Although cookies will soon be off the menu and mobile identifiers are under fire, advertisers are taking their sweet time to cook up alternatives.

The ad industry has its reasons for procrastinating. Google’s decision to delay the deprecation of third-party cookies in Chrome until 2023, coupled with the continued availability of mobile ad IDs on Android, has been an invitation for advertisers to embrace the status quo.

Two-thirds of marketers say they’ve hit pause on actively transitioning from third-party identifiers, according to a new survey from Advertiser Perceptions, which polled 153 advertisers and agencies in the US between mid-November and mid-December 15 on their plans for identifying and measuring audiences in the wake of signal loss.

The first time Advertiser Perceptions did this study in May 2021, it was before the release of Apple’s AppTrackingTransparency framework and before Google had announced its third-party cookie deadline extension.

“There was a sense of urgency,” said John Bishop, a VP of business intelligence at Advertiser Perceptions.

This time around, most advertisers say they’re not rushing to replace third-party cookies or find alternative targeting methods for in-app environments.

But not everyone has their head buried in the sand.

Some advertisers are actively testing multiple replacement ID solutions from Google, Apple, LiveRamp, Yahoo and others.

And although third-party cookies remain the most popular method for targeting and measurement for now, a growing number of advertisers claim they’re abandoning using third-party cookies altogether.

Current state of measurement

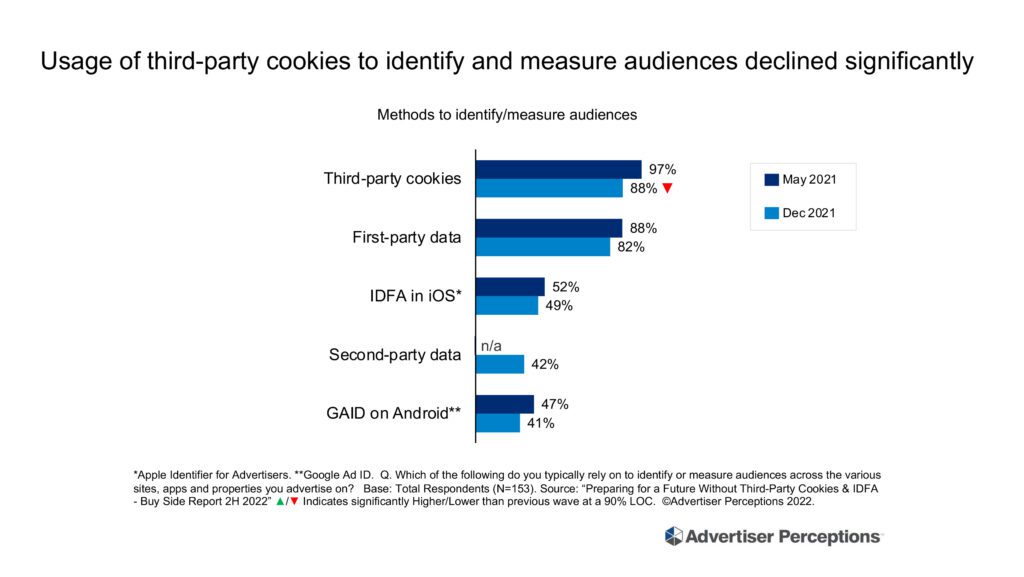

Eighty-eight percent of advertisers say they currently use third-party cookies – which is a heck of a lot. But that’s down from the 97% who reported using cookies the first time Advertiser Perceptions did this survey in May.

“Even though that is a statistically significant decrease, about nine in 10 are still using third-party cookies,” said Nicole Perrin, a VP of business intelligence at Advertiser Perceptions.

Still, a nearly 10-point drop over a six-month span in the number of advertisers that report relying on third-party cookies runs counter to the oft-repeated industry narrative that advertisers will remain all-in on cookies until they disappear from the bidstream, Perrin said.

“Cookies are still there, yet we are seeing a meaningful pullback in reliance on them,” she said.

From one perspective, the continued widespread use of cookie-based ID solutions suggests that advertisers are committed to the old ways of doing things. But it’s also likely some advertisers are testing the effectiveness of new ID solutions against the tried-and-true cookie, said Lauren Fisher, GM of business intelligence at Advertiser Perceptions.

First-party data was the second-most-popular mechanism to identify and measure audiences, right behind third-party cookies. Eighty-two percent of advertisers agreed they use first-party data like logins, email addresses and known user data. Forty-two percent reported using second-party data.

In a separate survey question, 70% of advertisers reported using their own first-party data.

(The discrepancy between those figures may reflect ambiguity as to what constitutes first-party data vs. second-party data. From an advertiser perspective, publisher first-party data would technically be second-party data, but some advertisers may still refer to it as first-party data.)

Over on mobile, nearly half (49%) are still using IDFA – when they can get consent, that is – and 41% are still using the Google Ad ID on Android, which continues to be available, at least for now. With the release of the Android Privacy Sandbox, the writing is on the wall for Google’s ad ID, and don’t be surprised if it is phased out within the next two years a la third-party cookies in Chrome.

Ad performance agita

Although advertisers are largely going about their business as usual, there is concern about the short- and long-term effects of signal loss.

Eighty-one percent of advertisers say they’re worried about how being unable to access third-party identifiers will affect their business.

Overall, advertisers predict the phaseout of third-party cookies will result in a 17% reduction in ad performance. Although that would be a significant drop, it’s a less pessimistic prediction than the 27% decrease in ad effectiveness respondents expected when Advertiser Perceptions did its poll in May.

Still, demand-side platforms should take notice.

Half of the advertisers Advertiser Perceptions spoke with said they would change DSP partners as a result of a 20% or higher drop in ad performance.

Opportunities

When asked to rank their top criteria for partnerships to address identifier phaseouts, advertisers cited interoperability, ease of implementation and technical support, in that order (although the percentage split between these was negligible).

DSPs with their own in-house ID solutions could stand to cash in.

Sixty-seven percent of respondents said they would shift some ad spend away from DSPs that don’t offer one-to-one targeting and toward DSPs that do – down from the 77% in May who said they would prioritize working with DSPs that offer one-to-one targeting.

Advertiser Perceptions tied that drop to the reemergence of contextual and the evolution of cohort-based solutions.

“Advertisers are still heavily invested in first-party data,” Fisher said, “but they’re also now migrating toward contextual and cohort-based, privacy-preserving approaches versus preserving one-to-one targeting and measurement.”