WPP has bought InfoSum, a data clean room and collaboration startup.

Terms of the deal, announced on Thursday, were not disclosed.

This acquisition reunites InfoSum with Brian Lesser, its former CEO. InfoSum will sit within GroupM, now led by Lesser, who was chairman and CEO of InfoSum until he joined WPP in September.

This is not the first time Lesser has acquired a startup where he was previously a board member.

Lesser was formerly CEO of Xaxis, GroupM’s programmatic trading desk, where he was an advocate of AppNexus. He became an AppNexus board director in 2014 after WPP invested in the company.

Lesser left the AppNexus board when he was hired to run AT&T’s ad business in 2017 – and then promptly acquired AppNexus.

But back to the deal at hand.

WPP acquires InfoSum?!

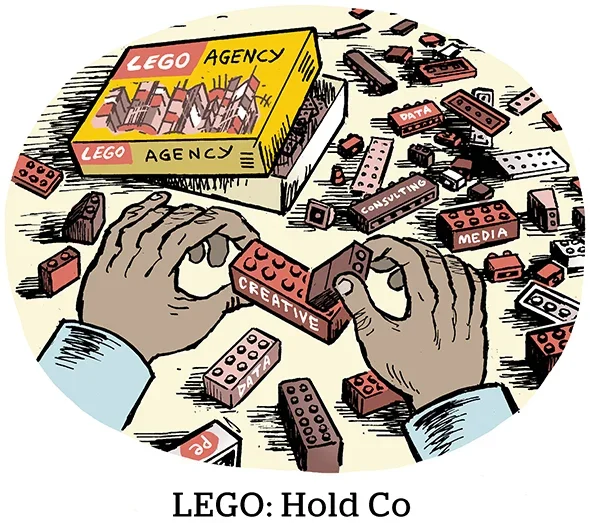

Not so long ago, a holding company buying a data clean room would have been surprising news.

For the past few years, however, there has been a growing trend of major agency holdcos buying data sellers, subscription software and ad tech businesses. Publicis is a prime example of the trend, having brought Epsilon, CitrusAd, Profitero and, most recently, Lotame under one roof.

Lotame is also an instructive case study for why an ad tech or mar tech company – or InfoSum in this case – might choose to join a huge agency. Lotame traditionally made its living on the sell side, working primarily with publishers, merchants and media companies. But over time, its revenue increasingly came from advertisers who connected their first-party data to publisher first-party data.

Now, as a tool being offered to Publicis clients, Lotame has access to a near-bottomless pool of advertisers.

Similarly, InfoSum CEO Lauren Wetzel, who will remain in the role within GroupM, told AdExchanger last year that agencies would become more important partners for data collaboration tech vendors.

Rather than having to win RFPs one by one as marketers decide to test clean rooms, vendors can take advantage of a large agency’s existing book of advertiser business. Wetzel also noted that agencies are often the ones that present and teach data collaboration tech to marketers, as opposed to the vendors themselves.

Media agency Canvas, which selected InfoSum as its first agency-wide data clean room partner early last year, opted for InfoSum because it’s more intuitive and less of a technical lift than Habu.

Habu, acquired by LiveRamp in 2024, is more of a data warehouse built for data analysts, Canvas SVP of Technology Kevin McEvilly told AdExchanger. The agency does work with Habu, too, he said, but the UI is built for data scientists, not marketers.

Independence day

Without getting sidetracked by talking about “Liberation Day” tariffs – InfoSum is based in the UK, and Trump just imposed 10% tariffs on all British imports to the US – the acquisition of InfoSum by WPP raises the ever-present and increasingly complicated question of whether it’s possible for ad tech companies to maintain their independence as part of another company.

From InfoSum’s perspective, as Wetzel previously put it to AdExchanger, independence for data collaboration providers isn’t just about whether they’re operated by players that also sell media and provide ad tech (namely, Google and Amazon). Vendors are also called into question when they connect data collaboration software to their own identity graphs and ID services. Think LiveRamp/Habu and Snowflake.

Habu, an ostensibly independent data collaboration vendor – and InfoSum’s main rival – is now perfectly placed to distribute LiveRamp’s RampID. Is Habu really not going to prefer the RampID?

On the flip side, an acquisition by an agency doesn’t mean InfoSum is necessarily incentivized to prefer a particular ad tech vendor or media provider. But it does create questions for a competitor to raise during a pitch.

Media agencies such as Canvas are choosing data collaboration vendors to help them as they transition to new cloud-based advertising solutions. If they’re choosing between InfoSum and Habu, for example, a preference for RampID may not matter as much as the fact that InfoSum now rolls up to GroupM.

InfoSum’s irreverent attacks on data brokers may fit comfortably within GroupM, though. Wetzel has roasted the idea of data collaboration tech that is also part of a data brokerage system that aggregates identity data signals from clients, anonymizes those signals and then resells or reuses them as audience IDs.

But the big data marketplaces that are connected to data collaboration tech now include Lotame (sorry, Publicis), LiveRamp (which acquired InfoSum’s main rival) and data brokerages Epsilon (Publicis again) and Acxiom (part of IPG).

In other words, WPP has a lot of new friends for InfoSum to play with in the form of enterprise brands – but it also has all the right enemies.