When it comes to shopping ads, it’s not all about Google anymore.

When it comes to shopping ads, it’s not all about Google anymore.

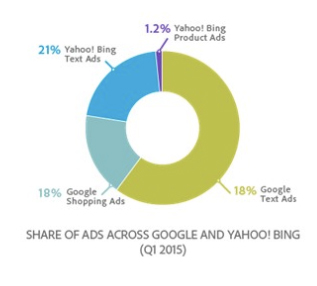

While Q1 US spend for Google Shopping Ads (formerly Product Listing Ads) was up 37% year over year, Bing/Yahoo is starting to encroach on Google, at least in the United States, where spend increased 72% last quarter, according to the Adobe Digital Index Q1 Advertising Benchmark, released Wednesday.

The sample, based on Adobe Media Optimizer data, represents 525 billion Google and Bing ad impressions and 490 billion Facebook impressions.

“In the past, we’ve noted higher conversion rates and average order value with Bing/Yahoo, but there wasn’t enough traffic, so marketers just didn’t invest there,” said Tamara Gaffney, principal analyst for Adobe Digital Index.

“In the past, it used to be, ‘We need more traffic, let’s throw money at Google,’ but now we’re seeing this shift where they’re saying, ‘Let’s invest in programmatic technology and create automated buying schedules to figure out where we’ll get the most return.’”

Although it’s too early to tell how Facebook’s product ads will compete in the race dominated by Google (it’s estimated Shopping Ads are an $8 billion business) with spend on product ads starting to grow in influence on Bing, marketers generally favor image-based ads over text ads when it comes to driving engagement.

Although it’s too early to tell how Facebook’s product ads will compete in the race dominated by Google (it’s estimated Shopping Ads are an $8 billion business) with spend on product ads starting to grow in influence on Bing, marketers generally favor image-based ads over text ads when it comes to driving engagement.

However, there are challenges all three must overcome in order to foster long-term success with these formats, Gaffney added. Although each platform optimizes for price, there needs to be tighter integration to retailers’ back-end systems to ensure product availability and proper creative.

Pay (And Stream) For Play

Shopping ads held steady last quarter despite standard holiday spikes and, in addition, several social formats surged in marketer interest. Little surprise – Facebook’s organic reach was down 35% year over year while paid impressions went up 8% as the social platform pursues deeper monetization.

“We wanted to look at how these changes in Facebook are impacting industries, which is data we had not pulled before,” Gaffney said. “We found the ones most [negatively] impacted [by organic declines] were travel businesses while retail was less impacted. With retail, we’ve seen [marketers look for new] ways to acquire users to their site, so it’s possible retailers have adjusted faster to algorithm changes than other industries” or have been swift to adopt Facebook’s aforementioned product ads.

Although Gaffney said she predicts Facebook’s overall paid social dominance will persist, that doesn’t mean marketers won’t test-drive new formats, particularly since Adobe’s data showed declines in interaction rates among standard text-based posts on Facebook mainly due to algorithmic changes (links fared far better).

In addition to Facebook and Twitter’s investment in auto- and click-to-play video ad formats, Adobe data showed consumers are engaging with brands on live-streaming video apps Meerkat and Periscope, which portends future experimentation with newer, niche social platforms, Gaffney said.

Parsing 2 million social app mentions for Periscope and Meerkat through Adobe Social, the index found Meerkat clocked the most overall usage since the beginning of March while Periscope clinched the highest daily average use over the last 14 days. The index predicted Periscope will edge out Meerkat in Q3.

“It’s kind of proven that Periscope was under the radar in production for a lot longer, but that doesn’t Meerkat can’t respond fairly quickly,” Gaffney said. “As a marketer, this is the perfect use case for how you could get a large following just by letting people watch you play a video game, comment on it and integrate sponsorships or product placements in the process.”