Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Slump Bump

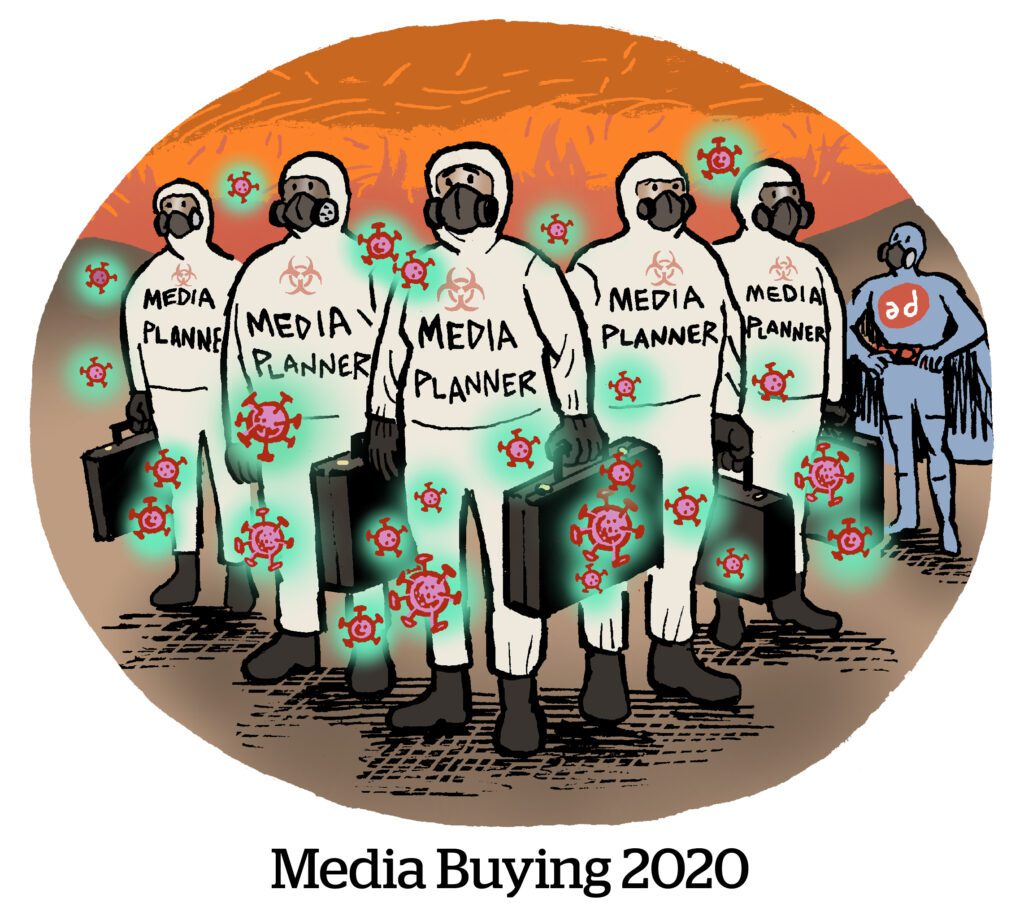

When the economy goes south, the ad industry goes south-er, writes Peter Kafka at Vox. It was true during the 2008 recession as well as in 2020, when the pandemic hit and businesses pulled the emergency break on ad budgets.

Now, ad-based companies are suffering at a disproportionate rate to the market (which is still way down over the past year).

Why is this happening? There are a bunch of reasons or, rather, hypotheses.

One is that advertising is a canary in the coal mine for broader market trends, and ad spend is already starting to drop. Another popular go-to is blaming Apple, particularly among media practitioners that were reeling from ATT even before the market crash was evident.

But the ad slump is also the result of a structural problem. It’s relatively quick and easy to redirect ad budgets if a business needs cash. Can’t do that with pensions, leases or manufacturing costs.

And then there’s this hard-cold fact: Yes, ad spend is down, but perhaps that’s just the market rationalizing after a crazy couple of years.

Seems Legit

Big free-to-use consumer tech platforms are suffering from fraudsters that co-opt their visual tools and cues designed to convey trust and legitimacy, often by combining efforts across multiple platforms.

One scheme involves using free Spotify and Apple Music accounts and free press wire services to procure a blue checkmark from Instagram. Other scammers use free IMDb accounts to write themselves into the cast lists of Bollywood films with small fake roles and then corroborate those “parts” with fake Spotify and YouTube accounts. The end result is that they get Google to provide a “Knowledge Box” on searches for their name.

The latest tactic comes courtesy of LinkedIn, where there are suddenly a large number of seemingly fake “Chief Information Security Officer” roles. It’s not clear what purpose this scam serves, but it sure is shady.

LinkedIn could address the issue by placing a public date verification that shows when an account was created so people can see if it’s suspiciously new, writes security researcher Brian Krebs.

Twitter includes an account creation timestamp, which helps root out new-spun created bot accounts. But the prevalence of bot accounts is far from a solved problem. Fraudsters have been known to hack, buy or just wait to take over blue-check verified accounts, then use that symbol of legitimacy to sucker other accounts by DM.

The Tube Tithe

YouTube just launched a new subscription option for YouTube TV that allows users to purchase subscriptions to specific networks rather than pay a hefty lump sum every month for the whole package.

Subscribers can switch from YouTube TV’s basic plan, which includes 85 channels at a whopping $64.99 a month, to YouTube’s new “add-on only” plan, which lets users mix and match only the networks they want and pay a lower price accordingly.

The “add-on only” plan offers 20 TV networks, including Starz, Showtime and HBO Max.

The new plan brings YouTube TV closer to emulating streaming content aggregator services like Apple TV, Amazon Fire TV and Roku, TechCrunch reports.

The move makes sense from a monetization standpoint. A lower-priced offering will help YouTube grow its subscriber base and pull in a percentage of streaming ad revenue from its content partners for itself.

But why would media owners participate? It’s all about converting viewers into subs.

Before, programmers weren’t paying to push viewers to subscribe to YouTube TV. That was Google’s job. But now that there’s a conversion event to target and add potential subscribers on the table, programmers will promote YouTube TV subscriptions in an attempt to drive up their own conversions.

But Wait, There’s More!

Google Ventures shelves its algorithm for identifying promising new startups to invest in. [Axios]

FullThrottle touts a new way to generate first-party data without privacy-compliance issues. [Digiday]

BrandTotal and Meta resolved a two-year battle over data-scraping, with BrandTotal paying a “significant financial sum” and deleting browser extension info. [MediaPost]

Netflix’s plans to restrict password sharing face more criticism. [Techdirt]

Mark Zuckerberg freezes hiring at Facebook-parent Meta. [WSJ]