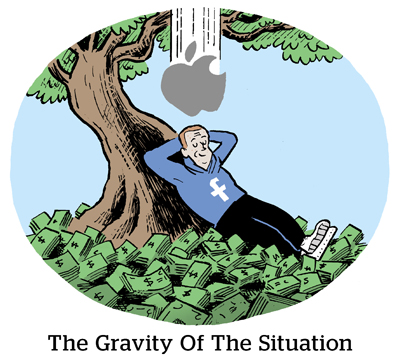

It’s been hard to rely on Meta’s measurement since Apple released its AppTrackingTransparency framework last year.

In September, pre-name-change Facebook alerted advertisers that Apple’s privacy changes were causing Facebook to undercount web conversions on iOS by around 15%.

At the time, Graham Mudd, Facebook’s VP of product marketing, acknowledged that the inability to target as precisely as before was driving up the cost of outcome-based campaigns on the platform, while at the same time it decreased the accuracy of its measurement.

Well, measurement accuracy is still down, but Meta says the investments it’s been making on aggregated measurement tools to address the problem are starting to bear some fruit.

In a blog post on Monday, Meta claims it’s been able to close its measurement gap by nearly half, from 15% to roughly 8%. In other words, only around 8% of iOS web conversions – aka platform campaigns that drive sales on the web, not Facebook-owned apps – are now going unreported.

Facebook reached its 8% estimate by using tactics like conversion modeling, then comparing the results to different conversion attribution types like last click, for instance.

New normal

But although it’s making progress, measurement on Meta is never going back to what it was.

“As we continue to build ad solutions that can do more with less data, we expect some level of underreporting will remain as part of our baseline,” Goksu Nebol-Perlman, Meta’s director of product marketing, noted in the blog post.

Gotta work with what you have, though. Facebook says it’s been able to claw back more accuracy in its measurement because advertisers are starting to more widely adopt products to deal with signal loss, including the Conversions API, which sends web events directly from the advertiser’s server to Facebook, so Facebook doesn’t need to rely on SDKs or site pixels.

On Meta’s Q4 2022 earnings call in early February, COO Sheryl Sandberg directly addressed efforts the company has been making “to improve things.” She pointed to progress in closing the underreporting gap for iOS web conversions and the introduction of tools like Aggregated Event Measurement, which limits the number of domains for conversion events that advertisers can use for campaign optimization.

Although Sandberg told investors these efforts should help “mitigate” matters, the overall targeting and measurement headwinds will continue to blow – and even “to moderately increase,” as Sandberg decorously put it – throughout the rest of the year from a combo platter of Apple’s changes and existing and coming regulation.

As was widely reported, Meta expects Apple’s privacy efforts on iOS 14.5 onward to decrease its revenue this year by $10 billion.

Burden of proof

And it’s a bitter pill when people are potentially converting – but you’re unable to measure that it’s happening.

Separate from Facebook’s challenge counting iOS web conversions, in August of last year a bug discovered in Facebook’s measurement system caused it to undercount app install campaigns coming in via SKAdNetwork on iOS 14. Turns out it’d been happening for nearly seven months. (SKAdNetwork is Apple’s privacy-centric API for app attribution.)

Although that issue only affected iPhone 12 owners using the Facebook app, it’s evidence that measurement on Facebook, once the easy onramp for ad dollars, suddenly needs to prove itself.

Ad buyers want demonstrable performance before they spend.

“Advertisers worry they’re not getting the ROI they’re actually getting,” Sandberg said on the Q4 call.