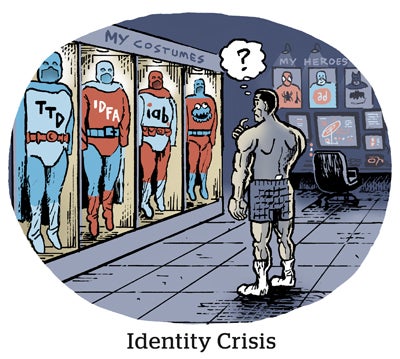

Like digital publishers, however, smart TV companies are now testing alternative identifiers to lessen their reliance on the IP address, says Paul Gubbins, a former VP at video-focused ad server Publica, in an explainer video he shared on X.

Gubbins highlighted three popular alt IDs: ID5, Yahoo’s ConnectID and The Trade Desk’s UID 2.0.

Now that major streaming publishers and distributors are adopting UID2, smart TV makers are following suit, Gubbins said.

Speaking of, on Thursday, LG Ad Solutions announced a new integration with UID2 that will allow advertisers to match their own first-party data with that of LG.

Fubo, meanwhile, became the first streaming publisher to adopt UID2 in 2021, followed shortly thereafter by Fox-owned Tubi and Disney.

If UID2 continues to scale on the sell side, more advertisers and media buyers will likely consider testing it themselves.

Pod Numbers

The IAB released its state of podcast advertising report to coincide with Thursday’s Podcast Upfronts – and it looks like 2023 wasn’t a great year for podcasters.

Total US ad spend on podcasts was $1.9 billion last year, up 5% compared to 2022. But that growth rate is disappointing considering podcast revenue had been growing by double digits since 2015. It grew a whopping 72% in 2021 – when the market eclipsed $1 billion for the first time – and by 26% in 2022.

Podcasting also lagged behind overall digital advertising revenue, which grew 7.3% last year.

Why the slowdown? The IAB blames a relatively soft ad market and says losses among mid-tier podcasting companies offset double-digit gains by the larger platforms.

The IAB also noted an interesting spending trend: Q4’s share of podcast revenue is mostly flat, dropping a smidge from 35% in 2020 to 30% last year. The IAB says this is in line with its prediction that 2023 podcasting revenue would shift from direct response to brand awareness campaigns, with direct response tending to be more common in Q4.

Looking ahead to this year, the IAB forecasts 12% revenue growth, bringing the total podcast market size above $2 billion.

Streaming Woes

This week, Warner Bros. Discovery unveiled a new bundle with Max, Disney+ and Hulu. The bundle will launch in the US over the summer.

The goal is to reduce subscriber churn, which is still not as low as WBD would like, according to CEO David Zaslav.

But it’s unlikely this bundle will help either WBD or Disney reduce churn, writes media professor Evan Shapiro on LinkedIn.

Programmers are laser focused on distribution and scale, but if consumers aren’t already engaged with at least one service in a bundle, it’s unlikely they’ll be incentivized to act on a bundle deal. According to Shapiro’s math, based on research from Antenna, only roughly 58% of Disney+ subscribers globally use the service at least once a month, while roughly two-thirds of Max accounts are inactive (as in not active at least once a month). This calculation includes both ad-free and ad-supported accounts.

Inactivity is one of the main reasons why subscribers cancel their accounts, and a fancy new bundle deal isn’t going to change that, Shapiro writes.

Instead, programmers should prioritize raising engagement on their own platforms. One way to do that is to lower commercial ad loads by introducing more noninterruptive ad units.

But Wait, There’s More!

The judge presiding over Epic Games v. Apple thinks Apple is being shady about how it displays buttons and links in its App Store. [The Verge]

Agency execs are uncertain about the longevity of the agency-holding group model. [Digiday]

What up-and-coming media buyers want to change about the TV and video ad buying landscape. [Ad Age]

Vizio touts year-over-year growth in average revenue per users thanks to advertising. [release]