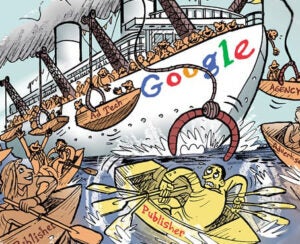

The ad industry is still smarting from last week’s news of a laissez-faire set of court-ordered remedies after Google was found guilty of operating a monopoly in the search ad market.

Well, the frustrated masses now have another reason to seethe.

Late Friday evening, Google filed its proposed remedies to its ad tech monopoly to District Court Judge Leonie Brinkema, and, unsurprisingly, they’re rather mild – and very different from what the Department of Justice is looking for.

The DOJ filed its remedy proposals earlier in the week last week.

Google’s filing sketches out a set of light penalties that would, if anything, represent a natural set of ongoing changes that are already happening. For example, Google, like a snake shedding its skin, would agree to pull back from ad serving specifically in the open web display ad market, which has already been shrinking within Google for three consecutive years.

The details

In its filing, Google is quick to point out that Judge Brinkema only found Google guilty of exercising a monopoly over two ad tech categories: the open web display publisher ad server market and an open web display ad exchange market.

“Nothing in this Final Judgment applies to AdSense, AdMob, Google Ads, DV360, or any other Google advertising technology tool besides Google Ad Manager, or applies to any inventory other than Open Web Display Inventory,” writes Google’s counsel, who also calls for no divestitures.

The DOJ doesn’t feel so limited. One of the first remedies it calls for is Google’s “obligation to divest AdX.” The DOJ also argues that a requirement to divest the rest of DoubleClick for Publishers [DFP] should be contingent on whether other remedies have alleviated the illegal monopoly.

[Editor’s note: For those who are separately interested in digging further into both filings, it can get confusing because the two sides often discuss Google’s many businesses using different terms. “AdX,” as cited by the DOJ, is now a nameless element of GAM. Likewise, the DOJ is calling for the divestiture of DFP, which was incorporated into GAM eight years ago.]

How would Google punish Google?

Publishers and advertisers don’t like Google grading its own homework. So what do they think of Google taking on the role of principal and punishment arbiter as well?

Some of Google’s remedy proposals underscore why publishers felt gaslit for so long. There may very well be some “Wait, this wasn’t allowed before?” responses.

One remedy proposed by Google would be that, within a year, publishers could use non-Google ad servers to access AdX demand or, at least, “access real-time bids from AdX in response.” The same goes for allowing a Prebid integration.

When non-Google ad servers are used, Google commits to not charging those publishers by allocating itself a greater revenue share of impressions, which has been its historical practice.

Publishers using the one-time DFP ad server would also be allowed to export their own ad server data via an API, and there would be no charge to do so.

Some of the potentially harsher penalties are also limited by the narrow definition of open-web display markets.

Google says it also won’t “reimplement either First Look or Last Look functionality within DFP or AdX with respect to Qualifying Open Web Display Inventory.”

Not that Google won’t continue to exercise its first look and last look advantages elsewhere, just not within its ad server or ad exchange when it comes to web banner ads.

Lastly, Unified Pricing Rules, one of the more flagrant examples of Google’s monopolistic actions in publisher ad tech, will be “deprecated and not reimplemented,” but also just for web display inventory.

The DOJ Side

Without getting too deep into the DOJ’s 61-page filing, one aspect to call out – aside from Google not once using the word “divest,” which the DOJ uses 44 times – is that the government proposes financial remuneration for publishers, as well as far greater service to publishers who are switching from Google, and to whichever theoretical company acquires its publisher ad tech.

The DOJ proposes that, starting from the beginning of Q2 this year, Google must set aside 50% of net revenues from the AdX and DFP businesses; the net revenue being profit, rather than total spend on the platform. This sum would go to publishers to defray switching costs and toward open-sourcing the administration of Google’s publisher auction logic, which is also part of the DOJ’s proposals. Any remainder once the businesses are divested or reduced to non-monopoly status would be deposited with the US Treasury. Cha-ching.

The required level of maintained customer service and cloud infrastructure support are also very different between the two sides.

For instance, while Google commits to allowing publishers to export ad server data, it says it will “publish sufficient documentation to reasonably enable Publisher Ad Servers to understand and import the data in provision.”

The DOJ, by contrast, envisions Google being required to provide more migration services, as well as to support cloud computing during a transition period.

And the DOJ also proposes a supervision period during which Google could not bundle or make contingent any parts of “DFP, AdX, Adwords, or DV360 or otherwise condition (in whole or in part) the sale or use of services from any of these products on the purchase or use of services from another of these products.”

Google’s counsel, however, expressly notes throughout its own filing that any restrictions on Adwords, DV360 and other non-GAM or non-web display inventory are outside the bounds of the court’s decision.

In other words, right now, the two sides seem irreconcilable – but, hey, there’s no need to compromise at this point and, also, the final remedies aren’t up to the DOJ or to Google.

Once the remedy phase of the trial – which begins on September 22 in Alexandria, Virginia – is over, Judge Brinkema will issue a new set of remedy proposals, this time stamped “it is hereby ORDERED, ADJUDGED, AND DECREED.”