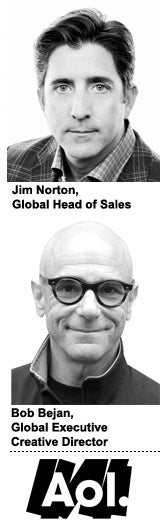

When AOL agreed in June to bring Microsoft’s sales organization into AOL, nearly doubling the amount of front-line salespeople to a total of 1,000, head of sales Jim Norton saw an opportunity.

When AOL agreed in June to bring Microsoft’s sales organization into AOL, nearly doubling the amount of front-line salespeople to a total of 1,000, head of sales Jim Norton saw an opportunity.

AOL knew there were a number of ways it could improve its sales force to better align with the organization’s structure: custom solutions on one end and tech-driven programmatic ones on the other.

Clients sometimes wanted aspects from both ends, and AOL needed specialist sales staff to close those complicated deals. Sales staff focused on just custom deals or just programmatic deals weren’t empowered to get deals done without outside help.

Norton compared this mistake – common among publishers – to a clown car: “Fifteen various AOLers would walk out of the car for a meeting with two people.”

Now that AOL is handling Microsoft inventory sales, Norton is putting more power in the hands of account leads.

“We’re trying to evolve that specialist model,” said Bob Bejan, who led Microsoft’s sales force and now heads up the premium end of the barbell as global executive creative director. “One of the things we learned at Microsoft and AOL is if you start building specialist teams, the sales organization atrophies and [doesn’t] become more than appointment bookkeepers.”

AOL worked to create opportunities for salespeople to have quick wins selling each other’s products. “In a sales organization, you need belief and momentum, and small victories create that belief,” Bejan said.

Additionally, clients had told Norton they wanted fewer partners – not a portfolio of content and technology partners. AOL consequently came up with the model of having a lead person and “solutions architects” to come in for unique, content-driven opportunities.

Bejan hopes to add clarity to AOL’s “vision of the barbell strategy,” as well as correct its weakness in premium offerings.

And now he’ll have a larger canvas of options to work with: AOL-owned properties like Huffington Post, an area with a strong branded content operation, as well as Microsoft-owned Xbox and Verizon’s new mobile video network G090.

Bejan and Norton are optimistic that the combined power of selling AOL and Microsoft will change the relationship buyers have with the two companies.

“We had a meeting with a client, where we moved from being off the strategic buy list to on,” Bejan said. (Both Microsoft and AOL had been off that buy list for the past two years.)

Bejan said clients want AOL-Microsoft to be an alternate to “the two huge gorillas,” Facebook and Google.

“But it would always come with a but,” Bejan continued. Hopefully, AOL and Microsoft fill each other’s respective weaknesses.

Microsoft, for instance, has a bigger international presence, experience developing custom content, especially around Xbox, and strong finance and entertainment content. On the other hand, AOL has a better tech stack and more video inventory.

AOL tended to focus on direct-to-client relationships, while Microsoft went through agencies. And it turned out there were many accounts where AOL was doing well and Microsoft poorly, and the reverse.

Together, they have a combined global reach of half a billion across mobile and desktop, not including Xbox or OTT.

These expanded buying opportunities, however, complicate the sales process. To streamline, AOL created a database of 1,000 different sales opportunities, representing every package and sponsorship opportunity across AOL and Microsoft.

The spreadsheet is a workaround to allow salespeople to quickly sell each other’s products. Next year, AOL anticipates a more complete systems integration that connects the AOL and Microsoft back ends.

AOL and Microsoft have also had to reconcile who leads accounts when both companies have a relationship with a client. The most important accounts retain both AOL and Microsoft sales teams. On others, a new seller may team up with an established one for the account.

There will be another integration ahead, after AOL closes its acquisition of mobile ad platform Millennial Media.

Thankfully for Norton and Bejan, AOL won’t have to worry about fitting in with its parent company. Verizon, which bought AOL in May, didn’t have an existing sales force that requires being stitched into this fold.