“The Sell Sider” is a column written by the sell side of the digital media community.

“The Sell Sider” is a column written by the sell side of the digital media community.

Today’s column is written by Gabe Bender, product strategy lead at Sharethrough.

Although programmatic advertising is approaching critical mass, the industry has failed to standardize auction pricing, and the debate continues over hard-price floors, soft-price floors and everything in between.

Dynamic price floors are widely considered to be the answer to this problem, but without standards, they further complicate the matter. As the industry matures and faces greater regulation, we must come together and agree on a transparent, mutually beneficial model for making dynamic price floors an industry standard.

The Problem

Among most supply-side platforms and exchanges, second-price auctions, where the winning bid pays one cent more than the second highest bidder, are generally accepted as the most effective auction format.

While some have contested its benefits, second-price auctions are more widely preferred because they encourage buyers to bid the exact value they think the impression is worth and they provide buyers with incremental value, as they end up paying a discount on what they were willing to pay. Second-price auctions also benefit publishers by allowing buyers to bid more aggressively, ultimately driving up prices in the auction.

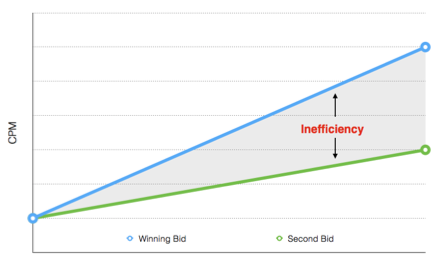

Second-price auctions do, however, perpetuate price inefficiencies by creating large gaps between the buyer’s winning bid and the price they actually pay. In some instances, gaps as high as 70% have been found between the first- and second-price bid. A lack of competition for each impression – also known as low bid density – further exacerbates the issue, causing most impressions to clear at the floor.

Herein lies the crux of the issue: Second-price auctions work, but retain a central inefficiency that needs to be addressed.

The Band-Aid

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

Most exchanges have responded with a range of tactics to reduce this inefficiency, claiming to offer sophisticated dynamic price floors. In reality, these platforms resort to soft price floors, phantom bidders, buyer discrimination or some mix of the above, none of which are particularly effective. These opaque solutions end up resembling first-price auctions, jeopardizing the trust of both buyers and sellers. Demand-side platforms (DSPs) then respond by sometimes contractually prohibiting such practices.

The data imbalance between buyers and sellers adds salt to the wound. On the buy side, DSPs are employing vast amounts of data and custom algorithms to make bidding decisions on a per-impression basis. Sellers need a mechanism to level the playing field, a system that enables them to use data to protect the value of their inventory. This system should not come at the expense of buyers, but should reinforce a level of transparency benefiting all marketplace participants.

The Solution

Exchanges have access to a wealth of data detailing the intricacies of every auction. Using this data, exchanges can algorithmically derive a fair market value of each impression based specifically on sell-side attributes.

A sell-side attribute is defined as any variable specific to the publisher or user, including URL, placement, time of day, geography, device or user session, to name a few. In contrast, a buy-side attribute is any variable specific to the buyer: DSP, Seat ID, advertiser, bid price, bid volume or bid variance.

Once the exchange has determined an impression’s fair market value based solely on sell-side attributes, it could then pass that value as the price floor in the bid request using OpenRTB protocol.

In keeping these attributes specific to the sell side, exchanges avoid buyer discrimination and other unsustainable auction manipulations. Further, in passing the derived value as the price floor in the bid request, buyers are able to respond according to their own data and algorithms, without questioning whether they are facing different price floors than their competitors – a win for transparency.

As part of the standardization process, the industry should form an “OpenDPF” committee to specifically detail which attributes can and cannot be included in the exchange algorithm, in the same way the OpenRTB committee has detailed which attributes are to be passed in the bid request.

That being said, these restrictions are specific to exchange-wide dynamic price floors. If a publisher wishes to impose other restrictions or price floors based on their own criteria, they certainly have a right to price their inventory accordingly.

Creating a standard for dynamic price floors is a win for both buyers and sellers. It would reduce auction inefficiency while reinforcing buyer and seller trust.

Digital ad spend is expected to surpass television for the first time in 2016. In an industry rapidly turning mainstream, we must establish the proper infrastructure to foster a liquid, efficient and sustainable market that protects all parties involved.

Follow Sharethrough (@sharethrough) and AdExchanger (@adexchanger) on Twitter.