Video buyers see a future where they can bundle new-wave TV ad inventory – including VOD and connected TV – with linear television buys.

Video buyers see a future where they can bundle new-wave TV ad inventory – including VOD and connected TV – with linear television buys.

But the “CTV” impression pool is still too shallow for many agencies and brands to bother.

“We’re not going to scrape for impressions on some new 5 million-subscriber video startup,” said David Campanelli, SVP and director of national broadcast at Horizon Media. He added, “But as Nielsen starts to measure over-the-top (OTT), our linear buy will partially be VOD, digital and connected TV.”

The crop of new streaming services that emerged in 2015 easily consists of more than a dozen players, including AOL/Verizon’s Go90, Comcast’s Watchable, DISH’s Sling and NBCUniversal’s forthcoming comedy-oriented SeeSo, which will debut this month at CES.

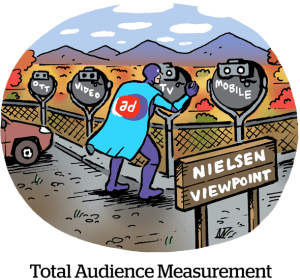

All these platforms require accurate third-party measurement, and Nielsen is trying to meet that demand through its ongoing development of a Total Audience Measurement system.

The TAM methodology will incorporate viewing on both traditional TV and digital/VOD. Some streaming video clients, such as CBS All Access, are already using it to track tune-in across digital and mobile.

But the sheer number of these offerings, and their relatively small subscriber bases, can discourage media buyers. Some liken the streaming frenzy to perpetual shiny toy syndrome.

“Fragmentation and tracking is the big issue,” added Rob Griffin, EVP of media futures and innovation at Havas. “Overall, it’s about optimizing the viewing experience. I wouldn’t watch my favorite shows if I couldn’t use my DVR and fast-forward the commercials.”

There’s also some semantic confusion as the CTV space matures. A lot of sellers talk about buying “Roku” inventory, but Roku is primarily the platform/operating system – not the end supply source.

“That’s like saying you should buy Comcast or Cablevision,” Campanelli added. “We don’t buy Comcast or Cablevision. We buy A&E, which is distributed on Comcast and Cablevision, the same way it is eventually distributed on Apple TV, Roku or Sling TV.”

Buyers recognize there’s value in buying high-indexing audiences for a show like “Modern Family” across OTT, linear and digital properties. But getting a complete audience picture is not possible through current means of measurement, and targeting is nascent.

“There are some device IDs and maps where we can layer in data, but targeting is really difficult and really doesn’t exist yet,” said Christina Beaumier, an SVP of product at GroupM’s Xaxis. “Same thing with scale. There’s not a lot of it today, but will we get there? With roll-outs like Apple TV, eventually that’s a lot more inventory that’s accessible to us.”

“There are some device IDs and maps where we can layer in data, but targeting is really difficult and really doesn’t exist yet,” said Christina Beaumier, an SVP of product at GroupM’s Xaxis. “Same thing with scale. There’s not a lot of it today, but will we get there? With roll-outs like Apple TV, eventually that’s a lot more inventory that’s accessible to us.”

Ashwin Navin, CEO of the IPG-backed TV data and analytics platform Samba TV, called connected and addressable TV a catalyst for broader “programmatic TV” executions that can include linear broadcast media.

Because connected TV generally mimics a digital buy, digital buyers averse to the vocab of traditional TV buying – things like upfront and scatter market commitments – see it as a way to broaden their TV impression pool. Plus, many VOD environments offer non-skippable ads, which some advertisers, as Griffin pointed out, like.

“CTV and addressable TV may be the way buyers automatically add reach to the equation, because active CTV users are probably cord-cutters and probably not using cable services in the first place,” Navin said. “The big problem with programmatic TV in linear is its reach and that the entire infrastructure hasn’t been upgraded yet.”

In that sense, connected and linear TV serve as an informal measuring stick for the two forms of buys.

“If you’ve got a programmatic TV strategy built around cable, you still need to hit the audience that doesn’t use cable to add incremental reach,” Navin explained. “The combination of CTV and linear/addressable is additive and will help de-duplicate those audiences further.”