There are a great many things to be learned when making the jump from regional favorite to national brand.

Just ask Dawn Brodehl, Tillamook’s manager of omni-shopper marketing. She joined the dairy company almost five years ago and has seen it outgrow its roots in the Pacific northwest while becoming a nationwide grocery brand.

“There were some lessons early on,” she told AdExchanger.

For one thing, did you know that ice cream and dairy products often explode when they’re shipped over the Rocky Mountains?

Tillamook is developing a new facility in Decatur, Illinois, she said, where ice cream and other products can be manufactured and shipped from east of the mountain range.

Back to data-driven

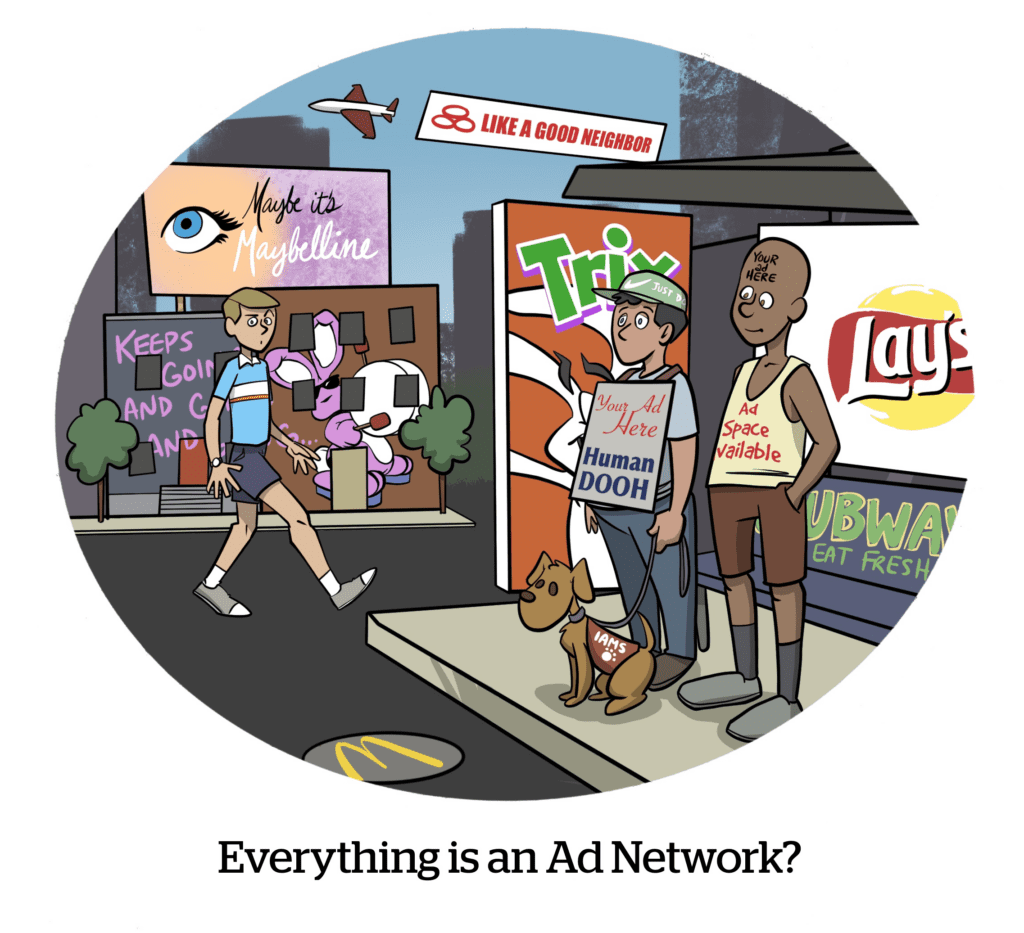

Aside from building new facilities east of the Rockies, Tillamook has had to navigate the vast complications of the growing retail media market.

Like so much ice cream flying over the mountains, the number of retailers and plug-in retail media networks has exploded. Each grocery chain Tillamook sells through has its own RMN, Brodehl said, with the exception of Publix (which uses Instacart’s ad tech).

“And every retail network is at a different stage of its development,” she added.

Plus, each network uses different metrics to attribute conversions and often different attribution windows. “Everything isn’t always apples to apples,” she said, even with a single retailer evaluating its own campaigns year over year. And these networks are in such a state of flux that the inventory supply, ad formats and how the retailer attributes conversions may be fundamentally different than one year ago.

The benefit of RMNs, she said, is that there is closed-loop reporting. Disentangling that data from the campaign report may be difficult, but when push comes to shove, the company at least knows if it’s selling products in a certain store. Although the data can be deceptive.

“I have a love-hate relationship with add-to-cart, to be honest,” Brodehl offered as one example.

The add-to-cart metric is considered a lock in retail media and can trigger waves of retargeting because it’s such a strong indicator of a near conversion. But that also means an organic sale might be attributed to paid media.

Given these complications, it’s hard for marketers to find a “common denominator” metric to use as a benchmark across RMNs, Brodehl said, at least not until there’s a wider adoption of retail media standards.

For Tillamook, a key internal metric is targeting new households – part of its expansion into new states.

This is also why it’s important to have trusted vendors with the RMN business, according to Brodehl. Tillamook works with The Trade Desk and Chicory, among others, she said. And while retailers are adept at analyzing or retargeting their own shoppers and attributing a sale, they are bound by their first-party data. But a vendor like a Chicory is a compliment to that, she said, because it can explicitly target audiences that aren’t part of the retailer’s network, thus widening the net for Tillamook.

The shopper focus

Brodehl is part of Tillamook’s shopper marketing team. She’s assigned to specific retail chains and is tasked with driving conversions in those locations. Overall brand-building or social media marketing are managed by different teams.

There is a convergence of the groups, though, she said.

For example, Chicory is an RMN vendor for shopper marketing, but it increasingly overlaps with social media. There are now affiliate or RMN partnerships aimed at using social media posts to generate a grocery purchase or add-to-cart.

Meanwhile, the Tillamook brand team uses The Trade Desk, but sometimes those placements also lead to direct online grocery purchases, à la shopper marketing.

However, there are still fundamental differences between the different marketing segments, despite the increased overlap.

“In my world,” Brodehl said, referring to the shopper marketing group, “my customer is the retailer, and my consumer is our shopper.” But, for the Tillamook brand marketer who sits on the TTD account, the individual shopper is the customer, not the retailer itself.

The shopper marketing group team also has different ways of capitalizing on the fact that Tillamook is a premium brand, she said. One particular focus right now is to integrate the brand’s dairy items directly into popular recipe destinations. Chefs, cooking magazines or recipe influencers tend to use better products and ingredients, because they make the dish look and taste better.

Tillamook wants to be a part of that moment of recipe inspiration “so consumers make this recipe with the quality that the publisher intended, versus trading down to a store brand,” she said.

So try the good dairy products, people. The kind that explode when they travel over mountains.