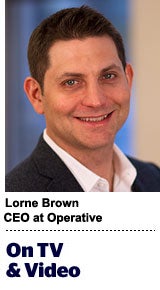

“On TV And Video” is a column exploring opportunities and challenges in programmatic TV and video.

“On TV And Video” is a column exploring opportunities and challenges in programmatic TV and video.

Today’s column is written by Lorne Brown, CEO at Operative.

I believe impressions will win over gross rating points (GRP) as digital and TV converge. Impressions are more granular, allow for better targeting and create better measurability.

But I think the real change is not simply a change of metric. It’s one of power and control in the advertising ecosystem and it’s driven by several factors, including consumer behavior, addressability and data.

Consumers use a lot of different screens, and they want to watch what they want to watch, when they want to watch it. Content providers are keen to meet consumer demand, but many of the middlemen in the TV market have created unfriendly environments. So the world has started to move around them.

By 2018, over-the-top (OTT) ad revenue is predicted to top $30 billion, according to the Diffusion Group. That’s more than half of today’s TV market.

So whether the TV establishment embraces the change quickly or not, innovators are growing quickly enough to force the change. As a result, every major player in TV has no choice but to plan for a future where consumers get what they want. Advertisers will expect content to be addressable, too. That means they will want more targeting and granular control over media buying than TV affords today.

In an addressable future, data is the currency. We can see everywhere the signs of data working its way into the TV market as cable companies amass the most powerful positions that they can. Many companies already allow for impression-based spot buying, and companies like Visible World provide some form of programmatic TV buying that allows for digital-style audience targeting.

As these programs grow, programmers need the data that the cable companies own, as well as the capabilities cable companies possess, such as video on demand and addressable insertion. Verizon’s acquisition of AOL is the result of the unbalance of those in the ecosystem who need and have data or content.

Advertisers Want ‘And’

While advertisers want to buy one audience (convergence), media companies must aggregate that audience across an array of channels and screens (divergence).

For advertisers to have it all, digital and linear addressable inventory will need to coexist with GRP-based inventory. Monday Night Football will be sold alongside an upfront sponsorship model and an impressions-based audience.

Advertisers want to reach their consumers on mobile AND tablet AND television.

They want shows AND targeting AND frequency capping.

Just because new ways to reach audiences are coming into existence doesn’t mean the old ways are out. Marketers want it all, and they want it optimized.

Cable media companies need to offer a single view of the consumer. The future of TV and video, at least from an advertising perspective, will end up looking like portfolio management, allowing publishers to market and sell an audience in a single transaction. Universal presentation of a media company’s supply will be key.

Change Is Inevitable

The infrastructure will not be easy to create, but it will get done.

As consolidation continues, media companies will partner with each other, whether it’s done opportunistically or as a last resort. It’s possible that in the future there will only be 50 media companies that participate in cable-packaged bundles, the big ones having absorbed the smaller ones that can’t keep up or don’t fit in. Linear will become addressable in order to stay competitive.

But there will always be a new innovation that those in the market will add to their portfolios. Coexistence is key. One proposal, IO and invoice will create a single yield curve that incorporates all available inventory and matches impressions with buyer types. The mature publishers that are able to make this all work without killing business profits will be the ones left standing.

Follow Operative (@Operative) and AdExchanger (@adexchanger) on Twitter.