Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

An Agent Of Chaos

In developer toolkits and technical forums like the W3C, the term “user agent” means an individual using a web browser. That notion of a user agent is a “holdover from a more civilized age,” when technology was developed to serve individual users and customers, writes Cory Doctorow at the blog Pluralistic.

For the most part, browser operators and consumer tech companies that should offer true user agents have abandoned that philosophy. Instead, the “user agent” is a product beholden to the business and its bottom line.

There are real examples of the user agent philosophy. It’s not uncommon for a browser to warn users that a site is considered insecure and prompt them to click again to load the page.

But too often now services that should be “user agents” are for-profit trojan horses. Voice assistants and home smart speakers are agents of a business, not of the person or household.

In-app browsers are downright traitors that trick people into using a clone of their browser that’s stripped of privacy protections.

“A ‘faithless’ user agent is utterly different from a ‘clumsy’ user agent, and faithless user agents have become the norm.”

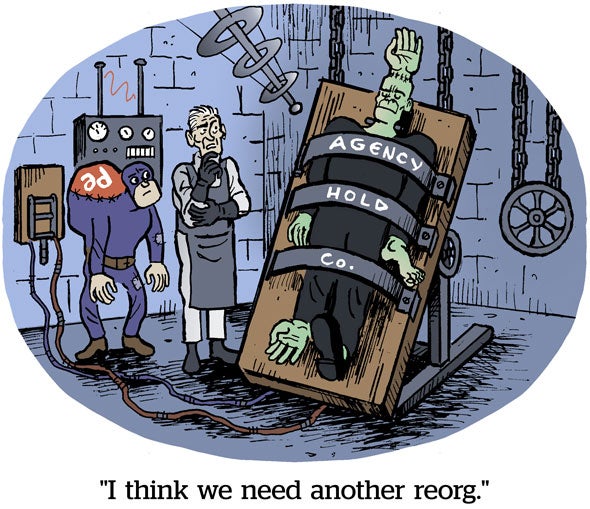

On Principal

Does the term principal-based buying ring a bell?

It’s akin to media arbitrage, but it flies more under the radar.

Media buying agencies are reselling inventory to their advertisers at marked-up rates; and most marketers don’t know it’s happening, Ad Age reports. These markups are usually hidden in the fine print of agency contracts, often buried in a “bucket of non-transparent services,” says Keri Bruce, a partner at the law firm Reed Smith.

Principal-based buying caused controversy nearly 10 years ago. Marketers discovered they were paying huge markups when they bought programmatic through agency trading desks (Xaxis was a $1 billion business at its peak), in addition to a host of other hidden fees and nontransparency practices that juiced agency holding company bottom lines. And many contracts were razed during the process.

Marketers aren’t necessarily against publishers and sell-side companies offering incentives or kickbacks to buyers. They just think the advertiser itself should get the ad credits, not the agency.

So, while agency take rates may seem low, many agencies are really arbitraging media at a markup and pocketing the difference.

Most major holding companies still run principal trading operations, and there are signs that this practice is increasing again, according to Ad Age.

So add ad agencies to the list of players gobbling up a hidden percentage of marketers’ media spend – across programmatic and everything else.

Injured List

What went wrong at BuzzFeed?

Since going public in late 2021, BuzzFeed’s share price plummeted from nearly $40 at its peak to between $1 and $2.

CEO Jonah Peretti regrets the ill-fated acquisition of Complex, The Information reports. That deal was part of what now clearly seems a misguided effort by BuzzFeed to buy its way to scale that might match platform giants like Google and Meta.

Multiple former BuzzFeed executives echoed Peretti’s assessment.

The Complex acquisition was doomed because it didn’t fit BuzzFeed’s audience or editorial style, according to The Information’s sources.

Plus, combining BuzzFeed and Complex’s ad sales teams under one unified vision was like mixing oil and water. The Complex team felt BuzzFeed’s brand was outdated and uncool, and its salespeople were hesitant to pitch advertisers on cross-brand activations.

The merger and IPO also came just in time for the great ad spend pullback of 2022.

BuzzFeed sold the bulk of Complex’s assets at a loss in February. Peretti confirmed he’s looking to unload the remaining assets, including recipe site Tasty and First We Feast, the video brand behind the hit show “Hot Ones.”

But Wait, There’s More!

Buyers ask to prune streaming TV ad tech partners ahead of the upfronts. [Adweek]

Instacart and Uber Eats join forces to incorporate groceries and restaurant delivery (and fend off DoorDash). [WSJ]

How Campbell’s navigates the burgeoning retail media landscape and its additional walled gardens. [Digiday]

Dotdash Meredith inks a licensing agreement with OpenAI, with plans to use OpenAI’s tech to enhance its D/Cipher contextual targeting solution. [The Verge]

You’re Hired!

The Washington Post hires Jana Meron as VP of revenue operations and data. [release]

Danilo Tauro joins Uber as GM of Uber Eats Advertising. [post]