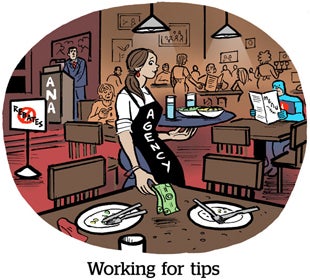

The Association of National Advertisers’ crusade for greater agency transparency entered phase two on Monday, when marketing analytics firm Ebiquity and its subsidiary, FirmDecisions, released an anticipated set of guidelines for advertisers on how to maintain transparent relationships with their agencies.

The Association of National Advertisers’ crusade for greater agency transparency entered phase two on Monday, when marketing analytics firm Ebiquity and its subsidiary, FirmDecisions, released an anticipated set of guidelines for advertisers on how to maintain transparent relationships with their agencies.

The overarching message: Agencies may have crossed a few lines, but the onus is on advertisers to take more control of and accountability for their media relationships.

To do so, advertisers will have to first turn inward and reevaluate how they govern their media partnerships, said Bill Bruno, CEO for Ebiquity North America.

“There are seven strategic pillars [in the report],” he said. “All of them are very important, but it starts with internal governance.”

While advertisers believe their agencies are obliged to act in their best interests, agencies largely see their duties within the scope of a contract.

Once marketers better understand how their agency relationships are structured, they should establish strict management principles. These include contracts with “robust provisions to deliver full transparency,” such as opt-in agreements on principal transactions, as well as “robust and far-reaching audit rights” that extend to any principals, subsidiaries or parent companies of the agency. Contracts should be reinforced by a uniform code of conduct signed by both parties.

The report includes a contract template, which it suggests be signed annually by the agency or holding company CFO. It does not mention how often agencies should audit their media partners, but Bruno said that will vary based on each relationship.

Advertisers are also advised to take ownership of their own data and technology, which many agencies currently manage for them.

If they are unable to manage these relationships, they should have “unimpeded access to the platforms, tools and data used on their behalf throughout the programmatic trading process … without having to get access or permission from the advertiser’s media agency or trading desk,” the report said.

Whether or not technology ownership will overburden marketers or accelerate the in-housing trend hasn’t yet been explored by the firm.

“Right now, the crux of this is that advertisers need to be able to make informed decisions, regardless of what path they take,” Bruno said. “The only way to create that is with the right level of governance, contractual terms and conditions.”

And it’s up to advertisers to make sure these contracts are being honored, Bruno said.

And it’s up to advertisers to make sure these contracts are being honored, Bruno said.

“Governance shouldn’t be a one-time thing,” he said. “It needs to be an ongoing process that’s reviewed continuously.”

But part of the problem lies in the overburdened role of the CMO, who has been pressured to take on more media and financial responsibilities in a rapidly changing landscape. The report notes “considerable media management deficiencies among marketers” that could have made room for the transparency issue to proliferate.

Advertisers must get up to speed by enrolling in continuous media education programs with an emphasis on digital media. They should also consider implementing a “chief media officer” with strong knowledge of the space in order to monitor agency relationships.

Unlike the previous report, Ebiquity’s guidelines recognize the pressure agencies have felt from shrinking fees and growing management responsibilities. It suggests that advertisers offer “more active stewardship of their media investments and fair compensation of their agency partners.”

Like its predecessor, this report did not mention names of specific agencies engaging in non-transparent buying practices.

That earlier ANA report, released in June in conjunction with investigative firm K2 Intelligence, found nontransparent buying practices to be “pervasive” among agencies. Fifty-nine out of 117 media buyers surveyed said they were directly involved in some sort of non-transparent buying practices. The report defines these as rebates (in the form of cash, free media, debt forgiveness and equity), principal-based transactions or agencies holding equity stakes in media suppliers.

“Advertisers have several things to do in-house around governance, internal training and really starting to try to keep up with a very difficult media landscape, but externally, they need to have the right amount of transparency and focus with their partners,” Bruno said. “It will start internally, and what will hopefully flow from that is a much more transparent and accountable industry.”