The Thanksgiving to Cyber Monday online shopping bonanza was in full effect this year.

But it’s hard to make judgements about whether this season is helping buoy retailers and brands as in years past. (For shoppers, it’s a different matter).

Cyber Monday saw an ecommerce haul of $11.3 billion in US sales, according to data from Adobe, which tracks retailers and merchants that carry the Adobe Analytics tag. That was up almost 6% over last year and represented the largest-ever online shopping day in America, said Vivek Pandya, a lead analyst for Adobe Digital Insights.

Sounds great. Yet, these days, it’s getting harder to know what success looks like. For example, although overall revenue was up, it was on the basis of selling many more items at much steeper discounts. Promotional levels were double what retailers sold at last year.

“It was a much different time then,” Pandya said. “That makes it sound like it was so long ago, but it was just a year ago.”

Once upon a time, a steady upward growth trajectory in the total revenue number for the Thanksgiving shopping weekend would have been a sign that retailers are on the right path and that they should do more of whatever they’re doing.

Nowadays, though, there are more complicated factors at play making it difficult for retailers to interpret their results and understand what this year’s shopping patterns imply about next year – or if they’re completely irrelevant.

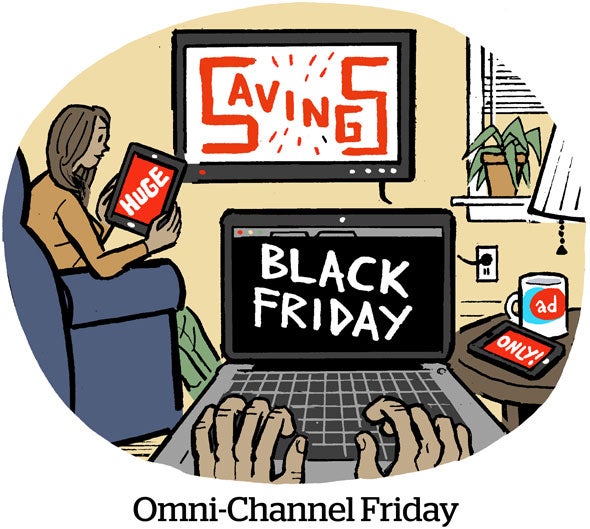

Mobile shopping, for instance, usurped the desktop web and was responsible for the majority of overall sales this year, Pandya said. While Cyber Monday still saw a majority of sales on PCs, that was likely because people were shopping during the workday.

It’s also becoming more difficult to figure out which channels shoppers are coming from.

For example, social media was a relatively lower driver of sales this year, leading to 5% of retail site and app purchases, compared to paid search (28%), affiliate (18%), organic direct traffic (18%) and email (17%).

But, Pandya said, social attribution is likely deflated because platforms, including Instagram and TikTok, have launched affiliate-style programs for creators in the past year, and that traffic is now falling under affiliate instead.

There were also fewer curbside pick-up and buy-online-pickup-in-store orders this year compared to the past couple seasons, according to the Adobe data.

“We attribute that largely to consumers feeling more confident that their online orders will come on time this year,” Pandya said.

With higher fulfillment costs (store pick-up is much more cost-effective for retailers than home delivery) and with very high discounts this year – more than twice the sales levels on average compared with last year – retailers might see big top-line sales numbers but still be hard pressed to achieve profitability on those sales.

Yes, large retailers can “promote their discounts pretty heavily,” Pandya said, but those ad costs also reduce the profit margin.

For that reason, retailers are sometimes a little reticent about how far to push discounts.

But in this type of competitive environment and an environment where consumers have more constrained budgets, discounts are an effective way to get people to spend with you rather than someone else, Pandya said.

“Then, once they’re in your consumer base off of that discounted initial purchase,” he said, “you can work on cross-selling and upselling to them, and really driving up that lifetime value.”