The Trade Desk continued its shaky 2025 earnings schedule when it reported Q2 results on Thursday.

The company made a total of $694 million in Q2, up from $585 million a year ago. Its net profit in the quarter rose from $85 million to $90 million in the same time.

However, investors were unmoved by the steady growth. The Trade Desk’s growth rate, after all, dropped from 26% to 19%. So even though TTD is outgrowing the market and added more net revenue to its total than a year ago, investors don’t like the look of a fast-diminishing growth rate.

The Trade Desk’s net income margin decreased from 15% a year ago to 13% as of Thursday’s earnings.

The Trade Desk also announced some board table reshuffling. Alex Kayyal, a current board member and the principal investor at one of TTD’s early venture capital backers, will be the new CFO, replacing Laura Schenkein. Omar Tawakol, an ad tech veteran and the founder and CEO of Rembrand, an AI-generated creative and product placement startup, will join TTD’s board.

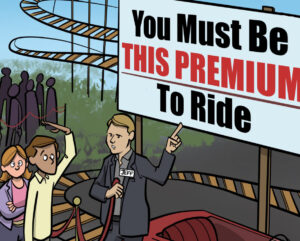

The walled garden dichotomy

Jeff Green, The Trade Desk’s founder and CEO, elaborated on the company’s frangible relationship with the walled garden giants.

On the one hand, The Trade Desk’s core value proposition is as a foil to the walled gardens. The premium internet, if you count streaming TV apps where someone longs in and watches content via the internet, not a cable cord, gets more overall attention than the biggest walled gardens. But the platform giants continue to earn more of the ad dollars.

“And the premium ad-supported internet performs better,” he said. He compared how people listen to their favorites podcasts, music, movies and shows on the open internet, where they’re more open to ad engagement and the ad placements have more effect. On YouTube, Green says, he, “like nearly everybody else,” has his finger hovering to skip ads, and those placements breeze by while leaving no lasting brand impact.

“I think it is only a matter of time,” he said, before more ad spend goes to the open internet than walled gardens.

But on the flip side, The Trade Desk is hardly a competitor to Google or Amazon at all, according to Green.

And Meta doesn’t have a DSP.

Google’s DSP spend across the open internet has diminished for years. In fact, Google and Facebook have “largely abandoned the open internet,” Green said.

And the Amazon DSP isn’t even a main priority for Amazon Advertising, he said. Amazon’s ad priorities are its sponsored product listings and Prime Video, just like Google’s priority is search and YouTube.

The “sliver” of Amazon DSP spend, which is already a sliver of Amazon’s ad revenue, that goes to the open web; Okay, The Trade Desk does compete with that, Green said.

Investors were not exactly sold. The walled gardens are earning the lion’s share and still growing their market control, noted one investor. Is The Trade Desk’s prospects really based on that trend reversing?

Relatedly, TTD shares dropped by about 25%-30% after the company released its earnings.

AI investments

It wouldn’t be an earnings report without some boastful AI investments.

Green said that Kokai, The Trade Desk’s main AI-based advertising vehicle, now accounts for 75% of all budgets on the platform. The Trade Desk “expects all clients” to be on Kokai by the end of the year.

Green also touted The Trade Desk as sitting atop “one of the most underappreciated data assets on the internet.”

The company conducts more transactions every 30 seconds than Mastercard and Visa do in a year combined, he said, and all of its data is geared toward advertising and identity.

That data, he added, “is now feeding an AI engine that helps the biggest buyers in the world sort out the most complex supply chain they’ve ever faced in advertising.”