Despite the recent flurry of mobile acquisitions, marketers are still somewhat in the dark when it comes to defining objectives for their mobile campaigns and deploying analytics tools to help them measure cross-channel reach, one study suggests.

Despite the recent flurry of mobile acquisitions, marketers are still somewhat in the dark when it comes to defining objectives for their mobile campaigns and deploying analytics tools to help them measure cross-channel reach, one study suggests.

In a survey of agencies, vendors and 228 marketing professionals, the study by Forrester Research determined that 37% of marketers do not have defined mobile objectives and, of those that do, mobile is viewed namely as a vehicle for customer engagement and satisfaction. According to the “Make the Most Of Analytics To Meet Your Mobile Objectives” report, 39% of marketers say they do not track mobile users across multiple channels.

“What surprised me the most is marketers’ inability to prepare for the mobile mind shift,” commented Thomas Husson, VP and principal analyst at Forrester and lead author of the report. “They know mobile is strategic, but a good chunk neither define mobile objectives [nor] have implemented mobile analytics tools.”

Mobile consolidation has begun with moves such as Criteo’s acquisition of AD-X Tracking, Amobee’s purchase of Gradient X and Twitter’s buy of MoPub.

And yet, says Husson, “[m]obile is still a fragmented space with a lot of innovative new entrants and, at the same time, mobile is starting to be integrated into the mobile [marketing] mix, so we should be seeing more of these acquisitions from more established players like Criteo.”

Less than half, or 49%, of marketers have implemented a mobile analytics solution. Marketers are more advanced at this point in deploying traditional Web analytics, but are still fairly nascent in monitoring activity on mobile apps.

For marketers to advance, Forrester notes the importance of defining precise metrics that will be tracked to indicate progress and to match the metrics to clearly defined objectives. It’s also vital to use the right tool for the defined objective.

As more analytics players eye attribution modeling as a way to tackle cross-channel users, “it requires [companies to move from] a channel to a customer-centric vision,” Husson noted. “It implies a different perspective [from] the organization to move away from siloes.”

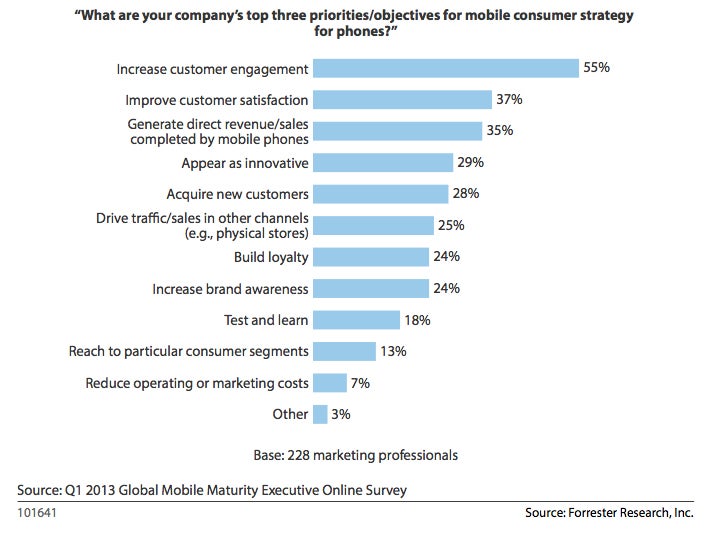

At present, 55% of marketers view mobile as a channel to increase customer engagement while 37% see it as a way to improve customer satisfaction and 35% see it as a way to generate direct sales and revenue. Only 13% reported mobile as a means to reach particular consumer segments.

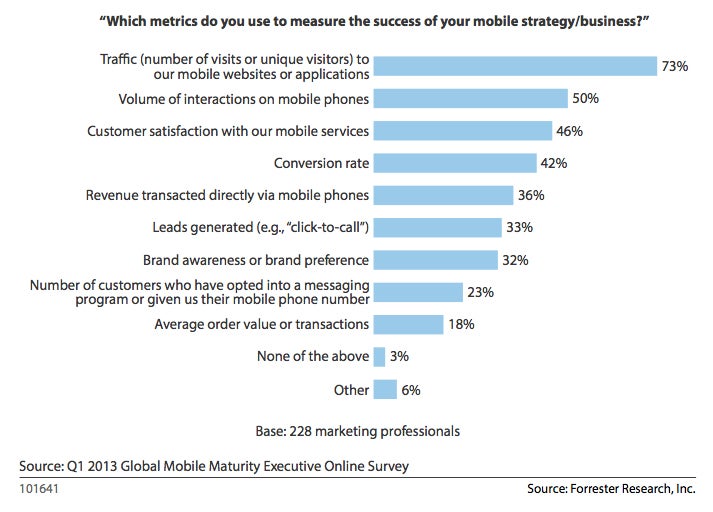

In terms of the metrics marketers use to measure the success of their mobile strategies, 73% look at overall traffic, such as the number of visits or unique visitors to mobile sites or apps. Fifty percent look at the volume of interactions while 46% measure customer satisfaction of mobile services.