Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Let’s Get Real

Last year, BeReal was flying high on organic growth. Apple named it “App of the Year,” a coveted title, because the prize is sweet, sweet App Store homepage visibility.

But can BeReal keep the magic alive long enough to, uhhh … start making money?

BeReal’s average active user count has halved from an average of 14.7 million last October to 7.7 million in February, based on Apptopia data.

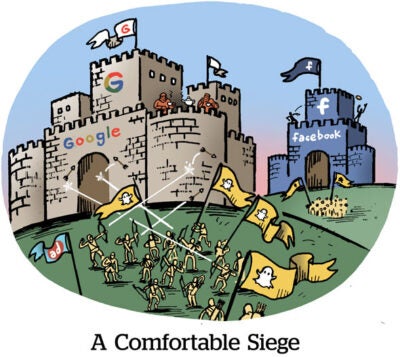

The problem for social apps – even verified hits – is that it’s extremely difficult to transition from popular to profitable (or even optimistically viable).

HQ Trivia, Vine, Clubhouse: These once-booming social nets were never able to make the leap.

But BeReal isn’t in that sad bucket just yet, nor is it in what Digiday dubs its “flop era.” It is, however, in a precarious position. Even mature players like Snapchat, Twitter and Pinterest haven’t figured out profitability after ATT set them way back.

Attracting traffic at global scale is expensive, so BeReal has its work cut out.

“Don’t get me wrong, we love to experiment and help our brands get extra share of voice,” says Tamara Littleton, CEO of agency The Social Element, “but we’re not rushing down this particular road with BeReal.”

Simpli Acquired

Ad tech consolidation nearly ground to a halt after the heady days of 2021. It was pretty much crickets on the M&A front last year.

But ad tech dealmaking can still get done despite – or perhaps in light of – the tricky economic environment.

Simpli.fi bucked the trend with its acquisition of CoreMedia late last January. And on Tuesday, it announced plans to acquire Bidtellect, a demand-side platform that focuses on contextual and native advertising. The deal price wasn’t disclosed.

Simpli.fi’s main offering is a DSP for local advertisers, although it’s been investing more in CTV recently (who hasn’t?), including releasing a tool that helps advertisers add incremental reach for campaigns via streaming households.

The Bidtellect deal will expand Simpli.fi’s platform with some new bells and whistles, and vice versa.

“This will allow us to bring new capabilities and services, like advanced CTV advertising, precision programmatic targeting and advertising automation, to our clients,” says Lon Otremba, Bidtellect’s CEO, in a release.

Simpli.fi was itself acquired in 2021 when Blackstone took a majority stake that valued the company at roughly $1.5 billion.

Truth In NAD-Vertising

The National Advertising Division of BBB Programs is a kind of “appellate court” for truth in advertising regulations. The NAD makes suggestions and recommendations, while the FTC is the one with real teeth.

But the NAD is setting bounds on new instances of potentially deceptive or unfair online advertising.

Last year, it suggested that certain emojis could constitute disparagement. For instance, if a beverage brand is barred from suggesting in a TV ad that its rival makes you sick, can it associate a rival with the nauseated emoji face? (Answer: Nope.)

Advertisers typically adhere to NAD’s recommendations – otherwise, the FTC may come a-knockin’.

For example, take the retailer Pier 1, which the NAD recently called out for its aggressive subscription sign-up practices. For US residents, the $10 monthly loyalty program was added to orders as a prechecked button when people created an online cart, without conspicuous-enough information about the auto-renewing payment.

The FTC, meanwhile, officially warned advertising and mar tech companies that it plans to enforce against them if they make unsubstantiated claims about their AI capabilities.

“One thing we know about hot marketing terms is that some advertisers won’t be able to stop themselves from overusing and abusing them,” Michael Atleson, an attorney with the FTC’s Division of Advertising Practices, wrote in a spicy little blog post.

But Wait, There’s More!

Axel Springer, a German publishing giant and major acquirer of news companies, will restructure its business with a focus on the US. [WSJ]

GroupM introduced a program to support reinvesting media budgets in credible news publishers. [release]

Oliver, the in-housing company that’s part of The Brandtech Group, launched a diversity-focused unit called InKroud. [MediaPost]

Warner Bros. Discovery sues Paramount for allegedly failing to deliver on streaming rights to “South Park” content. [Engadget]

You’re Hired!

The Guardian appoints Imogen Fox as its chief advertising officer. [release]